Idiocracy Trades

In the nine days since President Biden announced he was shutting down his reelection campaign, a fresh wave of political prognostications has infiltrated my news feed as market pundits adjust to the new race.

As Kamala attempts to pull off an upset victory, the questions I’m fielding are blurring the lines between politics and markets. Almost everyone I interact with in my personal and professional life wants to know one thing:

What stocks and sectors will outperform if Trump wins, and which ones could benefit from a Harris victory?

But markets don’t read the political rulebooks. If trading was this simple, we could literally take the polls to the bank. In reality, big political predictions rarely lead to profitable short-term trading insights. Simply put, proposed policy changes don’t always affect the market in the most obvious ways – and they usually take a lot longer to play out than you might expect. Like trying to get a cranky toddler to eat his vegetables, the more politicians attempt to bend the market to their will, the less it obeys.

So instead of asking what might happen to the markets if a certain candidate wins this fall, let’s try to find the trends and trades that have the best chance to persist no matter who takes the win in November.

Consider this my list of Idiocracy Trades. These are the plays that have the potential to lead the market higher into November – even if a bumbling cartoon dad scores a write-in victory (I can see the T-shirts now: Don’t blame me – I voted for Homer Simpson!)

Before we get to the details of my three favorite ideas, let’s take a quick peek at our market roadmap…

The Nasdaq Composite finished the first half of the year with a gain of almost 20%, with the S&P 500 not far behind. Semiconductors and the mega-caps were the driving forces in the push to all-time highs. The mega-cap dominance led to an incredibly smooth ride higher – a rally devoid of the typical gut checks and resets that keep investors honest.

But the strongest stocks that propelled the major averages to during the first half of the year have finally cooled. You might recall a curious data point I shared with you a couple of weeks ago: The stock market had gone almost 380 days without a one-day selloff of at least 2%, the longest stretch since the Great Financial Crisis.

We’ve experienced a bit of downside over the past two weeks, and last Wednesday’s meltdown (S&P -2.3%, Nasdaq -3.6%) reset the clock on the drawdown drought.

Now, we’re diving headfirst into a packed earnings week as the semiconductors and mega-cap tech names attempt to recover from nearly two weeks of corrective action. Add in a Fed meeting and rate decision on Wednesday and payroll data on Friday, and you have a critical week for this market heading into the new trading month…

As you’ve probably already guessed, chip stocks and mega-caps didn’t make the cut this time around (Don’t worry – they’ll probably be fine after blowing off some steam). In the meantime, here are the trades that have legs heading into election season…

Gold Defies a Metals Reset

It’s been a rough few weeks for the metals trade.

Despite the poor performance of the dollar, precious and industrial metals haven’t played nice this month. In fact, you can find plenty of downside action in silver and copper – both of which are down double-digits from their respective July swing highs.

Yet throughout this bout of summer volatility, gold has remained relatively calm. Gold futures briefly climbed to new all-time highs earlier this month, only to retreat back into their consolidation range. Yet the late July drawdown in gold hasn’t been as severe as the move in copper or silver – and I suspect the shiny yellow metal could continue to attract buyers if it manages to halt its skid and turn higher before getting dragged down to the lower bounds of its consolidation zone near $2,300.

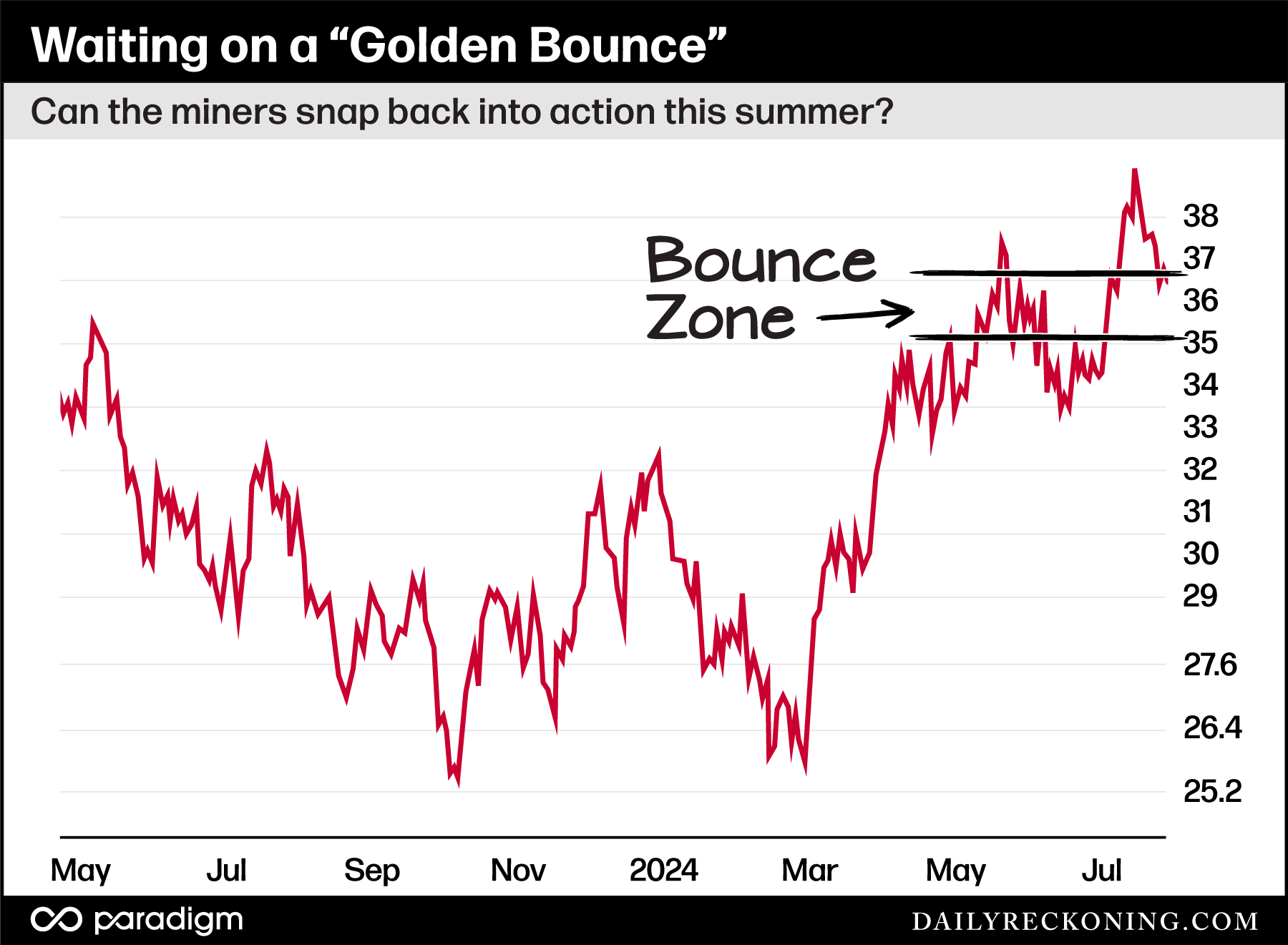

I’m even more impressed with the resilient VanEck Gold Miners ETF (GDX).

Yes, the miners flew a little too close to the sun as they roared higher in early July. But GDX can remain a viable long-side play if it can put in a strong bounce before cracking below $35.

Small Stocks Continue to Soar

Two weeks ago, we chronicled the rise of the iShares Russell 2000 ETF (IWM) as it exploded back above 200. Even after a rocky start to the new trading week, it’s still up nearly 10% since this move began earlier this month. Make no mistake: this is a powerful breakout that could send these small stocks much higher in the months ahead.

We’ll see just how aggressive small-cap buyers are feeling in the 225 area. This is the spot where IWM has been running into sellers for nearly two weeks. We’ve mentioned how IWM has been short-term overextended since it first tagged 225, but it has been able to consolidate and bleed off some of the excess momentum without giving back too much of the double-digit move that got us here in the first place. Out of all the rotation trade candidates, small-caps are at the top of the heap. All signs point to the rally continuing in the weeks and months ahead…

Bitcoin Breaks from Big Tech

While the chip stocks and big tech have trended lower this month, Bitcoin has ignored the carnage and pushed back within striking distance of its all-time highs.

What’s even more impressive is Bitcoin’s move began after appearing to break down as it dropped below critical support back at the beginning of the month. The chart looked downright terrible… until Bitcoin caught a bid at $55K and started pushing back into its wide consolidation range.

Now, Bitcoin is attempting to retake $70K, which just so happens to be the last area of resistance before it’s able to make a go at those March highs.

To be fair, Bitcoin has been a downright exasperating asset for the past four months. It threatened to break down more than once, with buyers stepping in each time it got close to falling apart. That’s impressive in its own right. But what really sells me on Bitcoin right now is the fact that it’s ignoring the pullback in tech, which it usually follows closely.

If Bitcoin were to take out $70K and push toward the March highs amid a broader tech correction, I would consider this turn of events extremely bullish for crypto.

Comments: