It’s Do-or-Die for the Bulls…

The toughest part of any new bull market is the beginning.

Traders usually refer to these early-stage moves as disbelief rallies for obvious reasons. During a bear market’s last gasps, buyers are bled dry. Fear of missing out has sucked them into every relief rally, only to trap them in their snapback plays when everything begins to fall apart. The bulls are mentally exhausted – and many simply give up on the markets altogether.

Then, when a rally does finally stick, the market’s cried wolf so many times that most investors simply don’t trust the move. They opt to sit on the sidelines and lick their wounds, angrily watching the market move higher without them.

Every new bull has to start somewhere. Trouble is, we only know it’s a new bull market in hindsight. As we watch it unfold in real time, that first bounce might not be the beginning at all – just a pause before the next leg lower begins.

This is the exact situation we find ourselves in today.

Two months of 2023 are nearly in the books. A powerful snapback rally materialized out of nowhere in early January, sending the bears running for cover and rekindling a flicker of hope amongst the tech-growth bagholders.

The theme for January was simple: the worst performing assets of 2022 flipped the script and enjoyed the strongest rallies. Meanwhile, the “safer” trades that weathered last year’s storm began to lag. It was just like old times. The Covid Bubble was back!

February was the opposite story. These same snapback trades started to fall apart while the dollar index and rates rallied. Investors suffered from debilitating inflation flashbacks as the Fed flipped slightly more hawkish. Now, we’re watching key stocks and sectors teeter at key levels.

Here comes the tricky part…

Are we experiencing the choppy start of a new bull market?

Or, was January’s strong performance just a bear market rally that’s destined to fail and open the trap door to new lows?

We can’t know for sure (You didn’t think it was going to be that easy, did you?).

But there are a couple key areas of the market we can watch for clues.

The Semi Situation

While the financial talking heads remain fixated on the S&P’s battle at 4,000, we need to dig a bit deeper to see if the year-to-date leaders can rediscover their January mojo.

Let’s start with semiconductors.

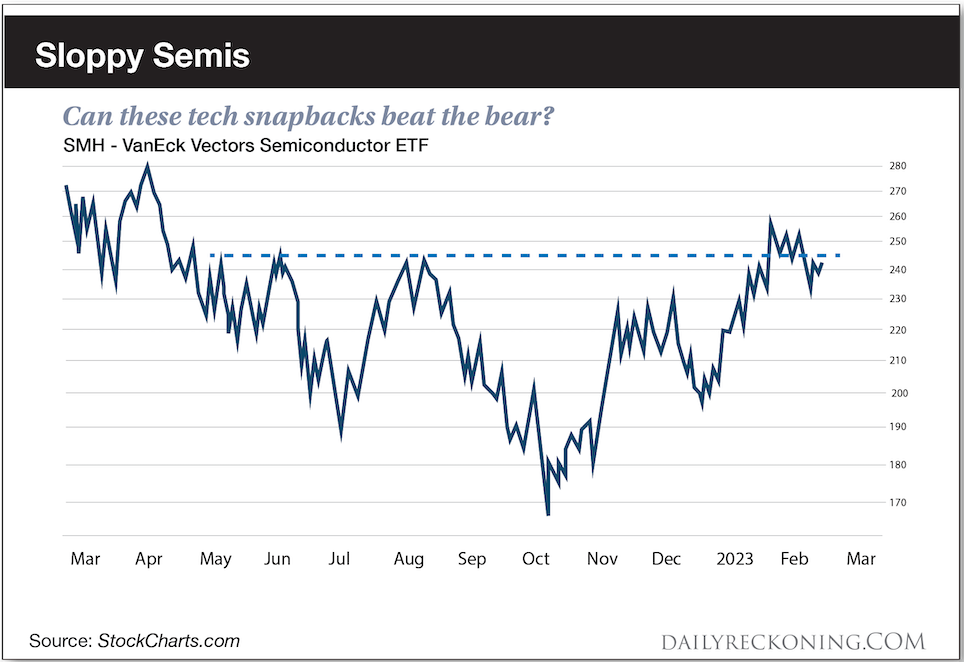

The semis were downright terrible trades on the long side during the 2022 bear market. But they snapped back to life in January, with the VanEck Vectors Semiconductor ETF (SMH) gaining more than 20% during the first five weeks of the year.

Like many of these snapback stocks, the semis flew a little too close to the sun in January and needed to blow off some steam. Where they go from here could be incredibly important to the health of this market.

SMH is flirting with a key level here between $240 – $250. This area marks the swing highs from June and August 2022. If it can continue to consolidate and rally off last week’s lows, it has a decent chance at extending higher and officially breaking out of last year’s downtrend.

NVDA’s post-earnings performance is one major reason SMH still has a fighting chance right now. Despite posting objectively poor earnings, NVDA managed to tantalize analysts and investors with some artificial intelligence hocus-pocus. The magic worked, and the stock popped more than 14% power-earnings. It continues to rally to new 9-month highs this week.

NVDA is still the de-facto leader in the semiconductor sector. It’s difficult to imagine the sector lurching lower if this leader remains resilient.

An AI-Driven Market Crash?

The snapback semis can certainly stabilize the market at these key levels.

But what about some of the market’s frothier, more speculative stocks?

Here’s a funny story from the artificial intelligence bubble:

Some rogue AI testers managed to (briefly) break through ChatGPT’s politically correct protocol to get some raw, unfiltered answers from the popular chatbot. As a rule, ChatGPT won’t tread in any waters anyone might find mildly controversial. I even highlighted the bland, unhelpful answers to my AI bubble questions when I dove down the rabbit hole a few weeks ago…

Thankfully, some financially-minded journalists agreed and snapped ChatGPT out of its PC stupor long enough to get it to make some bold (or maybe ridiculous?) stock market predictions. After inquiring about a possible market crash, the uncensored AI didn’t hold back, predicting a crash on March 15 due to inflation, consumer spending and geopolitical tensions.

To be clear, I don’t think ChatGPT is Skynet. Not even close! And I’d be more than a little surprised if the market crashed on something as benign as “consumer spending” on the Ides of March.

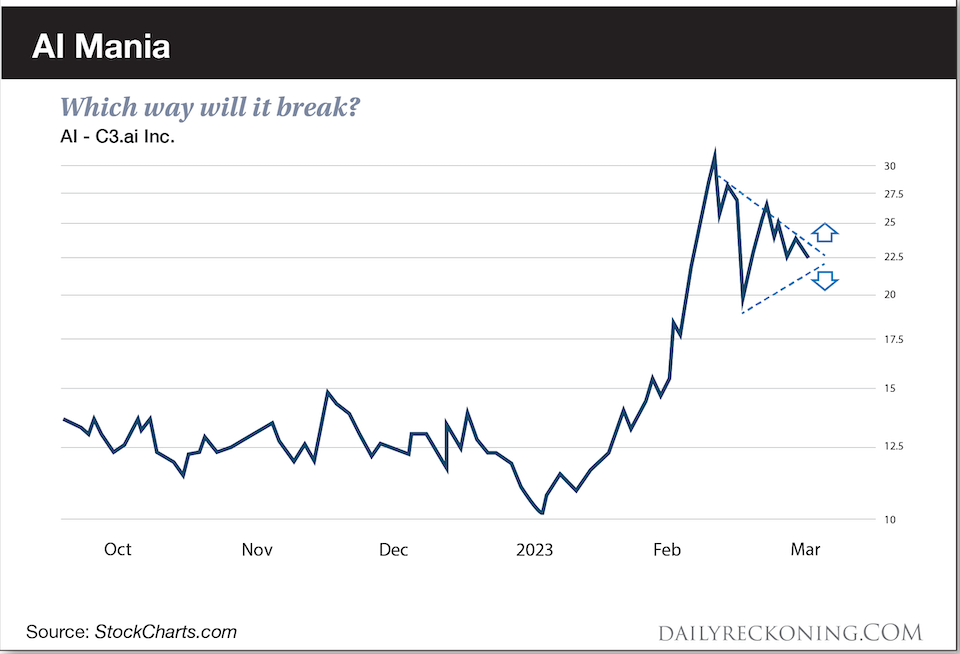

Crash predictions aside, it’s important to keep an eye on these bubbly artificial intelligence stocks that have suddenly captured the market’s attention this year. This has nothing to do with fundamentals or bigger tech trends, either. I’m more concerned about using the AI sector as a proxy to measure bullish sentiment.

If some of the speculative runners – such as C3.ai Inc. (AI) – can move higher out of these wide-ranging consolidations, it will demonstrate that traders are willing to continue to make risky speculations despite a shaky market backdrop.

One of the big dangers facing a young market rally is fickle buyers who give up and sell their shares at the first sign of trouble. If we begin to see stocks weather these pullbacks and push higher, it shows us that something could be changing in the markets.

There’s still a lot that needs to go right before we can begin to talk about the market officially recovering from the big, bad bear. Yet the bulls surviving this first true test of the year would go a long way toward repairing the damage – and could set us up for an extended push off these do-or-die levels.

Let me know what you thought of today’s article… and if you want any more topics covered by emailing me here.

Comments: