Gold Miners or NVIDIA? You Choose…

You have a choice…

You can either own Stock A that’s down 10% on the year amid negative headlines. Or you can own Stock B trading at record highs with a 17% return year-to-date.

Perhaps it seems like a no-brainer. I prefer to buy strength and sell weakness, so I know I would take Stock B any day.

Headlines aside, Stock A’s near-term drawdown puts it at a disadvantage right off the bat. Plus, I find it difficult to pass up new all-time highs.

But once we pull back the curtain on our mystery stocks, the choice is far from cut and dry.

If you haven’t already guessed, Stock A is Nvidia (NVDA), the market darling that has lost its sparkle.

All eyes have been on NVDA for over a year, and it has only intensified (if that’s possible) following the DeepSeek fiasco.

To be clear, I’m not bearish on Nvidia. I think it’s the same great company it was three weeks ago.

I’m simply looking for opportunities that could provide strength and stability as uncertainty spreads across the market.

Opportunities like Stock B: Alamos Gold (AGI).

I know we’ve all had our fair share of war stories involving gold mining stocks. But before you start throwing rotten tomatoes, please hear me out…

Gold is hitting record highs. And if the shiny yellow rock’s advance measures up to past secular bulls, this rally has legs!

The Bull Run Has Just Begun

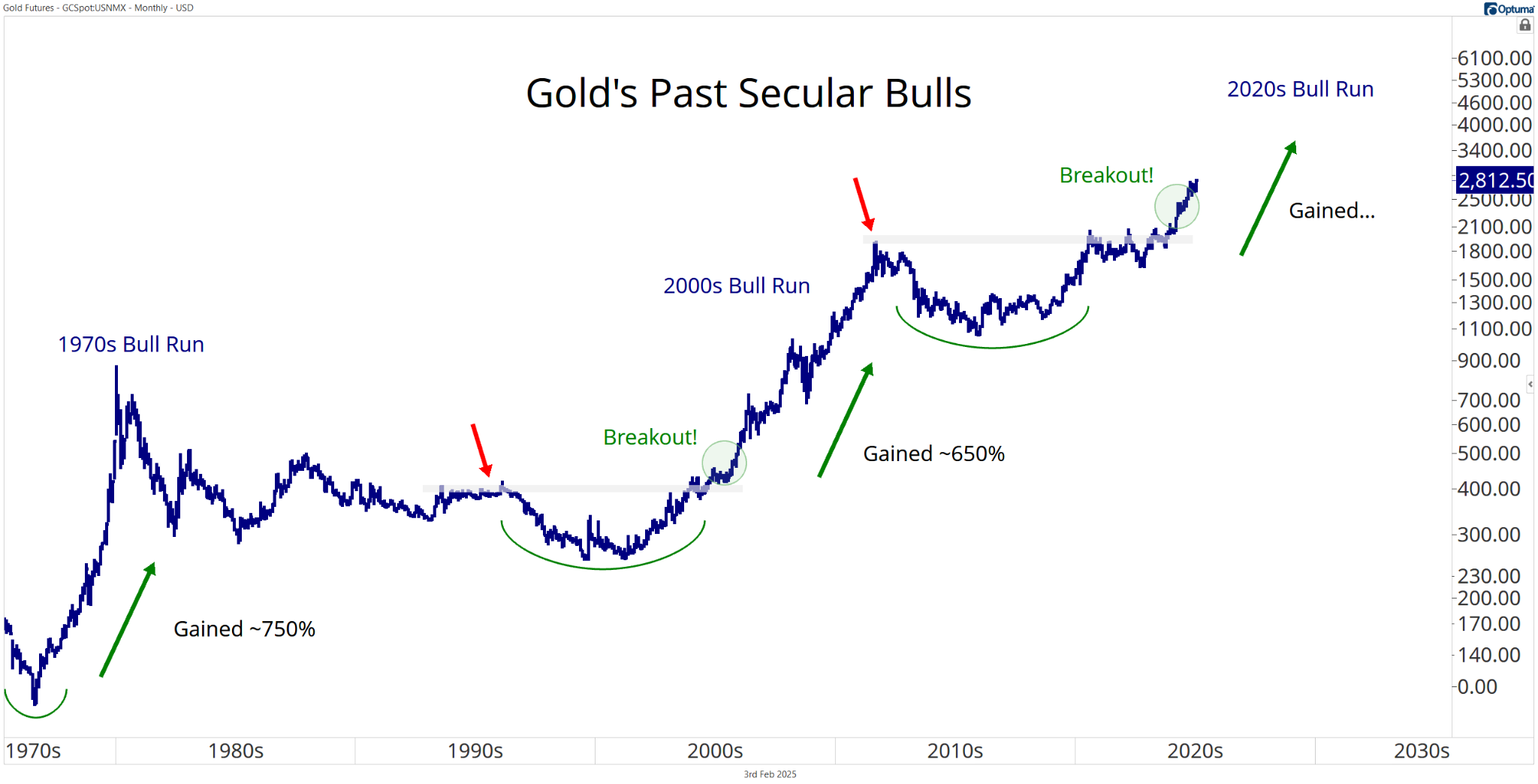

Check out the gold chart zoomed out to the mid-1970s.

Notice the explosive rallies followed by prolonged trendless markets.

After ripping roughly 750% during the 70s, gold went nowhere for my entire youth into early adulthood (almost 25 years).

Of course, that changed during the 2000s when gold jumped from $250 bucks to $2,000. Another bout of lifeless action mired precious metal markets until last year.

Today, gold is printing record highs. But it’s up a mere 150% off its 2015 low compared to the 650%+ gains of previous bull cycles.

Some might attribute gold’s lackluster rally to the real store-of-value asset: Bitcoin.

Perhaps. But I view Bitcoin and crypto generally as tech stocks. I’ve never noticed a sustained flight to safety into Bitcoin. Plus, crypto has a strong tendency to trend with the S&P 500 technology sector.

My best guess as to why gold hasn’t hit $5k lands somewhere between “no one is paying attention” and “no one wants a dumb yellow rock.” Both work.

However, rising gold prices will eventually capture more eyes creating a positive feedback loop as more investors turn to gold — ultimately Making Gold Great Again.

Of course, by then it will be too late.

Sure, you might capture the last leg or two of the rally, but you’ll also catch the increased volatility. The final stages of commodity bull markets are notoriously violent.

Now is the time to consider precious metals, especially mining stocks. Here’s why…

The Ultimate Catch-up Trade

During the 2000s bull run, Hecla Mining (HL) gained 2,200% while Agnico Eagle Mines (AEM) cruised to a cool 3,300%.

These numbers might sound similar to the performance of your favorite tech stock — and they should!

Mining stocks become the ultimate speculative growth trade during gold bull markets. And most mining names are trading well below past cycle highs.

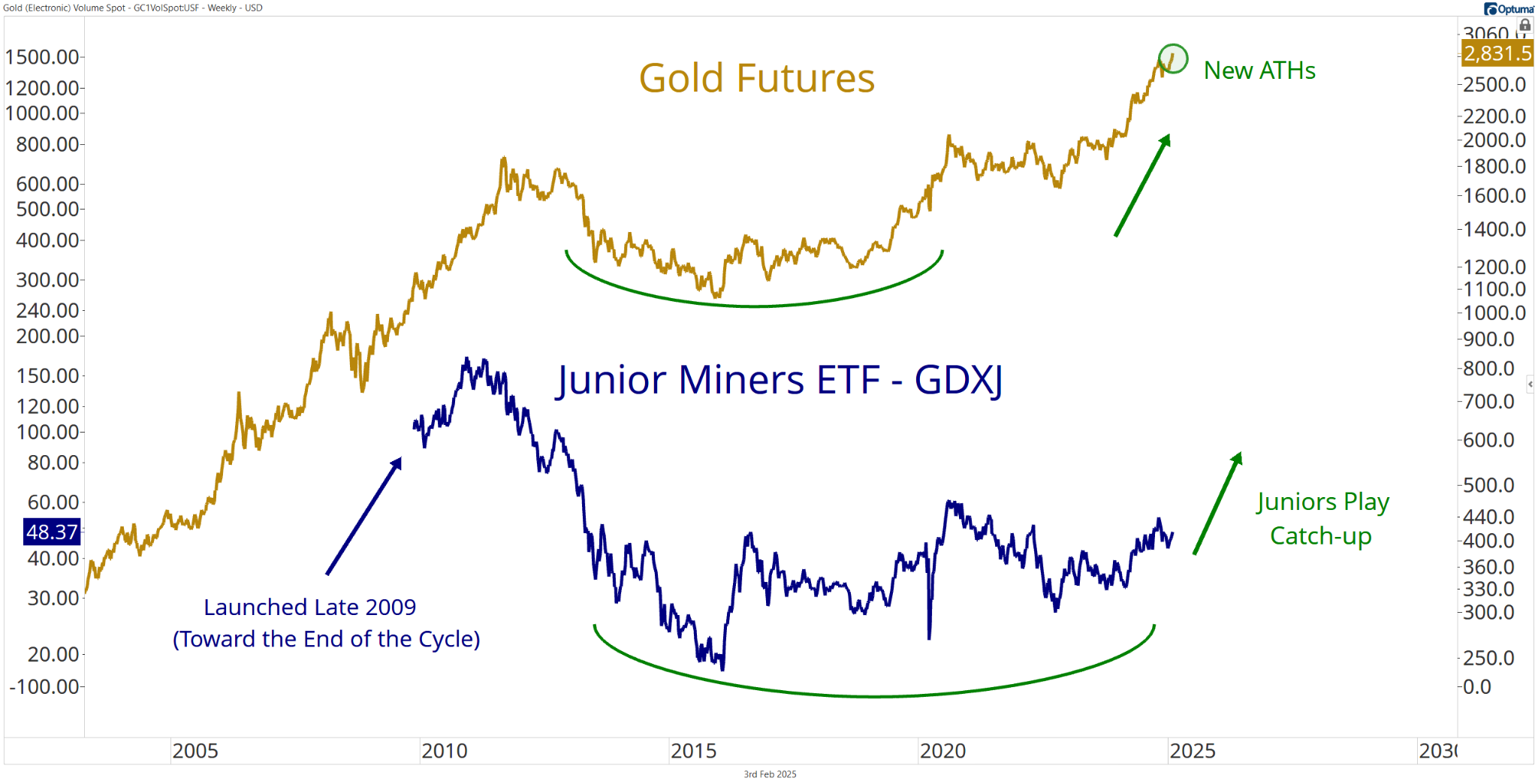

Here’s gold and the Junior Gold Miners ETF (GDXJ) side by side:

GDXJ has yet to break above its 2020 high, let alone its 2011 peak. Today, it’s bebopping around $50–$130 below its all-time high set during the last bull run.

Imagine the face-ripping rallies across the mining space if and when GDXJ starts to catch toward gold. They’ll look just like Nvidia’s rally off the 2022 lows.

A handful of names are already moving.

Iamgold (IAG) has climbed 600% over the past two years and its rally has only accelerated since gold’s breakout last year.

However, names such as IAG break the mold. The broader mining space has some serious ground to cover…

How to Play Gold’s New All-Time Highs

You don’t need to chase $50M market-cap companies — or $500M market-cap companies for that matter. Plenty of solid businesses operate within the metal and mining space.

Alamos Gold, Stock B from earlier, touts a $9B market cap. It’s also been around since 2003, which means it survived a full cycle. I like that! And, of course, it’s posting all-time highs.

You could also keep it classy by trading one of the bellwethers, like Agnico Eagles Mines (AEM).

It broke out of a multi-decade base last week to a new record high. Plus, it’s mined metals and minerals since 1957 and carries a market cap of $47.5B.

If you’re feeling lucky and want to take a swing with a five-letter ticker, you will find plenty of gold miners to choose from.

I prefer to sleep at night, so I lean toward the larger and more established companies. But Wesdome Gold Mines (WDOFF) is the exception as it teases fresh two-year highs.

Could WDOFF post NVDA-like gains? It might if gold continues to rally.

Bottom line: Taking a gold position today is taking a position in near-term strength. It’s buying an asset increasing in value — before the crowd shows up and spoils the fun.

Don’t get me wrong, I like trading AI stocks as much as anyone else.

I simply prefer holding the strongest assets as the market merry-go-round kicks into high gear.

Comments: