Don’t Let a Good Bank Run Go to Waste

I began my trading week by waking up to a long list of banks plummeting into the abyss as a whiff of panic spread beyond the walls of the Silicon Valley Bank implosion.

Everyone’s still groggy from the weekend time change – but that hasn’t stopped friends and relatives from blowing up my phone with countless market meltdown questions…

Are stocks going to crash?

What happens next?

What should I do?

These are simple questions. But they don’t have easy answers.

So, I’m going to stick with what I know.

When a crisis hits, all your plans begin to look silly and irrelevant. I was focused last week on rates, the US dollar index, and the market’s reaction to a slew of economic data as the averages chopped along at key levels.

We were debating whether the Fed would continue to drag the market toward another 50 basis-point hike. Could this fragile market handle another rate bump? Would shell shocked investors stick around if stocks lurched lower?

These concerns are now firmly on the back burner. This week, all we’re hearing about are banks, banks, banks.

It’s all too easy to get sucked into the noise machine. The financial news, our government overlords, and the venture capital echo chamber are using fear to get what they want. We’ve already witnessed a swift bailout over the weekend. As the old saying goes, never let a good crisis go to waste.

We shouldn’t, either.

Now’s a great time to reassess open positions, review bigger-picture market ideas, and (most importantly) figure out what has and has not changed in the market since last week.

How to Avoid the Next SVB

First, it’s probably a good idea to make sure we don’t get caught in any positions that could meet a fate similar to the crashing banks.

This is where charts are especially useful.

A crucial fact that gets lost in the noise of these inevitable crises is that stocks don’t crash from their highs. But that’s not how the financial media portrays these events. If we’re to believe the narrative, everything was going peachy keen for long-term SVB investors until late last week.

Sentiment and those slippery fundamentals (or at least, the market’s collective understanding of the fundamentals) did abruptly change. Aside from a few diligent short-sellers, no one was panicking about Silicon Valley Bank’s ability to keep its doors open seven short days ago.

But an avid chart watcher wouldn’t have been involved in Silicon Valley Bank.

Why?

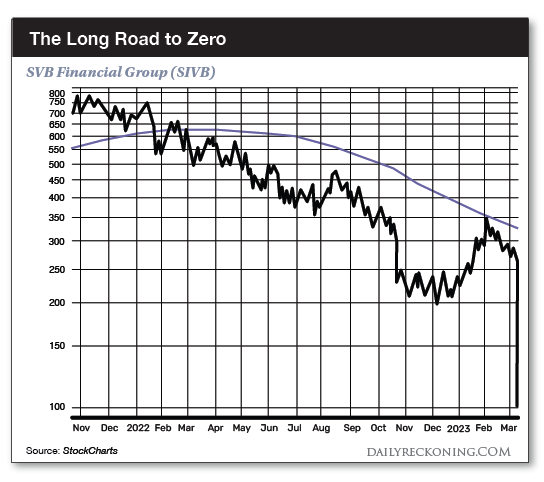

For starters, the stock was going down for a long time. More specifically, the stock was locked in an obvious downtrend while pinned under its declining 200-day moving average.

This stock gave investors zero reasons to trust any of its rallies since its peak in late 2021. Even a strong January snapback was roundly rejected before it could make an attempt at topping its 200-day moving average. That’s a decent sign the downtrend is still very much intact.

Aside from a short-term minded swing trader attempting to play a quick momentum move at the very beginning of the year, the chart offers no signals to a long-term minded investor.

Of course, not every chart that looks like this will crash. But every stock that does crash will likely have peaked many months before the main event that seals its fate. The sellers will trickle in little by little. Eventually, if everything goes perfectly wrong, the floodgates will open.

The lesson here is simple: Don’t buy stocks in downtrends.

Not only will you sleep better at night – you’ll probably also avoid any major market catastrophes in the future.

Surviving a Stock Market Shock

It’s a mess out there right now. It feels as if market conditions are changing faster than the weather in New England.

Decision making is especially difficult during these market shocks.

The first instinct of many investors is to do something.

News is breaking! Markets are in flux! It’s time to make a big move…

Unfortunately, these knee-jerk reactions often lead to trouble. A volatile market is like quicksand. If you thrash around too much, you’re going to be up to your neck in poorly-judged trades.

During these sudden, event-driven market moves, it’s usually best to take a step back. Yes, you should always honor stop losses on your open positions. I’m not advocating for taking your hands off the wheel! But firing off round after round of directional plays coming off a weekend of bank failures isn’t a winning formula.

Another valuable market exercise during these bursts of volatility is to turn back the clock to just before the event rattled Wall Street.

What were the key market levels before the trouble started? What trends were already changing?

The market’s still very much in-flux as I type. I want to relay to you exactly what I’m seeing right now – just understand these facts could change between now and when this note hits your inbox…

Here’s what has my attention now: The US dollar index failed at 105 and has turned sharply lower. Early last week, I noted that a move lower from the dollar at these key levels could help spark the next leg of the gold rally. Mix in a little fear from the ongoing bank crisis and the fuse is lit.

Gold has settled higher for three straight sessions and has blasted above $1,900 following an ugly February. Silver is rocketing higher. The miners are snapping back to life. Are they finally ready to break out of their choppy ranges?

The noise is deafening – don’t let it distract you from these opportunities.

Let me know what you thought of today’s article… and if you want any more topics covered by emailing me here.

Comments: