Geology, Precious Metals, and China-China-China

I was in Minnesota last week, in the storied “Iron Range” north of Duluth. In fact, I was out in the field on Friday, looking at Precambrian rocks, and missed the white-knuckle excitement of the market selloff for gold, silver, other metals, miners and more. It’s amazing what happens when I leave town, eh?

Good morning from northern Minnesota. BWK photo.

I spent all day Saturday traveling home and missed the so-called “No Kings” rallies, which was just as well when you consider my last name. I’m happy to be a King. All this, while the most political thing I encountered during my journey was airline reps blaming the government shutdown for a couple of flight delays.

By Sunday I was back at my desk, taking stock (so to speak) of Friday’s market rout. To me, though, it seems clear that despite the share price pullbacks, nothing much has changed about the general direction of hard assets, definitely gold and silver: up-up-up. That, and the purchasing power of dollars: down-down-down. It’s just a question of time and circumstances.

So, in this note let’s discuss a few things about Minnesota, and mid-America in general; and a few things about precious metals; and we’ll touch on rare earth elements (REEs) as well.

My Minnesota Treasure Hunt

Northern Minnesota is famous for iron ore, particularly its “banded iron” formations and other ores now processed into a material called taconite. Indeed, for over 150 years Minnesota has fed iron ore to America’s steel mills. And one thing to keep in mind is that all of that magnificent ore is relatively near the surface, amenable to relatively low-cost mining.

But there’s more mineral-rich geology at depth beneath Minnesota, and indeed all across the Midwest, southwest toward Iowa, Nebraska, Kansas, Oklahoma and even Texas; and east and southeast beneath Lake Superior, down through Michigan, and further south along the western side of the Appalachian Mountains, into Alabama.

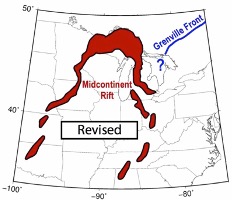

This map illustrates the geography of the “Midcontinent Rift” (MCR), a feature that has taken a century for geologists to decipher; and by no means is it yet fully mapped or well understood.

Generalized map of Midcontinent Rift System. Earthscope.org.

Basically, the MCR is a deep geologic scar within the crust, dating to about 1.1 billion years ago when material from the earth’s mantle ascended and split open the ancient structure of what’s now North America, right down the middle. By comparison, think of how South America unzipped and separated from Africa via more recent (200 million years ago) plate tectonics; or how the Arabian plate has recently (geologically speaking) uplifted and separated from northeast Africa via plate tectonics, creating the Red Sea.

The point is, over a billion years ago ancient North America began to break apart down the middle, but the process never came to fruition. At some point, and for reasons unknown, relative spreading motion stopped, and the outcome was what’s now the MCR. In other words, MCR is what geologists call a “failed rift system.” Each side of the continent was elevated due to forces acting from the mantle, and each moved slightly apart; but then the large-scale earth movement ceased, and the different parts began to move back together. But…

And there’s always a “but…” This rifting process left a massive, deep fault that, in its own way, connects the upper crust with the mantle. And through these channels, over geologic time, rose molten magma; in essence, large masses of high temperature material; i.e., mass and energy, to stick with terms of physics.

I could discuss this all day, but the takeaway is that beneath the entire MCR, and certainly beneath northern Minnesota where it’s exposed at the surface, are vast opportunities to discover important metals such as more iron, plus nickel, copper, platinum and palladium, and a large swath of other metals from the periodic table.

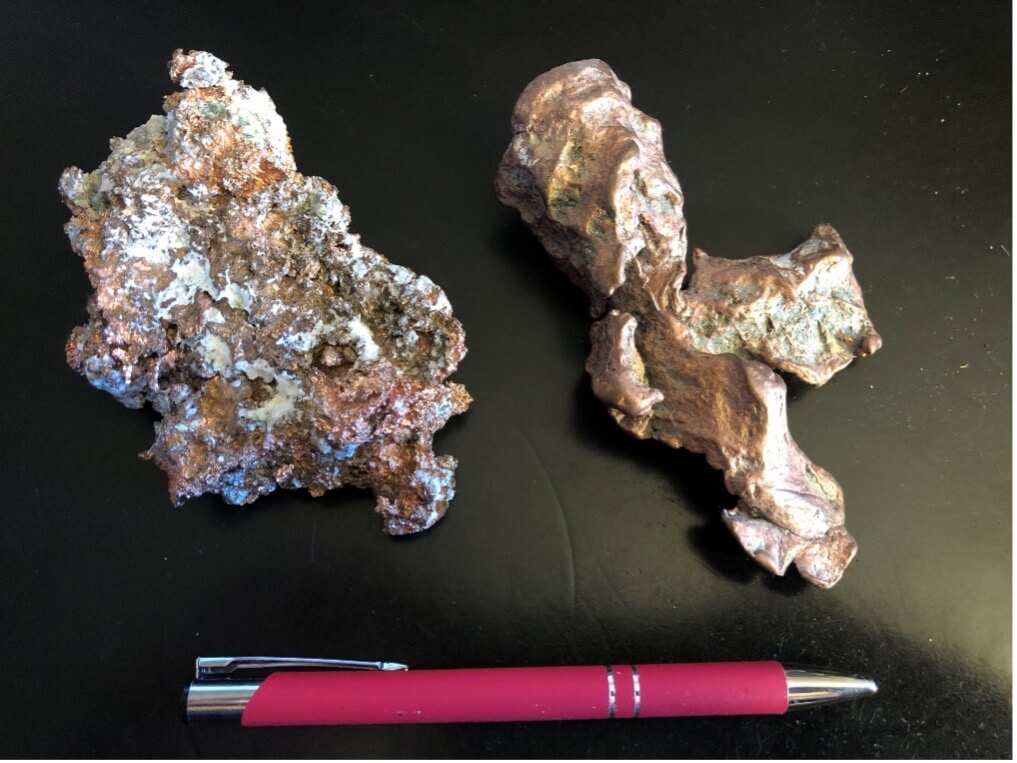

Just east of northern Minnesota, in Michigan’s Keweenaw Peninsula, this ancient geology yields deposits of elemental copper, both at surface and at depth. Plus, the region is famous for its hunks of copper that people have located in post-glacial deposits called “float,” because the copper specimens sort of floated along with the ice in Pleistocene Time.

Elemental copper from Keweenaw Peninsula, Upper Peninsula of Michigan. From BWK collection.

I’ll end this section by saying that what took me to Minnesota last week was the opportunity to visit an exploration project focused on extremely exotic rocks. The investment angles will evolve in due course, but for now I just want to explain a little bit about what’s behind the current treasure hunt in Minnesota, as well as across the world.

Market Giveth, Market Taketh Away… Hold or Sell?

Okay, now let’s go back to last Friday and the metals and miners’ selloff. Frankly, I hope that you too were out in the woods, or otherwise busy doing something useful and not worrying too much about what turned into a one-day drop in metal and share prices. You didn’t sell out, did you?

Last Friday evening, my colleague Adam Sharp offered a superb take on the immediate aftermath of the down-day, see here. Basically, don’t panic and hang onto your gold and silver miners.

This past Monday morning (aka “yesterday”), colleague Sean Ring also offered balm to the bruised investor with more cogent perspective, see here. Of course, we’re experiencing market choppiness, but we’re also firmly in the midst of a phenomenal upswing in metals and miners. Rising markets reflect a major capital rotation out of other sectors into hard assets, certainly into precious metals.

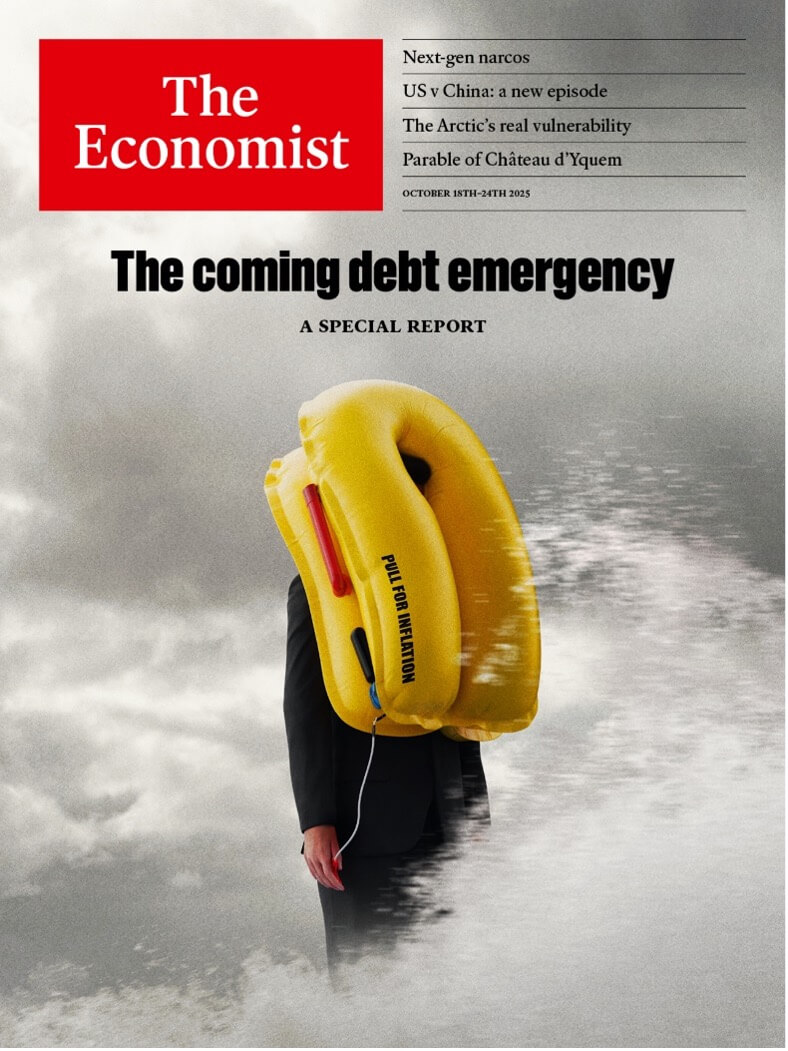

It makes sense, right? The U.S. government is over $37 trillion in debt, with another trillion hitting the books about every four or five months. Plus, there’s interest to pay on that debt, this year in the range of $1.7 trillion. And fiscal blowouts every year for the past many years, and looking ahead far into the future, government shutdown or no.

Globally, government finances are a total mess, and not just for Uncle Sam. And looking around, something must give way, sooner or later and probably sooner. Even the Economist Magazine has noticed the problem, as we see from this week’s cover and major story inside:

Economist Magazine cover, Oct. 18, 2025. Courtesy The Economist.

Almost all governments across the world are locked into excessive spending, and they lack sufficient revenues to cover obligations. Hence, we can expect continuous deficit spending, heavy borrowing, monetization of debt, higher tax rates, and inflation; which means a decline in purchasing power. And of course, gold and silver are the go-to, low-risk plays for people who want to preserve wealth through it all.

Another perspective comes from Rick Rule. I’ve heard him sing the virtues of participating in a generational upswing in hard asset valuations. But he warns that, despite the doubles, triples, quadruples and more than one might enjoy, there will be days or weeks of massive pullbacks. “If you liked that 200% rise,” he once noted, “then don’t sing the blues over a 40% retreat, either.”

In other words, it’s important to be in the right sector when money flows into it. Ride the waves and watch the gains. But also, expect markets to be fickle and take some of it back. If the underlying company is in good shape – good management, good assets, good business plan, etc. – then stay patient and don’t try to game into the winning-days and game out of the down-days; nobody is that smart or foresighted. Just stick with quality, and be in the right place when things break out.

Meanwhile, look ahead to looming earnings reports from mining companies that have been selling gold and silver at historically high prices these past few months. When they report numbers, expect blowout earnings and upside sticker shock from Wall Street players who have little familiarity with this entire sector.

And finally, let’s keep reality in the boresight…

The China-China-China Syndrome

Back in 1979 Hollywood released a movie called The China Syndrome, starring Jack Lemmon, Jane Fonda, Michael Douglas and others. The plot involved an accident at a nuclear power plant that could have led to a meltdown, and the theme utilized the idea of everything melting through the earth until it made its way to China. Hey, it was only a movie, right?

Except that China Syndrome sparked fears, and captured hearts and minds across the U.S., if not the world. Coincidentally, this movie came out about the time that Three Mile Island (TMI) had a serious accident in central Pennsylvania. To avoid a long story, I’ll just say that between this movie and the reality of TMI, the nuclear industry in the U.S. took a political and sociological body blow from which it has barely begun to recover, even today, 45 or more years later.

Beginning in the early 1980s, the West didn’t just back away from nuclear power. Those years mark the early innings of American deindustrialization, with literally tens of thousands of U.S. factories and plants closing across the Republic, and tens of million of people losing work in long-established industries.

And while the U.S. and West worried about cinematic meltdowns making their way to China, the Chinese had another idea. They began to send millions of their brightest young people to Western universities, and to build up massive energy and industrial capabilities at home. And today, it’s beyond clear that China dominates much of the global industrial landscape, from steelmaking to other metals and materials, shipbuilding, autos, electronics, energy in general, renewable energy, batteries, and the rest of a very long list.

One pillar of China’s dominance is its control over supply chains, all the way down to mines in distant parts of the world. And then processing material on site, and shipping it back to China by ship or rail, for processing into the downstream products that go into everything else. It’s all based on a comprehensive national plan.

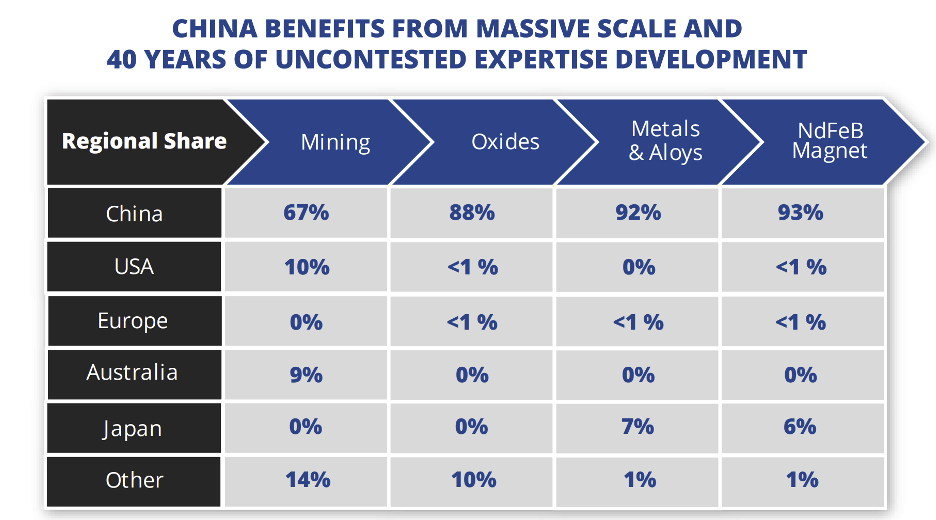

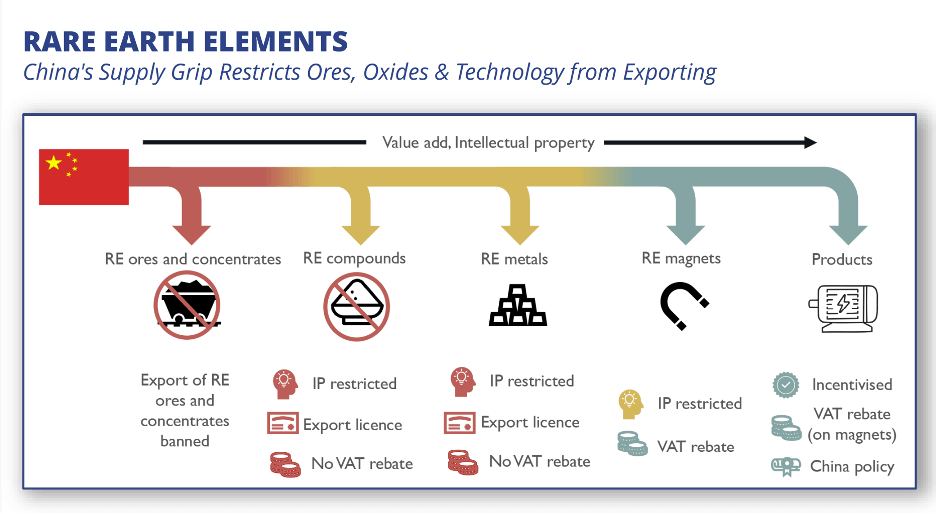

For example, consider rare earth elements (REEs), which I discussed in a talk at the Paradigm Press conference in Nashville, Tennessee on Oct. 9. Here’s one of my slides:

If you ever wondered about the scale of Chinese dominance of REEs, these are the basic data (and yes, the word “data” is a plural noun; a pet peeve of mine).

So when you hear talk about how USA-USA-USA is going to rally from behind and kick butt in the REE space, just consider that we’re way behind in points, and starting the comeback from our own 2-yard line, so to speak.

Another way to ask the question is, what is the U.S. up against, with respect to China? Well, here’s another of my slides:

In essence, China dominates every level of the supply chain, from mineral ores in the ground to processing, compounds, downstream intermediate products, and final items. They’ve had 40 or more years to figure things out, and for the U.S. and West it’s tough sledding ahead.

Meanwhile, Chinese geologists and purchasing agents have scoured the world and locked up many of the best known deposits, so even acquiring basic feedstock will be an uphill fight. Again, another slide from Nashville:

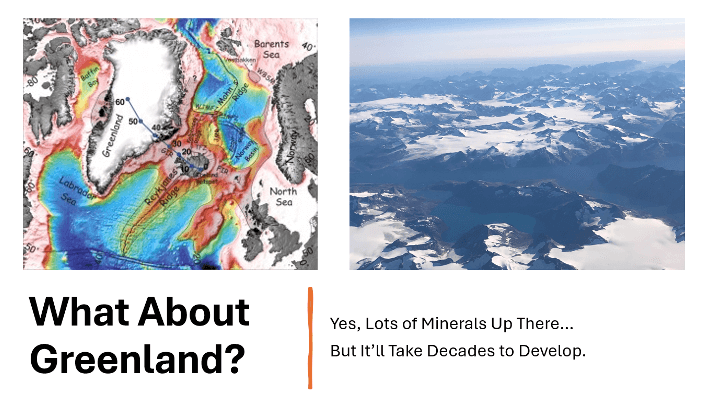

And not to get too far-fetched, but what about Greenland? Well, the place hosts many great deposits in those ancient rocks, but they’re also in a distant locale with the harshest of climatic conditions. Here’s a slide of Greenland, along with a photo I recently took of the southern tip of the place, as I flew over on an Iceland Air jet aircraft.

The place is a vast landscape of ice, mountains and remote fjords, mostly inaccessible during many months of the year. Which means that it will not be a picnic to develop Greenland; not fast, nor easy, nor certainly not cheap.

Which brings me back to those points I made at the beginning about Minnesota… It’s not just close to home; it is home. Which means that America must look inward. Invest in domestic opportunities in the U.S. and look also to Canada and Mexico.

And along these lines, we at Paradigm Press have plenty of ideas, so stay subscribed.

That’s all for now. Thank you for reading.

Comments: