Christmas Comes Early for Precious Metal Investors

What’s that sound outside? It’s Santa Claus, bringing gold, silver and cash flow into a sweet package of Christmas cheer. Okay, so he’s a couple of weeks early. Just enjoy it. Never turn down a good deal. So, what’s happening? Well…

What’s in Santa’s sack? Early 1900s image from Library of Congress.

This Monday – aka “yesterday” – news hit the wires that two superb precious metal exploration and development companies are merging to form a larger player.

No, it’s not some big company swooping in to buy out a smaller one for a 40% markup. Rather, it’s one solid, very profitable company with exploration, development, production and cash flow merging with another solid company in the high-potential, high-upside, exploration-development space.

Markets do what they do and the share prices for both companies didn’t move too much with the merger news. But looking ahead, the outcome will be a larger, more financially secure “junior” miner with immense upside, especially as gold and silver prices rise in 2026. Both companies hold significant cash in the bank, with more to come from operations. Let’s dig in…

Combination of Equals

If you’ve been reading either my Morning Reckonings in recent months, or my articles in Strategic Intelligence, or colleague Sean Ring’s Rude Awakening, the names ought to be familiar.

That is, Contango Ore, Inc. (CTGO) and Dolly Varden Silver Corp. (DVS) announced that they have entered into an agreement to combine in a so-called “merger-of-equals.”

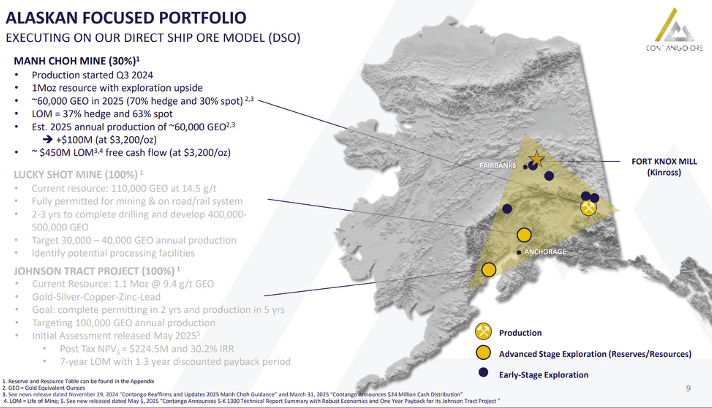

Contango operates in Alaska. It mines high grade gold ore from an open pit called Manh Choh, about halfway between Anchorage and Fairbanks. Then Contango ships its ore via haul-truck to Kinross Gold (KGC – $32 billion) and the Fort Knox mill just outside Fairbanks (Note: this is Fort Knox, Alaska; not to be confused with the U.S. Gold Depository in Kentucky.)

Contango’s Alaska operations. Courtesy Contango Ore.

Plus, Contango is redeveloping a high-grade gold mine called Lucky Shot, about an hour’s drive north of Anchorage. And Contango holds a superb mineral claim called Johnson Tract, about 140 miles southwest of Anchorage, just inland from a deepwater coastline. I have personally visited these operations*.

Contango has a tight share structure, so shares trade at about $26, which gives the company a market cap of about $390 million. The ore-processing arrangement with Kinross delivers significant cash back to Contango, which eliminates the need to issue new shares to raise funds, and thus there’s no dilution. Basically, Kinross cash flow funds Contango’s redevelopment work at Lucky Shot, plus the company’s exploration work at Johnson Tract.

I’ll add, as an aside, that the high grade Contango ore from Manh Choh has greatly benefited Kinross as well. It gives Kinross the ability to do what’s called “blending” during the processing cycle; that is, to add Contango’s high-grade ore to lower grade ore from other locales and thus improve the overall economics for gold output. You can see the outstanding results in Kinross financials and its share price.

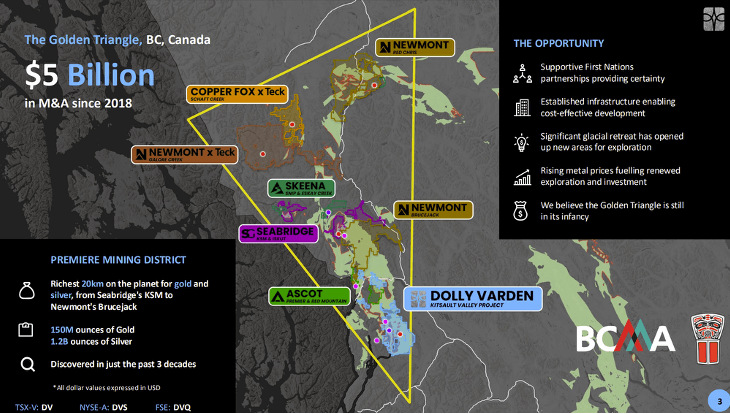

Meanwhile, Dolly Varden operates in the northwest corner of British Columbia, in an area called the “Golden Triangle;” and that alone ought to tell you something. The locality is adjacent to Alaska, and indeed the road grid weaves back and forth across the border, following topography. I should mention that I have personally visited Dolly Varden operations as well*.

Dolly Varden mineral claims in Golden Triangle. Courtesy Dolly Varden.

As the map shows, Dolly is in a high-class neighborhood, certainly as mineral endowment goes. Not far away you’ll find Newmont Mining (NEM – $97 billion), plus Seabridge (SA – $2.9 billion) and Skeena (SKE – $2.6 billion).

Over the past four years, Dolly uncovered significant silver and gold resources, although at this point the company is what we call an advanced explorer with some early-stage development. In terms of resources, the indicated-inferred number is not quite 100 million ounces of silver, or you could look at it as over a million ounces of gold… but Dolly is still in exploring too, and the upside is evident. Indeed, just last week Dolly published recent drill results with eye-popping gold-silver numbers.

Dolly Varden shares trade at about $4.60, giving the company a market cap of about $410 million. And not long ago, Dolly raised funds and now has over $40 million cash in the bank.

As for the “equal” aspect of the merger, when things shake out the current Contango and Dolly Varden shareholders will each own about 50% of the outstanding shares of the new entity, expected to be called Contango Silver & Gold Inc.

The CEO of the new company will be Contango’s founder and current CEO, Rick Van Nieuwenhuyse, whom I’ve known for over 15 years. President of the new company will be Shawn Khunkhun, who currently runs Dolly Varden and whom I’ve known for about 10 years. And the board of directors will include Clynt Nauman as Chairman, who ran a silver mining play called Alexco in the Yukon, before his operation was bought out in 2022 by Hecla Mining (HL – $10 billion). And yes, I’ve known Clynt for something like 18 years.

Along this angle of personal knowledge, all three above-named gents are solid players. They’re great at exploration and development geology and have worked extensively – meaning for many years – in the Alaska-Yukon-Golden Triangle arena. They all have a history of success. And as we see with Contango, Rick Van-N has current cash flow to demonstrate that he can turn rocks into money. Go with winners, right?

Here’s More…

Combining Contango and Dolly Varden delivers a multi-stage silver and gold company. The assets range from current – highly profitable – output at Manh Choh, Alaska, to development and advanced-stage exploration elsewhere in Alaska and the Golden Triangle.

Between the two merged companies, there’s over $100 million cash on hand with only $15 million in debt. Plus, there’s solid and ongoing cash flow from the Kinross deal. Thus, I don’t foresee any fundraising or shareholder dilution ahead.

Another key attraction is the upside leverage from high-grade assets such as Contango’s Lucky Shot and Johnson Tract, with the addition of Dolly’s rich endowment in what’s called the Kitsault Valley silver-gold project in British Columbia.

Even better, the Johnson Tract and Kitsault projects are located near tidewater port facilities. This allows for what’s called a “direct shipping ore” (DSO) approach to development and operations; that is, mine high grade ore and just ship it straight out, across the Pacific Ocean and into a global marketplace.

Another opportunity involves the merged entity acquiring its own processing facilities over time, which allows for more of the value-add to remain with the company. This is downstream, however. We’ll have to wait and see.

All this, and the exploration upside is wide open at all projects. This ranges from expanding Manh Choh over time, as mining proceeds, to the clear upside at Lucky Shot, Johnson Tract, and in the Kitsault Valley.

As mentioned above, initial market reaction to the news was unremarkable. Then again, as the dust settles, we can expect the merged company to attract new shareholders who want larger market cap and trading liquidity. Plus, no doubt, this new company will attract research coverage and more institutional ownership.

There’s always more to say, but at this point I want to share with you some photos of my visits to Dolly Varden back in August 2023, and to Contango in July 2025.

Here’s the Dolly Varden camp from the air. And yes, it’s nestled in that Kitsault Valley which is a very good thing…

Dolly Varden camp from the air. BWK photo.

Obviously, it’s rugged up there but that’s also why there’s so much mineralization; all that tectonic movement along with heat and mineral-rich fluids coming up from below.

Meanwhile, the photo doesn’t show it, but the Dolly camp is at sea level, not far from a tidewater fjord that can accommodate large barges and ships. And this means that the logistics of development are just splendid, plus the upside of the above-mentioned DSO.

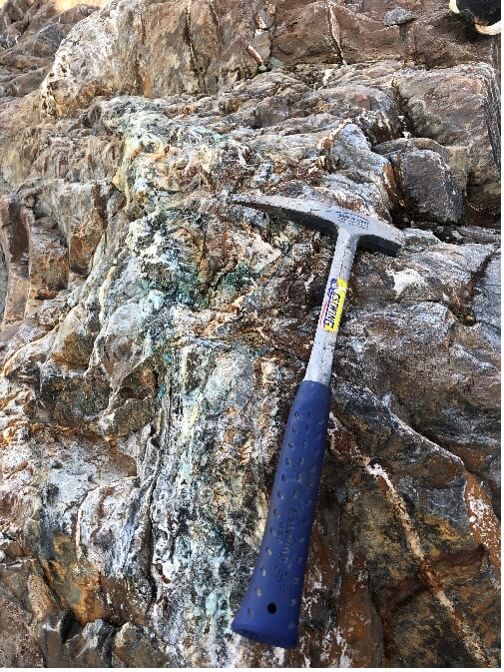

As for mineralization? Well, in places I found almost native silver outcropping at the surface. Like this…

Copper-silver mineralization at surface. BWK photo.

Of course, I grabbed a few samples because that’s what mineral-loving geologists do. And here’s me with mega-investor Frank Guistra after we sawed into one of those high-grade silver specimens…

Ha! Why is Frank smiling? BWK photo.

And yes, it’s spectacularly gorgeous up there. Mountains and valleys and glaciers… But don’t worry, the government still wants mining. So, it’s more than doable to acquire permits for good projects, of which Dolly has more than a few up its sleeve.

Your editor on a mineralized ledge, overlooking the Salmon Glacier. BWK photo.

As for the contango properties, I was up there just last July. Here’s a photo of the old Lucky Shot Mine portal.

Your editor and Contango CEO Rick Van-N at portal to Lucky Shot Mine. BWK photo.

This mine was developed in the late 1920s and 30s, and it made quite a bit of money for the owners during the Great Depression. Then, the U.S. government closed down Alaska gold mining during World War II, and post-war the site never reopened due to squabbling family claims.

Long story, but Rick Van-N finally obtained the mineral claims, and after revisiting the old geological data it’s clear that there’s more high-grade gold in the rocks below. In fact, I walked through the tunnel and saw the ore face.

Your editor examines Lucky Shot gold mine. BWK photo.

Plus, while visiting Alaska I headed down to the Johnson Tract… through very problematic Alaska coastal weather, I add. But no, I won’t bore you with the details of flying through pea soup fog; instead, I’ll just show you what the exploration camp looked like when we broke out of the clouds and mist.

Contango’s Johnson Tract exploration camp. BWK photo.

Yes, it’s spectacular. And it’s also located on Alaska Native Corporation Land, which means that federal and state authorities tend to be disposed toward development. And of course, the mining side must adhere to a long list of environmental regs, but the upside is that the permits can be obtained.

Meanwhile, here’s an example of the ore from the deposit. And you really don’t have to be a mineralogy expert to get the sense that this is high-grade material in terms of the elements inside.

Your editor with mineral sample from Johnson Tract. BWK photo.

Wrap It Up…

I could go on, but you get the picture (literally; see above). Contango and Dolly Varden are combining to form a larger, stronger mining company with money in the bank, solid cash flow, excellent production assets, and superb exploration and development upside.

Looking ahead, this is one of those things that geologists call a “hip pocket” play. You can buy shares, tuck them away in your portfolio, and just let things play out. The assets are great. The company has funds. Management is superb; kind of like when you walk onto an airliner and see that the pilots look like truly experienced fliers. You just sit back and relax, and let the pros fly the big jet, right?

Right now, I’m fine with owning either company’s shares, if not both: CTGO and/or DVS. But I should add that the Morning Reckoning doesn’t track a portfolio, although I do follow the companies and stay abreast of developments.

If you buy in, watch the charts, wait for down days in the market, always use limit orders, and never chase momentum.

Finally… Note those *-annotations above, concerning my visits to sites in Alaska and British Columbia. Just to be clear, neither Contango nor Dolly Varden paid for my travels. I either bought the airline tickets personally, or Paradigm Press reimbursed me for travel expenses. I mention this to assure all readers that my views on the companies are my best judgment, and I have received no payment or anything else of value… well, except for a couple of mineral samples.

Oh, and here’s a fireweed plant… Native Alaskan lore is that the full set of blossoms indicate a really hard, cold winter ahead. Just saying…

Flowering fireweed at Johnson Tract, Alaska. BWK photo.

That’s all for now. Thank you for subscribing and reading.

Comments: