Good Luck Getting Social Security

Greetings from a soggy Asti!

As I wrote, we got loads of rain, and the ground is just starting to get used to the water again. Last summer, we went almost 90 days without rain. This year, thankfully, we’re getting pummeled with sky water.

Good friend and Daily Reckoning Grand Poobah Brian Maher asked if I wanted access to the DR’s mailbag. I politely declined, thinking there were enough hands there to manage it.

But I simply didn’t realize how many people had written in. And I apologize for that.

To make up for it, I will do a Morning Reckoning Mailbag piece today, like I’ve done for the Rude this week.

I’m not sure I’ll get everyone’s excellent comments, questions and issues in this edition of the Morning Reckoning, but we’ll give it a go.

Speaking of answering your questions…

Before we get to the mailbag, I want to invite you to our Whiskey Bar event happening today, May 25 at 4pm ET.

This sitdown included Jim Rickards… Vice President of Publishing Doug Hill… market strategist Dan Amoss… income specialist Zach Scheidt… mining expert Byron King… and myself — all with drinks in hand (of course).

We’re going to get into the nitty gritty of what’s happening in the markets, what stocks we’re looking at right now and our discussion on gold, the dollar, the economy and how to build wealth will probably answer many of your most pressing questions.

Best of all… it’s completely free, no sign-up required.

As I said, the event doesn’t start until 4pm ET, so save that link and set an alarm so you’re ready when we begin.

Hell, grab yourself a drink and settle in with us! It’s going to be a good conversation you don’t want to miss.

Now, onto your questions…

Central Banks

Tell us in 3 to 5 bullets why people are WORSE off as a result of Central Banks.

Nice and simple, so we can feed the masses and start pushing back against the madness.

Jerry M.

Thanks for writing in, Jerry. What a great idea! Here are my bullet points:

- Lack of Accountability: Unelected officials have the “independence” to raise and lower interest rates without fear of public reprisal. I’m all for bringing back tar, feathers, and, if need be, the guillotine. But I’m not sure who’s with me on that…

- Economic Manipulation: Central bank interventions distort the markets, starting with interest rates. Like anything else, interest rates can find their clearing level without the help of twelve old folks. Their rate settings wreck the pricing mechanism of the economy. This makes it harder for entrepreneurs and business owners to accurately forecast future supply and demand.

- Fiat Currency: Central banks have the authority to issue and control a country’s fiat currency, not backed by a physical commodity like gold. With an “elastic currency,” central banks can – and do – print far more of the stuff than needed, creating bubbles in asset markets (see 2009-2020) and price inflation in consumer product markets (2020 to present).

- Bailouts and Moral Hazard: During financial crises, central banks provide emergency liquidity and bailouts to troubled financial institutions to prevent systemic collapse. These bailouts result in losses, shifting the burden of financial mistakes onto taxpayers. This creates a moral hazard by encouraging banks and financial institutions to engage in risky behavior. In a free market, these banks and FIs would go bankrupt.

Vivek Ramaswamy

Good day, Sean, from the sunny and warm Piedmont of the Carolinas.

Thanks for your daily Rude and today’s ‘Morning Reckoning’.

One question – in your list of presidential candidates, you didn’t list Vivek Ramaswamy. I just started hearing about him, first from George Gammon, and it appears he has the “Creature” in his crosshairs.

I realize he is currently a distant 3rd for the Republican nomination and I don’t trust ANY politician, but it is refreshing to hear one speak about the real issues as a regular citizen. I’m interested in your opinion.

Thanks,

Ed C.

And a good day to you, as well, Ed!

I’m a big fan of Ramaswamy. He’s an entrepreneur worth over $600 million and utterly loathes the Fed.

And that’s why he doesn’t have a snowball’s chance in hell of securing the nomination. He just makes too much sense to become President. You know, like Ron Paul.

But I did write about him in the Rude on May 3rd. And funnily enough, this ties in perfectly with Jerry’s query above.

Ramaswamy wrote this in The Wall Street Journal, “The global market will hang on every word of every FOMC press conference to see what a dozen central planners have to say. That won’t be because these planners have any special insight. Everyone will listen to see what the Fed may destabilize next.”

Right in the coconuts!

If you have a free minute, click on those links to read my Rude assessment of him and his op-ed in The Journal.

The Clinton Years’ Budget Surpluses

Sean,

If there were truly surpluses, why did the outstanding federal debt increase each of those years?

I heard that the accountants changed the way social security was being treated on federal books. They reasoned that because there was no real trust fund, social security receipts and payments should be included on the general books instead of being separate.

With receipts being greater than expenses at that time, it was a favorable change. But I have never verified this claim.

Jeff C

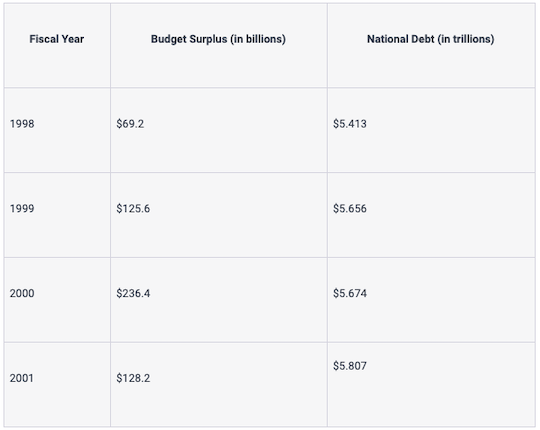

Jeff, this is brilliant. You know, I’ve always just looked at the year-to-year deficits. I just assumed the debt fell. You are correct. The debt increased!

Now how in Sam Hill did that happen?

Jeff, you are correct in that it concerns Social Security. And my goodness, the problem has ballooned to one that will never get solved.

If you look on my favorite financial doom website, usdebtclock.org, you’ll see the unfunded liabilities of the US are $187.8 trillion. Yes, $187,800,000,000,000 or so. That’s 187 with twelve zeros behind it.

Of that $187.8 trillion, $22.6 trillion is the amount the USG is supposed to pay out to Social Security.

Good luck with that.

But this number wasn’t nearly as gigantic back in Clinton’s days. Here’s what may have happened to the surpluses:

- Interagency Borrowing: The federal government operates through various agencies, and during periods of budget surplus, some agencies may have excess funds while others may not. To meet these needs, the government engages in interagency borrowing, where surplus funds from one agency are used to cover deficits in another. This practice can temporarily reduce the reported budget surplus and contribute to an increase in the national debt.

- Intragovernmental Holdings: (Editor’s note: this is the likeliest reason.) Most of the national debt is held as “intragovernmental holdings.” These are essentially IOUs issued by the government to certain trust funds, such as the Social Security and Medicare trust funds. When these trust funds generate surpluses, they invest the excess funds in Treasury securities, effectively lending money to the government. So, even though the overall government budget may be in surplus, the national debt increases as the government owes money to these trust funds.

- External Debt: The national debt also includes debt held by foreign entities and investors. While the budget surplus may reduce the need to issue new debt to the public, the government still needs to repay existing debt obligations. If debt repayment exceeds the budget’s surplus, it can increase the national debt.

The fact that Social Security is essentially an off-balance sheet item — a la Enron — is a crime in and of itself.

The Debt Ceiling

Hi Sean,

Does the treasury really lack the money to pay the bills, so the only option is to raise the debt limit? Or…. They do have the money to pay their obligations, but they would rather spend that money on green new deal stuff, Ukraine, welfare galore (with no work requirements), 87K IRS agents, etc…

There is an ex-congressman and author (Power Divided is Power Checked) from Minnesota by the name of Jason Lewis who says that there is plenty of money in the Treasury to make every single payment that needs to be made. How right/wrong is he?

Could you possibly shine some light on this and maybe explain in layman’s terms what is actually going on, as you so eloquently do through your no-nonsense, direct, and clear style we’ve all gotten used to?

Thank you!

Rafael V.

Hi Rafael. Thank you for the kind words. No pressure, then…

Let’s define it first.

The debt ceiling is the statutory limit the United States Congress sets on the national debt the Treasury Department can issue to fund government operations. Essentially, it’s the maximum amount of money the USG can borrow to meet its financial obligations.

I look at it as a completely made-up number. And not because I don’t think Congress should control its spending. It’s because the USG is so far gone these arguments are pointless.

The USG will never, ever be able to pay back its obligations. So instead of trying to stop digging, it should dig harder and get the inevitable over with sooner.

And though I can’t stand the Democrats, thinking Republicans don’t spend is complete horsefeathers.

We need a debt jubilee or a massive debt forgiveness program. But the Chinese are fresh out of forgiveness.

As Jim Rickards wrote in the DR:

There are always warning signs of a crisis, which are mostly ignored. The warning signs today include a dollar shortage, high-quality collateral shortages to support derivatives (made worse by the debt ceiling, which prevents net new issuance of Treasury bills), inverted Treasury yield curves, negative swap spreads, auctioned Treasury bills yielding less than the Fed overnight reverse repo facility and the flight of cash from banks to Treasury bills and money market funds.

That means the Treasury can’t issue new bills without redeeming old ones first.

And that just clogs up the whole system.

If a deal isn’t struck, you may get these consequences:

- Government Shutdown: Ok, this would be great. I’d pay them all to take an extended vacation.

- Payment Delays: Here comes at least the threat of Social Security payment delays and angry old folk voting out incumbents.

- Economic Uncertainty: this would hasten de-dollarization and further erode America’s leadership role.

- Credit Rating Downgrade: This would suck, but it would just be a consequence of the uncertainty wrought above.

In the face of these consequences, the government may use these measures to continue to fund itself:

- Prioritizing Payments: Essential obligations must be met first. This typically includes debt payments, Social Security benefits, military salaries, and other critical expenditures. By prioritizing these payments, the government avoids defaulting on its debt obligations and maintains essential functions.

- Using Available Cash: The government holds a certain amount of cash in various accounts. The government would rely on these cash reserves to cover its ongoing expenses.

- Implementing Extraordinary Measures: These measures can include suspending the issuance of certain types of securities, redeeming existing debt early, or tapping into federal employee pension funds. These actions are meant to free up cash and provide additional funding flexibility temporarily.

- Seeking Additional Revenue: This could be stopping non-essential programs, implementing emergency taxes or fees, or exploring other extraordinary revenue-raising measures.

So, yes, the government can still function to the extent the Treasury will make sacrifices.

Honestly, though, they’ll cut a deal.

Wrap Up

I didn’t get through half of what I wanted to.

But please keep writing in. Your intelligent comments, questions, and issues get my creative juices flowing.

I’ll look at the mailbag more often, I promise. And I’ll try to get to the rest of the questions soon.

If you have a question you want answered, be sure to email me here.

Have a wonderful rest of your week!

Comments: