COMING SOON: Silver’s Mania Phase

Every so often, silver goes through a mania phase.

I experienced my first and only silver mania from 2009-2011. There’s nothing quite like it in the investment world. Simultaneously thrilling, nauseating, and lucrative.

Silver is tiny compared to gold and other commodities, so bull markets tend to be almost violent in nature. Once generalist investors get involved, things can quickly get out of hand, in the best kind of way.

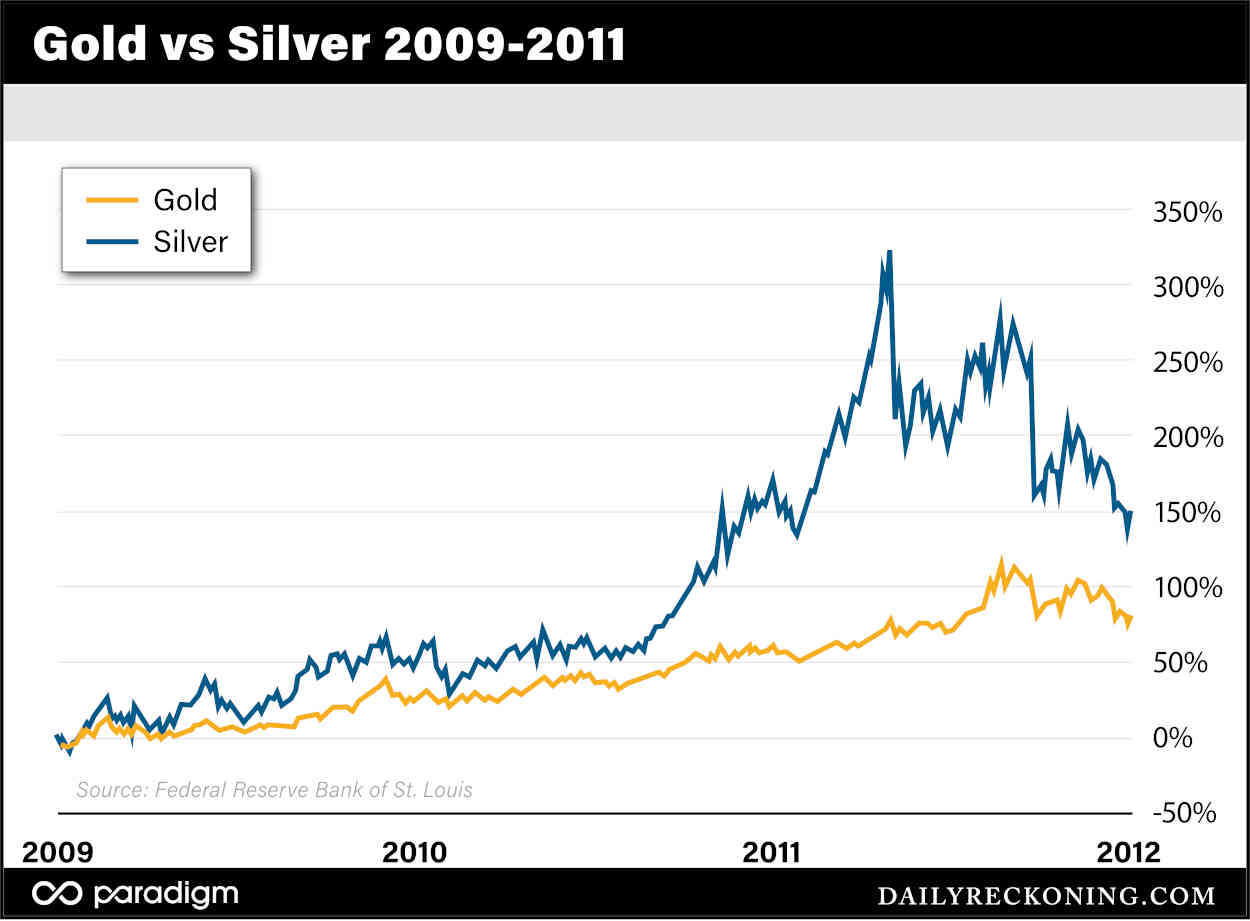

Here’s a chart showing the relative performance of silver vs gold from 2009 through 2011:

As you can see, the price of silver soared more than 300% over a few years. This was in the aftermath of the 2008 global financial crisis. People were rightfully freaked out about money printing, bank bailouts, and stocks crashing.

The 1970s, of course, was even more dramatic. Silver went from a low of around $1.50/oz to $50 in 1980. But, as we have discussed previously, that was the result of market manipulation by the Hunt brothers. So we can’t fully count that one as a benchmark.

But eventually we will experience another one of these mania phases. I can’t say for certain we’re on the cusp of one. But our current situation is the best fundamental setup I’ve seen (better than 2011, in my view).

- Huge silver deficits (much more is being consumed than mined)

- Industrial use is soaring

- Debt is spiralling out of control

- Inflation is back in the mainstream consciousness

- Stock markets may have peaked

Now that’s a recipe for a silver bull market. The only ingredient we’re missing is soaring investment demand. But I believe this will come with time, and patient investors will be rewarded.

Of course, we’ve already begun to see positive price action. Being up 40% in a year is nothing to sneeze at. But this is mostly the result of industrial demand. And if this is the beginning of another silver investment mania, what we’ve seen so far is just a small taste.

Here’s what famed commodity investor Rick Rulehas to say about silver bull markets.

When a silver bull market gets underway, it’s something to behold… There is a memory investors have of a market that went from $1.50 to $50. There’s an institutional memory and an individual memory…

I have watched now 3 times in my life the silver price flirt with $50… While the gains that were possible in the metal were lovely, the gains that were possible in the stocks, for people who actually did real research, were extraordinary.

Silver mining stocks can absolutely explode in a bull market. Silver miners are a tiny portion of the overall commodity space. Most silver is mined as a byproduct of other metals, and there are only a few companies who specialize in mining silver.

So when silver mania takes off, a huge amount of capital floods into the few miners who specialize in the metal.

In the same interview quoted above, here’s what Rick Rule has to say about silver miners during a bull market.

My friend Doug Casey famously said, “the market capitalization of silver [miner] equities is insufficient to accommodate the inflows of capital from generalist investors when the precious metals narrative takes over. When the generalist investors come in, the result is like trying to siphon the flow of the Hoover Dam through a garden hose.” I’ve witnessed this, and the most dramatic example is Coeur D’Alene which went from around $0.10 to $65.

Well said.

I continue to buy silver, and silver miners, on dips. We’re still well below the 2011 high of near $50/oz, and industrial demand is far higher than any other time in history. All we need is a spike in investment interest, and then a proper mania can begin. And silver will finally begin to find its new all-time high.

Needless to say, silver is a highly volatile investment which means it requires significant patience. If you can’t handle the price volatility, stick with gold. It’ll be a smoother ride.

But if you can stomach the wild price action, I believe silver longs will be rewarded over the coming years. A $100/oz target seems entirely possible, maybe even conservative, by the end of the decade.

So for most people, buying silver coins and bars is enough upside and volatility.

But if you’re a speculator looking for exposure to silver mining stocks, the Global X Silver Miners ETF (SIL) is a good place to start. That’ll provide some nice leverage to the underlying silver spot market. And if we do enter into a new mania phase, it should significantly outperform.

Comments: