How to Trade the Crypto Chaos

Too many investors waste valuable time attempting to explain what should happen in the markets instead of reacting to where prices are actually moving.

Redirecting your energy toward understanding how markets move will not only remove most of the frustration from your investing process – it will also quickly improve your returns.

Contrary to popular belief, years of study and practice are not required to begin improving your market timing. In fact, this week just so happens to be the perfect moment to adjust your mindset.

Earnings season is set to ramp up over the next several days, and I’m betting we’ll see more than a few surprises that catch investors off guard. My theory about why earnings cause so much angst is that the numbers and the market reaction don’t always match. A company can report stellar sales, a growing bottom line, and raise forward guidance. Yet shares can still drop once the opening bell rings.

These post-earnings shenanigans infuriate many market watchers because the stock in question isn’t acting right. “It’s not doing what it should be doing,” they grumble as the stock plummets despite beating analyst estimates.

If you are a glutton for punishment or you happen to have a few hours to spare, sit through an earnings call or thumb through a quarterly statement. Then, try to predict how the stock will move without checking the price.

Did it gap higher when you expected it to drop? Did it suddenly reverse at the end of the day after trending higher or lower?

Chances are, you aren’t going to nail the reaction to the penny. In fact, I’d wager that you can’t consistently guess the direction and magnitude of earnings events – even with the benefit of seeing the numbers first.

Sell the News

Earnings aren’t the only situations where investors drastically overestimate their forecasting abilities.

In fact, we just witnessed some fresh market shenanigans during the chaotic Bitcoin ETF news cycle. Unless the rock you’ve been living under is having internet connectivity issues, you already know the SEC officially approved the first US-listed Bitcoin ETFs last week just one day after its hacked Twitter account posted a fraudulent announcement.

The news sparked plenty of excitement throughout crypto exchanges and news providers, as well as the broader investing community. The mainstream media even dubbed the approval a watershed moment for Bitcoin and the broader crypto industry.

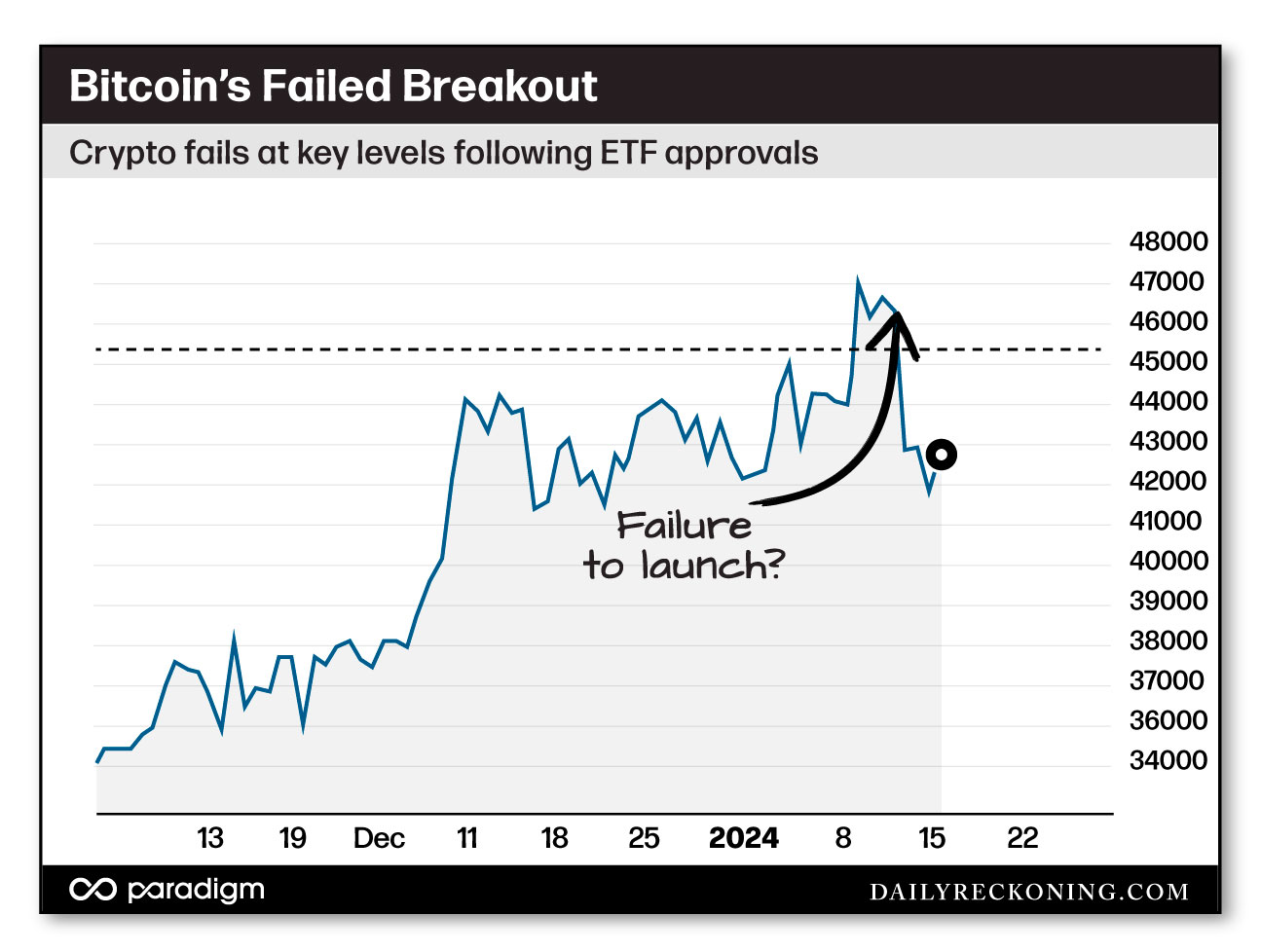

But for traders attempting to play the news, this watershed moment failed to yield spectacular gains immediately following the announcement. Instead, the new crypto ETFs dropped. As did Bitcoin. Other cryptocurrencies followed suit. The crypto celebrations flipped to confusion.

How could this have happened?

Behavioral finance (and a well-known stock market adage) offer an answer to this question…

Buy the rumor, sell the news.

Investors held overwhelmingly bullish positions into the SEC decision. The market then got its expected result: approval! But all the gains were front-loaded into the announcement. The bulls had already bought. When the mind-bending gains didn’t materialize right away, impatient traders sold the news.

The Bitcoin ETF debacle is a classic case of the market getting way too far ahead of itself. This doesn’t mean the ETF approvals aren’t good for crypto in the long-term. But we’ll probably need to see Bitcoin (and crypto-adjacent stocks and ETFs) backfill and consolidate before they resume their rallies that began late last year.

Last week’s Bitcoin move has all the hallmarks of a failed breakout. It pushed above $49K on the ETF announcement, only to immediately retreat back toward $46K, then into its previous consolidation range below $44K. This is classic sell the news action.

It’s Not Getting Any Easier…

Crypto isn’t completely broken – it probably just needs time to regroup. Whether this takes three weeks, three months, or longer remains to be seen.

If we take the time to look around the market, Bitcoin’s stumble isn’t the only potential trouble we’re seeing. Some of the powerful rallies we enjoyed in November and December continue to lose steam as the month progresses. As we recently discussed, this means traders will need to be a little more tactical when it comes to trades on the long side.

Despite a strong bounce early last week, many of the tech leaders outside of the Magnificent 7 mega-caps failed to push higher into the back half of the week. If we continue to see weak bounces, narrowing breadth, and distribution, we’ll need to adjust our expectations and prepare for choppier trading and a potentially bigger pullback.

As always, don’t chase breakouts without adequate confirmation – especially when the move is associated with an anticipated news event. If and when these breakouts do fail and you’re involved, obey your pre-set stop loss conditions and get out of the way. False moves tend to lead to fast action in the opposite direction. That quick $5,000 drop in Bitcoin is all the evidence you need…

If we continue to see more stocks and sectors stall out, we’ll probably need to shift our focus to more defensive strategies.

Comments: