Here's What They Aren't Telling You About TSLA

Now’s the perfect time for the red-hot semiconductors to take a nap.

If this year’s major chip winners – NVIDIA Corp. (NVDA), Super Micro Computer Inc. (SMCI) and Micron Technology Inc. (MU) – continue to chop sideways or retest key support levels in July, what will be your next big trade this summer?

We’ve discussed several potential summer rotation trade ideas over the past several weeks ranging from energy names, industrial stocks, and even small-caps. Any one (or all) of these plays could catch higher from here. But there’s another group – and one stock in particular – that’s already showing signs that it might take the lead during the third quarter.

I’m talking about Tesla Inc. (TSLA).

Groups of tech-growth names and the main Magnificent Seven laggard Tesla are waking up and beginning to break out as third-quarter trading gets underway.

But before I get into the details of this summer breakout, we should address the elephant in the room…

I can sense the skepticism every time I make a bullish Tesla argument. I get it! After all, this is a company that evokes strong emotions from just about everybody. Whether we’re talking about Elon Musk’s politics or online trolling, the latest Cybertruck recalls, or dwindling demand throughout the EV space, even casual investors hold strong opinions on Tesla. Most of them are negative!

I don’t necessarily disagree with a lot of the criticism. In fact, I could easily cobble together more than a few convincing bearish arguments against Tesla. And it’s almost impossible to escape the negative news swirling around Musk and the company that helped launch him into the public eye as one of the world’s most polarizing billionaires.

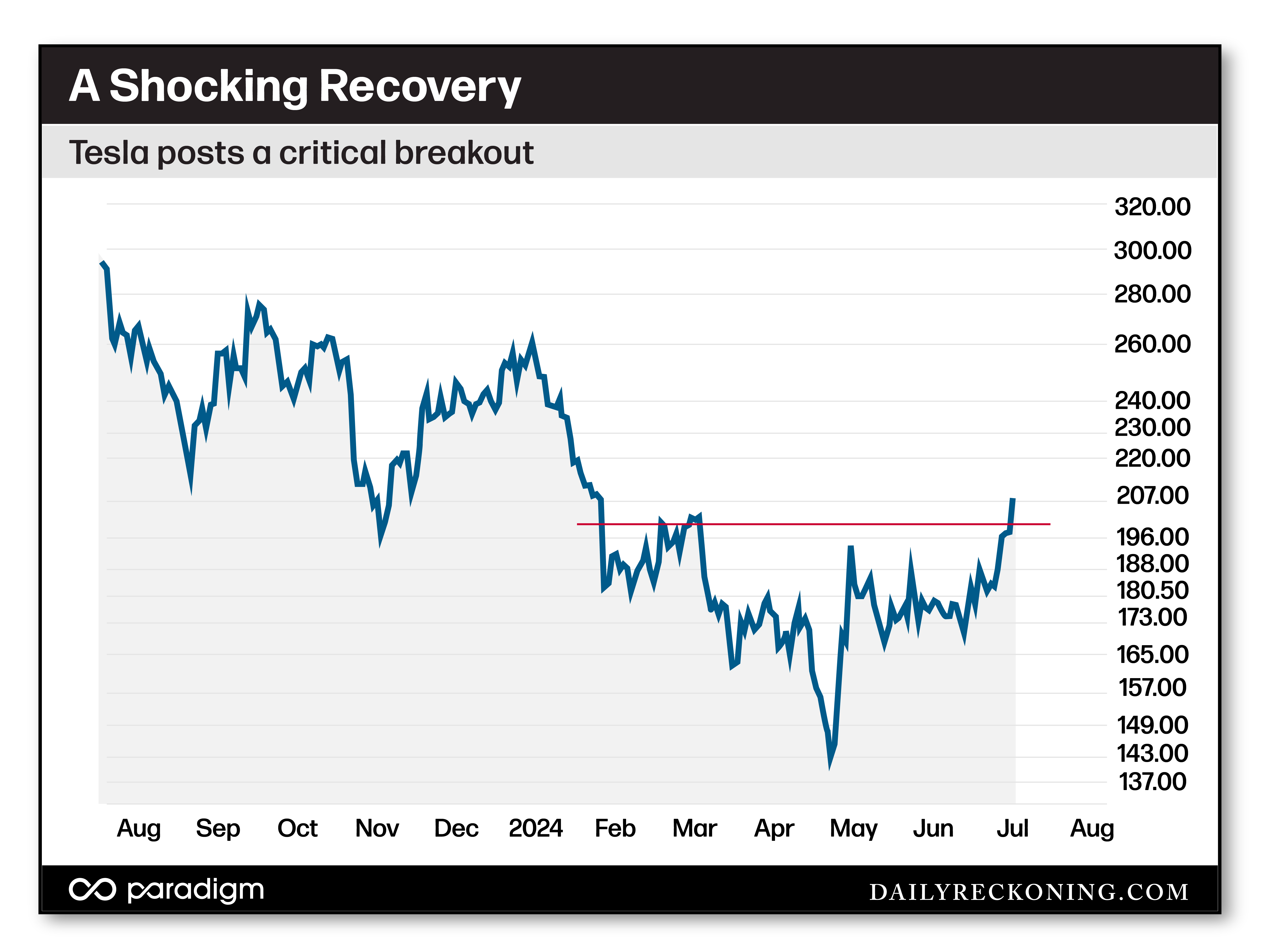

Despite a roaring tech rally, TSLA shares have remained out of favor for nearly three years. Most recently, the stock broke from its Magnificent Seven brethren in late December and spent most of the first quarter digging itself into a deep hole.

Tesla shares have lost as much as half their value so far this year. Based on performance alone, we can reasonably assume sentiment is extremely bearish. As most of the household name mega-caps were soaring to new highs back in the spring, Tesla was catching some serious flack as it badly lagged behind its Big Tech peers.

But something changed in the spring that would set the stage for the incredible comeback unfolding this week.

Bad Numbers, Good Results

One of our main concerns heading into spring trading was how some mega-caps like Apple Inc. (AAPL) and TSLA were decoupling from the melt-up.

Back in early May, TSLA shares bottomed out alongside AAPL after both stocks managed to rally on what the financial media and Wall Street analysts insisted were “bad” earnings.

Apple beat top and bottom line estimates, yet reported a 10% year-over-year drop in iPhone sales and offered lackluster guidance. The stock gapped higher and has since rallied nearly 25% to new all-time highs.

Just a week earlier, Tesla reported quarterly profits sinking to 3-year lows, along with a slew of other concerns ranging from pricing pressures and questions about whether full self-driving features would ever come to fruition. The stock was already in freefall, plummeting to new 52-week lows in the days leading up to its Q1 earnings announcement.

Yet the stock gapped higher and ran for five trading days, erasing the April meltdown and climbing back into its choppy range. After a quick trip back into the $190s, the stock consolidated for nearly two months.

That changed last week as shares started to build toward a breakout. The stock turned higher on Wednesday, then broke above the $200 level on Monday on a decisive 6% move.

Not only did TSLA break above $200 for the first time since February – it also filled the January earnings gap to close at 5-month highs.

Remember, most investors continue to expect the worst from Tesla. Yet despite a strong, positive reaction to mediocre earnings numbers along with bullish follow-through and a clean breakout, bearish sentiment prevails.

This could add fuel to the fire should Tesla continue to post any positive surprises. Second quarter earnings will drop on July 17. Is the stock setting up for a big beat? Are expectations so low that even small improvements will entice additional buyers? It’s possible!

Despite this latest base breakout, TSLA shares are still off by more than 15% this year. Even a modest earnings beat late this month could ignite a longer-term move.

Sometimes, a stock is so hated that the bar for “good news” becomes extremely low. I think that’s the case here. No one is thinking Tesla can beat earnings or announce anything productive regarding deliveries or full self-driving advances this summer.

But what if they’re wrong?

Price is telling a very different story. If this breakout above $200 holds and extends higher, the downtrend that has trapped TSLA since late 2021 could be finished.

If you’d like to watch a complete breakdown of this trade idea with Doug Hill, check out the video we shot last week for the Paradigm Profits YouTube channel.

Click below to watch…

Comments: