Following the Golden Path

Well, we finally got the mini-crash we’ve been expecting in precious metals and miners.

On Tuesday gold plunged 5.7%, its biggest daily fall since 2013. Silver fell a whopping 8%, slipping back under the key $50 level.

Miners fell harder, with the GDX gold miner ETF stumbling from $84 to $73 over the past week. The SILJ silver miner ETF fell from around $26 to $23 over the same period.

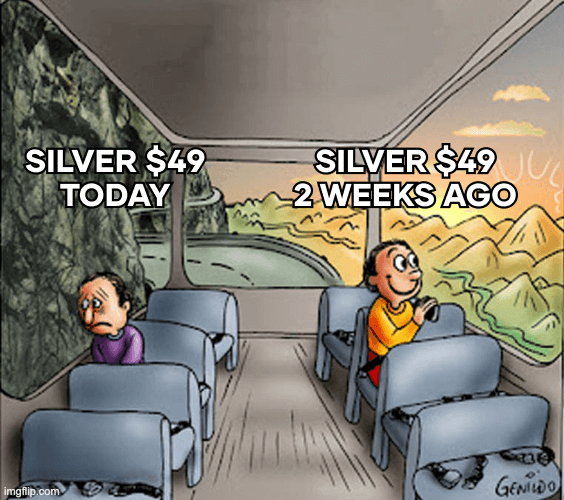

But it’s important to keep everything in perspective. I got a chuckle out of the meme below.

Source: Make Gold Great

Perspective is everything.

Silver is currently trading around the $49 level, which seemed like a remarkable achievement just a few weeks back. Gold fell from a fresh all-time high of over $4,400 to $4,130/oz, its lowest level in… 9 days.

Miners are rebounding slightly today after a rough week. The world’s largest gold miner, Newmont (NEM) reports earnings today after the closing bell. If they report a blowout quarter, and they should, that could revive the miner bull run (disclosure – I own NEM).

Of course, the correction may not be over yet. But today, let’s review why we believe the bull market still has plenty of gas in the tank.

Remember the Debt Bubble?

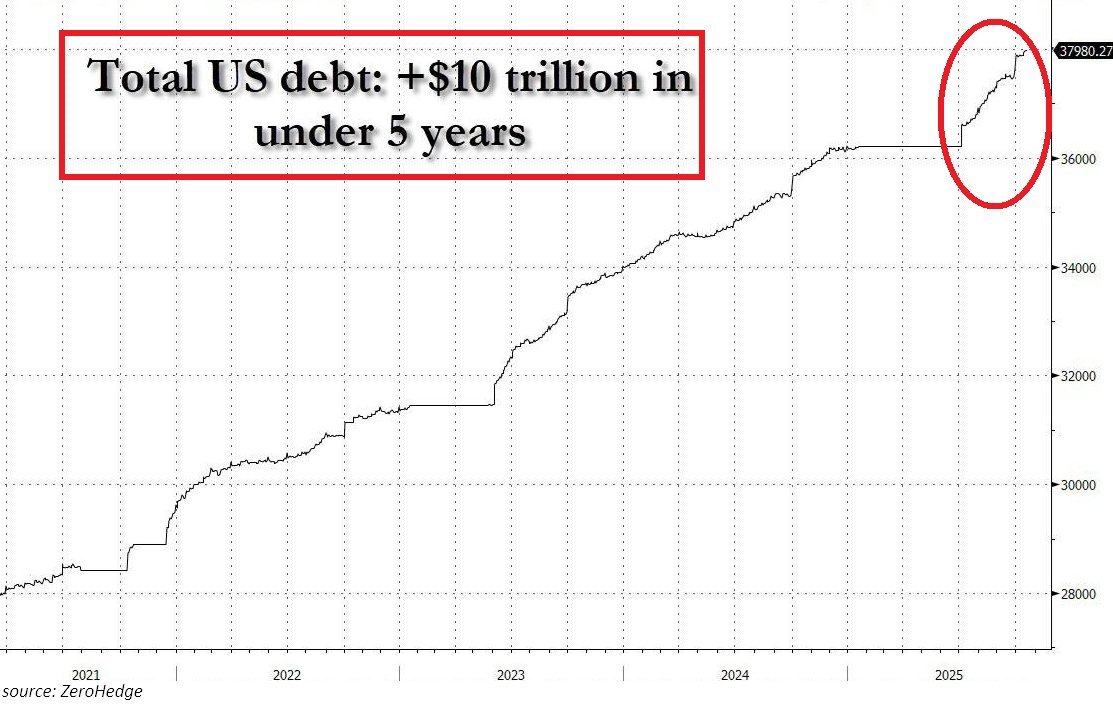

With everything going on in the world, it’s sometimes easy to forget that we’re in the midst of an epic, unprecedented debt bubble.

In less than 5 years, the U.S. federal government has tacked on more than $10 trillion of new debt.

Source: Zerohedge

And it’s not just Uncle Sam running up the tab. Total global debt just hit a new record of $337 trillion. That includes governments, households, corporations, and banks.

The U.S., China, and Japan stand out as having the highest debt-to-GDP ratios. But almost every country in the world is putting a big chunk of their spending on credit.

Resolving this debt crisis will require some… creativity by central banks and governments. Fortunately we have historical examples which hint at what comes next.

Back to the 1940s

Historically, when debt gets this high, it is not paid off in installment plans.

It is inflated away with freshly printed money.

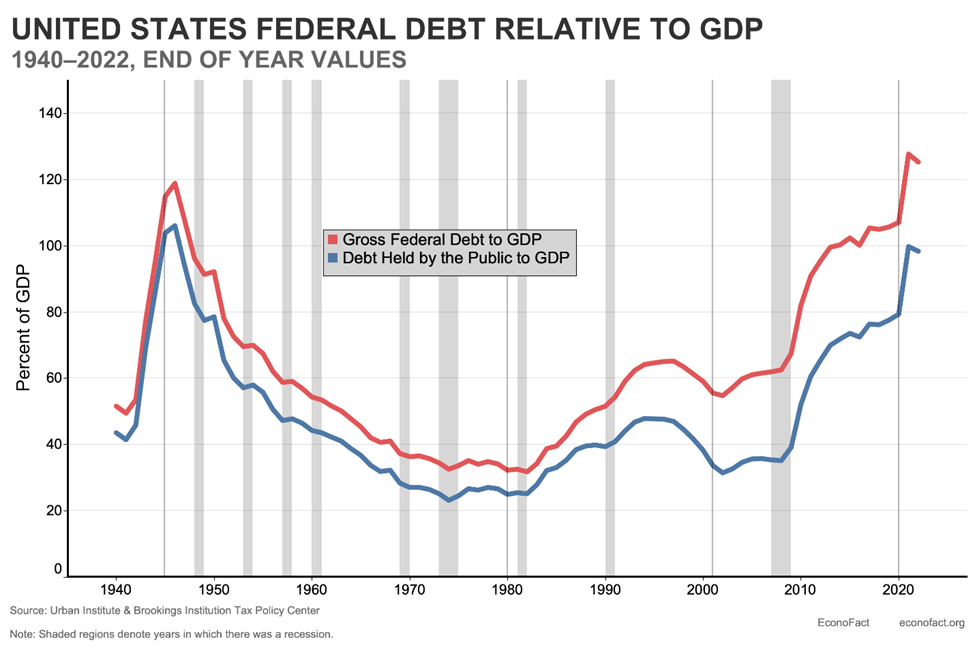

We saw this in 1940s America, as the government borrowed and printed money to pay for WW2.

U.S. money supply doubled from 1940-1945. Debt-to-GDP reached 119% in 1945 (it’s even higher today).

Source: Econofact

As a result, inflation peaked at 19.7% in 1947. And as we covered in The Fed Brews Up a Nasty Potion, the Federal Reserve gobbled up the majority of America’s newly-issued debt.

Interest rates on government bonds and notes were kept at artificially-low levels. Long-term treasury bonds yielded just 2.5% as inflation raged as high as 19% annually.

People who owned bonds and cash got hosed. But inflation helped wash away the overwhelming debt burden, rapidly bringing debt-to-GDP under 80%.

A post-war boom revived the economy, and eventually America grew out of its debt problems. But the burst of money-printing by the Fed and Treasury during the 1940s helped prevent an all-out collapse.

I suspect we will run a playbook similar to the 1940s again. There is simply no good way to get rid of a debt pile as big as ours.

Out of Good Options

Inflation is the path of least resistance. However, we will need to eventually get our spending under control as well.

And it’s going to be harder than it was in the 1940s. After WW2, government spending plummeted. The economy rapidly recovered as we converted military production lines back to civilian ones. Today our Department of War spends like we’re in a global-scale conflict every year.

Back then, America also didn’t have a gigantic social welfare system dragging it down. Spending on programs like Medicare, Medicaid, and Social Security today are sacred cows which cannot be slaughtered. Despite the fact that they will soon run out of money.

So it’s going to take longer than a decade to resolve our current issues.

Nobody knows exactly how it will all play out. The only safe bet is that it’ll involve a lot of money printing and inflation.

Financial repression is an old term, but one that will soon be back in vogue.

This is the primary reason I believe the bull market in precious metals is far from over. America, and the world, face unprecedented levels of debt and deficit.

2008 and 2020 were really just warm-ups. The money printing which lies ahead of us will dwarf both.

To reiterate, it’s difficult to nail the timing here. This is why I believe in holding a strong long-term position in gold, silver, and miners. They are the safest and best hedges we have to prepare for what lies ahead.

Corrections like the one we’re experiencing now aren’t fun. But maintaining a significant position in precious metals will be key to wealth preservation in the years ahead.

Jim Rickards recommends a 10% allocation, while I’m comfortable with 15-20%. Either option will offer significant protection if the next few years plays out like I suspect it will. Even a 5% allocation can act as a robust hedge.

If somehow the inflation I expect doesn’t materialize, and gold and silver underperform, that’s an acceptable risk. Precious metals are portfolio insurance. If things get bad, the policy will pay for itself many times over.

Comments: