Buy the Golden Dip in Miners

The gold price’s extreme rise took a break recently. But even a 10% decline hasn’t cooled off expectations for its future.

That’s why we need to use this pullback to add to our gold portfolio.

According to the Financial Times, gold bull markets commonly pull back up to 10% in bull markets. And none of the big financial institutions think gold’s run is over. Analysts at giant banks like Goldman Sachs and HSBC have price targets of $5,000 per ounce in 2026.

That’s because the global data that points towards stagflation across the world. We see rising unemployment and persistent inflation across the globe.

We define things like recessions, bull markets, and other economic periods by examining the past. The trickiest part of economics is flipping that on its head to look forward.

To effectively invest in natural resources, we must do that. We need to parse data today and project it out into the future.

Right now, the U.S., U.K., Japan, and other European countries appear to be in stagflation. We’ll know for sure in a few years… But the data we have right now says it’s riskier to bet on a fall in the gold price than on it going up.

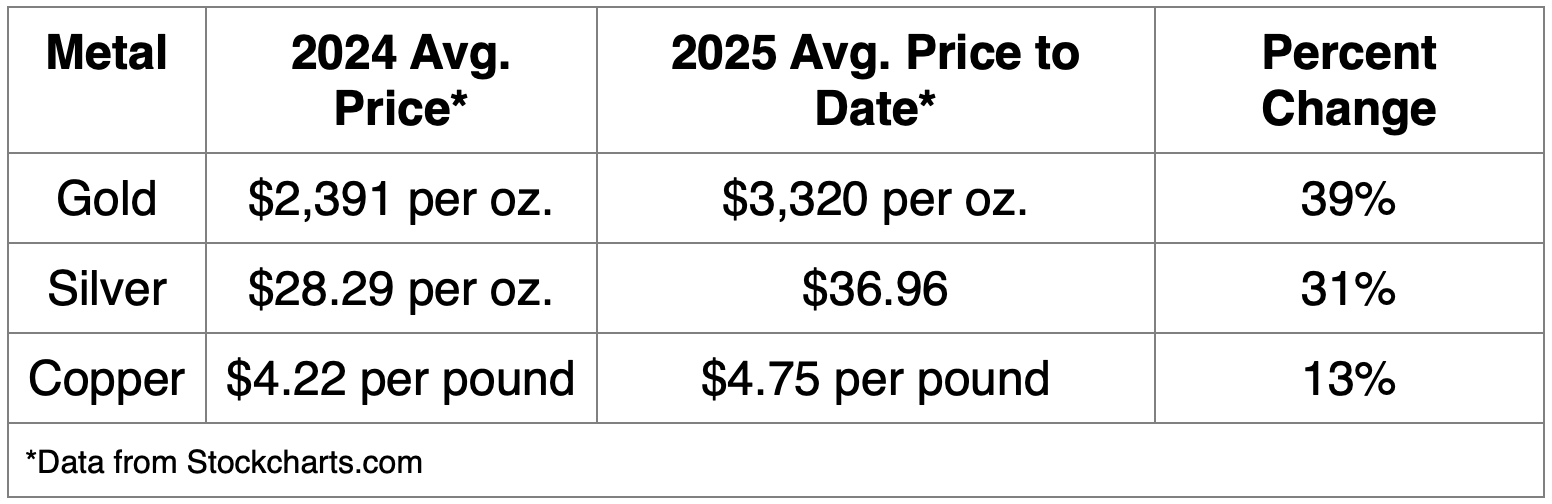

But here’s the other reason we need to buy the dip. Gold prices (heck all the metals) are significantly higher today than they were a year ago. Here’s a quick comparison of the average metal prices:

Imagine if Apple announced a 39% increase in the price of an iPhone. People would stop buying it. But with miners (and most commodity producers), they don’t set the price. The market sets the price that they sell their products.

And that price increase goes directly to the bottom line. It doesn’t cost the miners any more to produce that gold. So, each ounce they produce generates an additional $929 in cash flow. That’s an incredible amount of money.

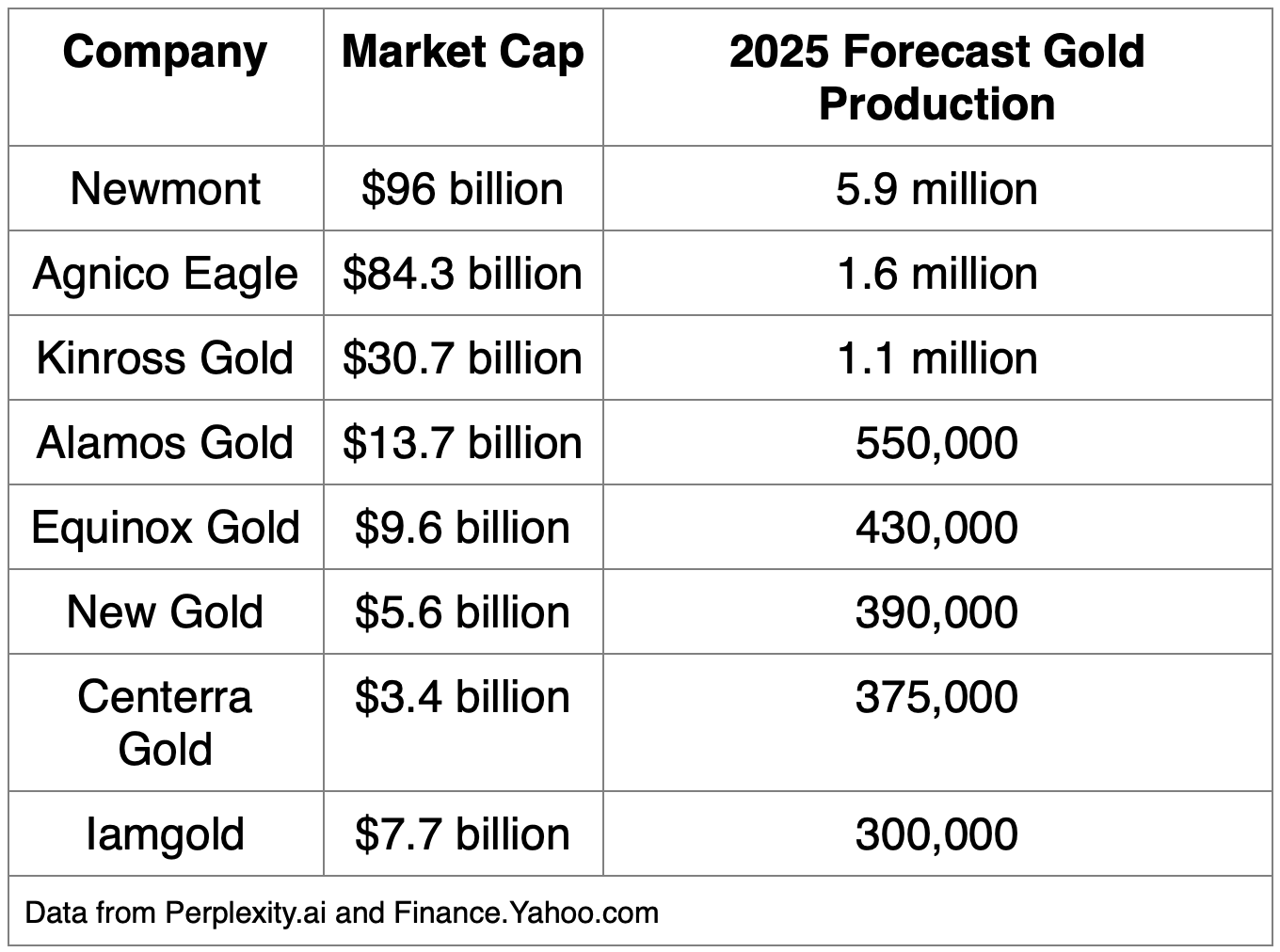

Newmont Mining (NYSE: NEM) forecast 5.9 million ounces of gold production in 2025. That works out to nearly $5.5 billion in additional profit.

Newmont Mining has a $96 billion market cap. That means it trades for less than 20 times its potential additional earnings alone! Newmont is an easy example, but there are many companies in the same situation. Here’s a quick snapshot of a few:

Commodity prices lead commodity producers. And we don’t believe the market has assimilated the impact of these higher gold prices on the value of the miners. That goes for silver and copper as well. In this setting, a major sell-off of miners is an opportunity to add to existing positions and create new ones.

Comments: