Missing F-22s, War Signals, and Opportunities

Today, we’ll discuss war in the Middle East, metals, energy, Big Tech, and how to protect wealth in turbulent times. Maybe it’s ambitious to think we’ll simultaneously make sense of so many different items, but let’s give it a try…

Begin with the Super Bowl, the other night. To me, the most interesting thing was that Air Force F-22s didn’t zoom over Levi’s Stadium in the opening ceremony. Originally, the gray birds were scheduled for an overflight, but were yanked due to “operational commitments,” per an official press release.

Sorry, no F-22s. They’re busy. Screen shot from You Tube.

The flyby included two B-1 bombers, although just one is pictured. Plus, two F-15s, two F/A-18s, and two F-35s. The Air Force and Navy have plenty of those, but no spare F-22s, alas…

And no B-2 bombers either, which is worth noting. Because perhaps the super-stealthy birds also had “operational commitments,” maybe something similar to what occurred last June in the skies over Iran. On that point we’ll have to wait and see because, from the outside, we can only ponder the possibilities of what may be in store for those airborne platforms.

Meanwhile, I’m mostly holding metal miners, related hard assets, and energy. And there’s no way I’d sell even an ounce of physical precious metal just now. Hang onto gold and silver. (That’s just me; this isn’t personal financial advice.)

Are You Hedged Against Risk?

There’s much to dissect here. But first I want to say hello and welcome new subscribers. Recent moves in gold, silver, other metals and energy have expanded our reader lists at Paradigm Press… and yes, you’re in the right place. Thank you for being here.

And to answer a commonly asked question: When you signed up for a paid newsletter, the package included complementary e-letters like this one.

Now, let’s return to the missing F-22s and B-2s at the Super Bowl. Evidently, they’re tasked with… umm… other things. Add in a large number of recent military transport flights to the Middle East, plus Navy assets in the North Arabian Sea. And it’s fair to say that “something” could happen sooner or later, and don’t be surprised if it’s sooner (see below). Which prompts me to wonder about stock markets, and more specifically energy and metals.

That is, big geopolitical events – like, say, dropping bombs on Iran – move markets. Globally, when missiles ignite and ordnance falls, people flee to safety which has traditionally been in dollars, but in recent years includes significant buys into precious metals, certainly gold.

Oil prices also serve as a predictor, definitely when the problem is in or around the Middle East. So, note that oil is moving up, currently in the mid-$60s per barrel. Oil services are strong, too: look at last three months for Schlumberger/SLB (SLB) or Halliburton (HAL).

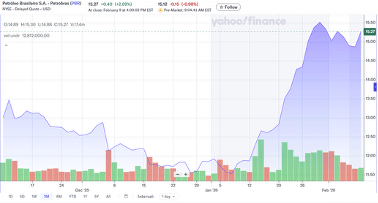

Which raises the question: Are your investments positioned for the possibility of conflict? Are you hedged against war risk? For example, consider an oil company that works far from any potential battle front, like Petrobras (PBR). Nice chart over the past month, eh?

Petrobras (PBR), three-month chart. Courtesy YahooFinance.com.

Do Markets Get It?

In an internal message over the weekend, my colleague Dan Amoss (with whom I work on the Jim Rickards letters under the Strategic Intelligence banner) pointed out how it seems that markets have lost sensitivity to the probability of an earthquake-level geopolitical event like a real, all-out war with Iran.

Here’s how Dan phrased it: “Investors assume the S&P and the VIX complex is a hyper-efficient Bayesian barometer of risk, but it could sleepwalk into a multi-day market closure event, and #REF! out, quantitatively speaking, in a paradigm shift historical event.”

In other words, in his inimitable way Dan critiqued the widespread belief in so-celled “efficient markets.” In particular, considering what’s obviously going on in the Middle East, Dan posed the question of why markets seem so upbeat, for example how the DOW touched 50,000 last week. Because really, when a war starts and if something bad happens – fog of war, and all that – then more than a few investment avenues could rapidly become locked-out to mere mortals.

If you’re old enough, think back to 9/11 when markets abruptly closed for almost a week, until they reopened on Sept. 17, 2001. Between those dates, nothing traded, with no price discovery. Tens of trillions of dollars in value hung in limbo.

Indeed, much of the U.S. and global economy went dark, into suspended animation. Trading desks and exchange channels were closed. Option expirations and settlements were deferred until activity resumed. And even if people did fire up their monitors to see the blank screens, market makers had no live prices to compare or hedge.

When things reopened the next week, people used pre‑close prices as anchors but quickly had to make dramatic adjustments to underlying prices and implied volatility as trades closed. It was a crazy time, and literal fortunes changed hands.

Well today, options markets are probably 1,000 times larger than back around 9/11, which in retrospect seems like Pliocene Time. Here and now, everything about markets is vastly upsized in scale, scope, speed, and dollars in play. Plus, today we have 24/7 algos and constant trading at the speed of electrons in wire, if not photons in fiber optics.

So again, it’s worth asking: Are you positioned for the possibility of conflict? Are you hedged against war risk? What do you own that will hold value, no matter what?

TACO? or Not TACO?

Clearly, President Trump has threatened the Iran regime, and no doubt he understands that for his words to have weight he must follow through in one way or another. Meanwhile, it seems that markets are biased towards what’s called a TACO mode, namely that “Trump Always Chickens Out.”

In other words, after a year of Trump 2.0 running the country’s executive power, people are accustomed to a certain modus operandi; he’ll make what sounds like an outrageous opening gambit, issue extreme statements, and then back down to some more-or-less normal outcome.

For example, consider Panama. At first – during Trump’s Inauguration Day address, no less! – it seemed that he would soon send in the 82nd Airborne Division, grab the Canal and depose that country’s government.

As things turned out, Panama’s own supreme court just voided a series of contracts with Chinese companies over ports, harbors and Canal access. In essence, Panama is booting China out of one of the world’s key geographic and logistic chokepoints. It’s perfectly in tune with U.S. national interests, and Trump just sits there and smiles.

Or consider Greenland. Again, at first Trump came across like he would send Marines to invade and seize the place. Greenland would become a low-population, icy, inhospitable U.S. territory, summarily grabbed from Denmark. And the talk in Brussels, London and Deep State Washington was that Trump would shatter NATO.

Instead, after back-room discussions the U.S. will wind up with ample fairway to beef up its defense posture in Greenland, primarily as an early-detection site contra Russian or Chinese missiles. And U.S. capital now has wide access to Greenland mineral deposits, to the extend its economic interests to explore, develop and produce minerals out of rocky coastal outcrops at the edge of a barren Pleistocene ice sheet.

Of course, Trump can also act decisively. He ordered the Midnight Hammer attack on Iran’s nuclear facilities last June, a decision that speaks for itself. Not exactly TACO Tuesday, right?

Map of Midnight Hammer airstrikes. Dept. of War image.

Then there were Trump’s efforts to hamstring Venezuela, which ranged from bombing narco speedboats to sending in U.S. troops (and law enforcement agents) to arrest, detain and extract that country’s president, Nicolas Maduro and his wife. No TACO there, either.

So, how about Iran? Will it be Bunker Buster Donald again, or perhaps another TACO? Well, we have credible intel leaks – likely planted, but still worth noting – which fall along the lines that Iran has restarted its nuclear weapons program, and that’s definitely a red line for Trump.

Meanwhile, there’s good old circumstantial evidence, which every lawyer learns in evidence class is among the most trustworthy means to prove a point because some things are just too hard to fake. Which brings us back to those missing Super Bowl airplanes.

That is, the stealthy jets are tasked elsewhere, we are told. And couple this with massive numbers of air transport flights, aerial tankers, and the navy offshore Iran, hiding in what’s called “dark mode” in waters south of Oman.

In other words, look at the buildup of combat power. But more importantly, look at the buildup of logistics, along with force protection like anti-missile systems. Or to quote my old aerial refueling pilot pals, “There’s no kicking @ss without tanker gas.”

Enhanced physiographic map of Gulf and Iran. Courtesy EpicMaps.com.

Keep in mind that this is all to the purpose of setting up events contra Iran, and where could this go? Again, and to me at least, the risk tilts towards owning shares in mines, metals and energy that are all far from ground zero over there.

Back to Levi’s Stadium

While we ponder the missing airplanes, let’s return to that flyby image. It shows how the Super Bowl was at Levi’s Stadium, in the heart of Silicon Valley. Not “Nvidia Stadium,” or “Oracle Stadium,” or “Google Stadium,” or “Apple Stadium.” Nope, the edifice is named after Levi’s, the blue jeans company that owns current naming rights.

In fact, Levi Strauss & Co. (LEVI) is a clothing maker headquartered in San Francisco, market cap about $8 billion, versus the $trillion$ of the tech giants. The company was founded by a man of that name in 1853 during the California Gold Rush.

And Levi’s is the quintessential, iconic tale of how to make money during a “boom” or a “rush,” such as those early days of California and its gold. That is, most Gold Rush wannabes didn’t become wealthy from panning for gold. No, the people who made money were the proverbial “pick and shovel” guys who – literally – sold picks and shovels to the miners. Or tough, durable canvas-cloth clothing like Mr. Strauss, whose company is still around.

Which brings us to those Silicon Valley tech guys and their ambitious, multi-trillion-dollar plans to expand AI, build data centers, suck down massive amounts of energy and crunch numbers. Will they be successful? Likely, some will… but equally likely, many won’t.

Whatever happens along the way, these tech companies will be buying trainloads of primary materials from – again – literally the pick and shovel plays, aka miners. They’ll need copper, for sure. Plus, a long list of other metals and materials all across the periodic table, from helium gas (chip manufacturing, cooling and more) to uranium (nuke power), and pretty much everything else in between.

And not coincidentally, the ongoing U.S. military focus will also require those same kinds of metals and energy plays, from across the periodic table.

Which brings us to the wrapup; namely, that it’s a good time to invest in minerals, mines and energy. Prices are solid. Producers are booking remarkable earnings. Long-term underinvestment has set up predictable chokepoints and clear shortages for downstream buyers and users. This won’t resolve and go away anytime soon.

Plus, and as discussed above, markets seem to discount important angles like war risk. So, my view is to get long on hard assets and physical stuff. Because that’s where things are headed.

And that’s all for now. Thank you for subscribing and reading.

Comments: