Declining Dollar, Rising Gold, and Combatting Normalcy Bias

Today, we’ll discuss gold, and its recent, upward price move along with the accelerating decline of the dollar, and by extension the global dollar system. The takeaway is that if you are not positioned in precious metals and miners, then you are not prepared for what’s about to hit you.

But first, I want to tell you what happened to me last week. Unexpectedly, I wound up over 540 feet beneath sea level, with the Atlantic Ocean above. I was dry as a bone, though, and my ears didn’t even pop. But definitely, it was strange.

I mention this because sometimes you don’t really know what’s happening until after it happens and you look back and ask yourself, “What just happened?” And this was one of those times.

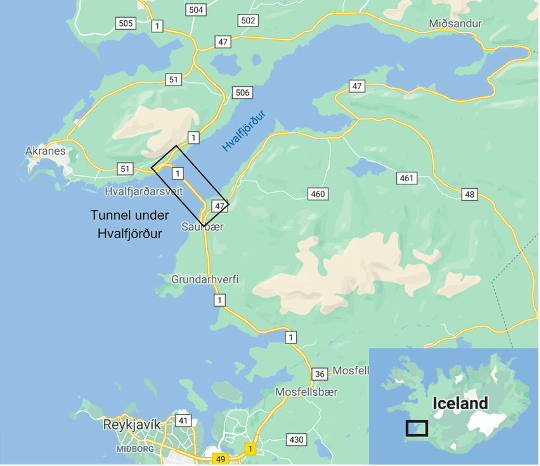

Map showing Hvalfjörður Tunnel, north of Reykjavik. Courtesy Researchgate.net.

Welcome to Iceland

Okay, here’s the punchline about being over 540 feet beneath sea level. Last week I was in Iceland, where I drove through a tunnel that passes steep and deep under the Hvalfjörður fjord, just north of the country’s capital city, Reykjavik (see map above).

I was northbound on Highway 1, one of the country’s main drags. Then seemingly out of nowhere, the road entered a tunnel; the Hvalfjörður Tunnel to be exact (see cross section below). From the roadmap I knew it was there, but I didn’t know what to expect.

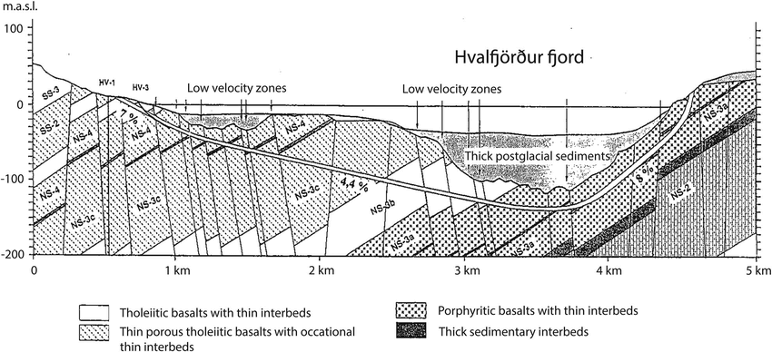

Geologic cross-section of Hvalfjörður Tunnel. Courtesy Researchgate.net.

Almost immediately, the path before me dropped down, down, down. But I kept driving… and driving… and driving… for over three miles, to include twists and turns; almost 19,000 feet through this engineering marvel. Then finally, up, up, up… and then out into sunlight; whew!

Tunnel dug through solid basalt rock. Gocarrentals.is.

Mostly, the tunnel route was 2-lanes (see photo above) but with side cutouts and even a couple of turnaround areas. The lighting was poor because the dark gray basalt wall rock doesn’t reflect the electric light illumination; it just sponges up those photons.

Even to my jaded sensibilities, the passage was creepy. And when I emerged on the north side of the fjord, I was relieved to find a pull-off area. Perhaps the Iceland highway department built it for sightseeing because there’s a nice view there. But more likely, it’s a designated spot where first-time Iceland drivers like me could pull over and let their blood pressure stabilize.

My point is that sometimes, things seem normal until they rapidly get weird on you. Most of the time, something like driving down a road is normal; you see the world through what’s called “normalcy bias.” It’s doable, and this is the case it’s doable even in a foreign country where all the road signs are in Icelandic. Yes, things are different in Iceland, but you can still figure out the general basics like speed limits and passing zones.

And then? You encounter something that you didn’t expect, like a deep tunnel carved out of basalt underneath a fjord full of seawater. Going in, you think that things are “normal” because everything up to that moment was okay, but it quickly dawns that something is very different. You’ve entered an unknown situation.

Which brings me back to the beginning of this note, where I said I’d discuss gold and whether or not you’re set up for what’s happening.

Gold Is Moving

Yes, I was busy on my Iceland adventure, mostly out in the field kicking rocks and doing geology. But I wasn’t too busy to notice that the price of gold moved solidly over $3,600 per ounce.

And unlike driving into that tunnel I described, I was not at all surprised by the upside movement in gold. My mind has long been prepared for gold to go higher, and I expect it. Or look at things from another angle, I wasn’t surprised by the downside move in the value of the dollar. I expect that, too.

If you already own gold, and/or you’ve invested in the gold mining sector, you must be pleased right now. Maybe you just started accumulating gold and mining shares in the past year or two, or perhaps you started long ago. And I hope that our thoughts and ideas here at Paradigm Press Group have helped with your understanding.

One way or the other, with gold (i.e., yellow metal in physical possession) you’ve managed to preserve wealth. And with miners, I hope you picked some solid plays like Kinross Gold (KGC) or Agnico Eagle Mines (AEM), among many others with strong recent gains. You’re in tall cotton, so to speak.

Just this year alone, in 2025 gold and the mining gang have moved quite a bit in eight months. Look back to January 20th, when President Trump was inaugurated, and the gold price was about $2,750. Now at over $3,600, the math is clear: gold has moved upwards by over 30%.

Plus, we see great earning reports from the mining side, which has led to solid moves in those mining companies’ shares. For example, look at the charts for major producers like Barrick Gold (GOLD) and Newmont (NEM), and many intermediate plays, junior miners, and a spectrum of royalty plays like Franco Nevada (FNV) and others.

Or again, look at that same gold-based math in a different way; namely, that over the winter-spring-summer of just this year the dollar has lost about one-third of its purchasing power with respect to gold. And no, I’m not carpet-bombing Trump for this because he inherited a systemic monetary mess that goes back almost a century, to the 1920s, and then Presidents Hoover and Franklin Roosevelt. But I won’t bury you in history on that.

More recently and looking back just to the campaign trail in 2024, Trump promised to fix the dollar, stabilize prices and all the rest; blah-blah, campaign talk. But c’mon, man… the truth is that the country’s monetary problems are beyond that “fixing” point now. If nothing else, our $37 trillion national debt and the annual interest of $1.5 trillion speaks for itself.

The Broken Dollar System: No Fixes, Only Gimmicks

Indeed, there are no fixes to the country’s fiscal and monetary problems, only gimmicks. And in my view, one way or another the dollar is doomed and it’s only a question of when, where and how the proverbial dam breaks. Hence, you should/must own gold and related hard assets that retain value.

Here’s the crux of the problem: It’s no secret that U.S. federal spending has been out of control for many decades. Some say 50 or 60 years, since the days of President Johnson’s simultaneous, so-called “War on Poverty,” coupled with his War in Vietnam.

In essence, Johnson broke the post-war dollar system that came out of Bretton Woods in 1944, and by 1971 President Nixon had to “close the gold window,” as historians call his actions. Then came many decades – 1970s through now – of an unmoored dollar, except that the trick – aka ‘gimmick” – was to tie America’s currency to global oil output via the Petrodollar (long story).

And for the past half century things muddled along, if you discount continuous, chronic, blowout spending, plus growing deficits and debt of the U.S. government, and by extension debts of U.S. states, localities, banks, businesses and consumers.

But everything comes to an end, including America’s free ride on that Petrodollar system, and the point of failure was the profligate use of sanctions against Russia, beginning in 2022 after Russia moved into Ukraine. Think whatever you want about Russia, Ukraine, the personalities and all that; but the point for us, here, is that the Biden administration weaponized the dollar, and that was “it” for much of the rest of the world. They began de-dollarizing.

We’re now three years post-sanctions/post-weaponized dollar, and the world is de-dollarizing faster and faster. More and more global trade is outside the dollar, such as China making deals with countries like Saudi Arabia and Brazil to trade in their own, respective currencies. Or we could discuss the fast-evolving BRICS (Brazil-Russia-India-China-South Africa) scenario, but that’s way beyond time and space here.

Meanwhile, we’re well into Trump’s first term and his signature foreign policy moves have been deeply colored by mercurial tariff schemes, and even more sanctions contra Russia despite clear evidence that sanctions don’t work in this regard. So we’re now at a stage where it’s clear that much of the rest of the world is saying “no mas, senor.”

In other words, the rising price for gold reflects a global flight away from kooky, unpredictable U.S. foreign and monetary policy, let alone the military angle. Central banks everywhere are buying gold to shed dollars and move towards some semblance of security; and also to prepare for whatever comes “next” in the arena of global trade, because the dollar is clearly in decline.

Closer to home and to where you live and work, you probably didn’t notice this year’s 30% decline in dollar-versus-gold at, say, the gas pump or grocery story. In fact, gasoline is less expensive now than last January, as are prices for many staples at the supermarket (and yes, some things are pricier). All in all, it reflects how there’s a global oil glut on the energy side, and in the broader economy not all prices readjust immediately or perfectly to inflation, let alone to Trump’s tariffs and changes in tax rates.

Over time, though, the decline in the dollar will continue to flow through the economy. And to preserve wealth for whatever comes next, you must own gold, just like governments, banks, businesses and people across the rest of the world. Because what do they know that you don’t? Well, they know something…

If You Don’t Own Gold?

And if you don’t own gold? Okay, maybe in the past few years you just didn’t have cash left after paying your bills, so you never bought any yellow metal. I get it, but you missed out on what, one of these days, we’ll look back and call the “early move” for gold.

To soften the sting a little bit, it’s not too late to climb onboard with gold. In fact, retail buying remains a minor factor in gold markets even now, and certainly in the U.S. (but not China, India, Russia, and many other parts of the world).

And if you didn’t buy gold because you had other investment ideas? Well, I get that, too. Maybe you bought real estate, or poured cash into, say, whole life insurance, or your stock portfolio is filled with high-flying tech names. If you’re doing well with what has worked, it’s good for you. But still, you might try moving some cash into gold as well, if for no other reason but to rebalance things.

On my end, and whether I’m at home in the U.S. or out in the craggy hills or ice-covered beaches of Iceland, my brain is wrapped around the idea that the dollar has been mismanaged by the U.S. government and Federal Reserve. The long-term trend is dollar-decline, and the salvation is gold.

Your editor, examining glacial ice in Iceland. BWK photo.

In this sense, investors – actually, everyone – must get past the long-established normalcy-bias that dollars are the only way to measure their financial health, because the U.S. currency is on a pathway to failure. Sooner, later, slowly, faster, then all at once.

If you haven’t done it yet, try to re-imagine the dollar in a failure mode, when what we presently use as day-to-day money transforms into something else. Imagine awakening to an American currency crisis, when prices for everything leave the rails, when posted prices become meaningless. And then, try to imagine moving ahead in life without also owning some gold.

That’s all for now. Thank you for subscribing and reading.

Comments: