Gold Tops $2K. Here’s What Happens Next…

Goldbugs, your time has come.

Welcome to the Big Show!

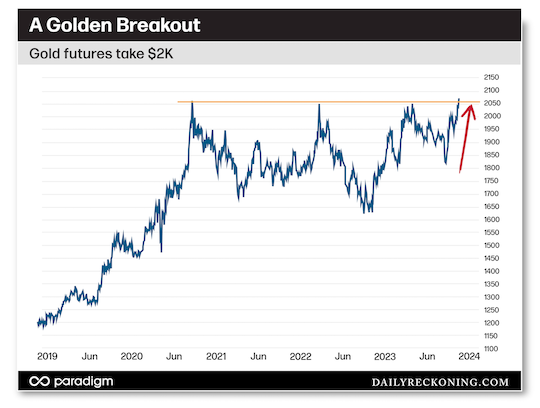

Gold futures have finally broken free of a choppy, four-year range to extend to new all-time highs.

Today, I’ll dig into gold’s massive breakout. I’ll show you how the move has developed, where gold’s headed, and some important milestones to watch.

But first, you need to see how choppy, post-pandemic trading has led to the biggest gold breakout we’ve witnessed in more than a decade… and why the move has caught so many investors completely off guard.

Gold quickly became one of the most frustrating plays on the market almost immediately after the pandemic bubble started to percolate way back in early 2020. In fact, for nearly four years, every single major gold rally failed to extend and produce a major breakout.

The first attempt at fresh highs began as gold futures exploded off their lows in March 2020. In just five months, gold jumped from $1,450 to $2,000.

But the big breakout above round-number resistance at $2K didn’t stick, and gold promptly fell back into a wide range. Gold futures sank back below $1,700 by early 2021, then repeated the process. First, a rally back toward $2,000. Failure quickly followed every extended gain. The bulls would walk away, and gold futures would enter a tailspin until buyers showed up in the $1,600 – $1,700 range. Lather, rinse, repeat.

Overcoming Failure

Choppy, range-bound action is enough to frustrate even the most disciplined investors. But four years of failure was directly responsible for triggering extreme bouts of market depression in any market participant who had ever even as much as glanced at a gold chart.

But eventually, the failures became routine.

So it wasn’t too surprising when the promising precious metals rally off the October 2022 lows hit resistance below $2K (again!) unraveled, sending gold lower for four straight weeks into November. And even as gold futures managed to get off the mat and rally earlier this year, they still were not able to hold above $2,000 for any meaningful amount of time.

As I noted a few short months ago: The shorter-term trend is sideways. Price is all over the place. The only saving grace for gold is that it hasn’t completely broken down following a test of $1,900 back in late June.

Thankfully for the gold bulls, the US Dollar index offered a small spark to help break the cycle of chop.

The dollar finally began to roll over in October, helping gold firm up and push back toward its summer highs. The end of October even featured a quick “tease” above $2K – but the monthly candle finished just below the historic level. Following a short consolidation, gold was back in action in late November, finally producing the first ever monthly candle to close above $2,000.

One quick note about this chart:

Once gold extends into blue skies, it’s highly unlikely the rally ends anytime soon. Remember, this breakout is years in the making. The bigger the base, the higher in space.

Precious metals have taken their sweet time to get their act together. But I believe a bigger breakout will attract more eyeballs from mainstream investors and the financial media. That will have a snowball effect as more speculators add gold positions to their portfolios.

This first move above $2K is only the beginning. Once we churn past some of this whipsaw action, a quick jump to $2,600 is possible before gold even thinks about consolidating.

But before that, the miners will probably wake up and start to run. The VanEck Vectors Gold Miner ETF (GDX) has already cleared resistance at $30. We should look for it to take out those summer highs near $36 in short order.

So Long, Charlie

You probably heard Charlie Munger of Berkshire Hathaway fame died last week just shy of his 100th birthday. Round-number resistance got one of the greats…

Munger is probably the most quotable of the finance legends — the Yogi Berra of compounding.

You don’t have to agree with all his views. I’ve seen some crypto hardliners posting snarkier takes regarding Munger, probably because Charlier wasn’t shy when it came to his disdain for the sector, calling Bitcoin “rat poison” years before its ascension to the mainstream.

I certainly don’t drink the Berkshire Kool Aid! But he was certainly entertaining. It’s safe to say Charlie’s best quips will live forever in the annals of investing lore.

I’d like to close today’s note with a couple of my favorites:

“It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.”

“The best thing a human being can do is to help another human being know more.”

RIP Charlie. Here’s to being a little less stupid today and every day.

Since we’re working on being our best, maybe we can also continue to learn a thing or two from each other along the way.

Comments: