Brazilian Stocks Offer 8% Yields at 8x Earnings

As investors, it is important to acknowledge our weaknesses.

My biggest weakness is that I hate owning overvalued stocks. I look at the S&P 500 today and simply cannot pull the trigger. It’s too expensive.

As a result, I’ve left some gains on the table over the past few years, as U.S. stocks soared to the extremes we see today.

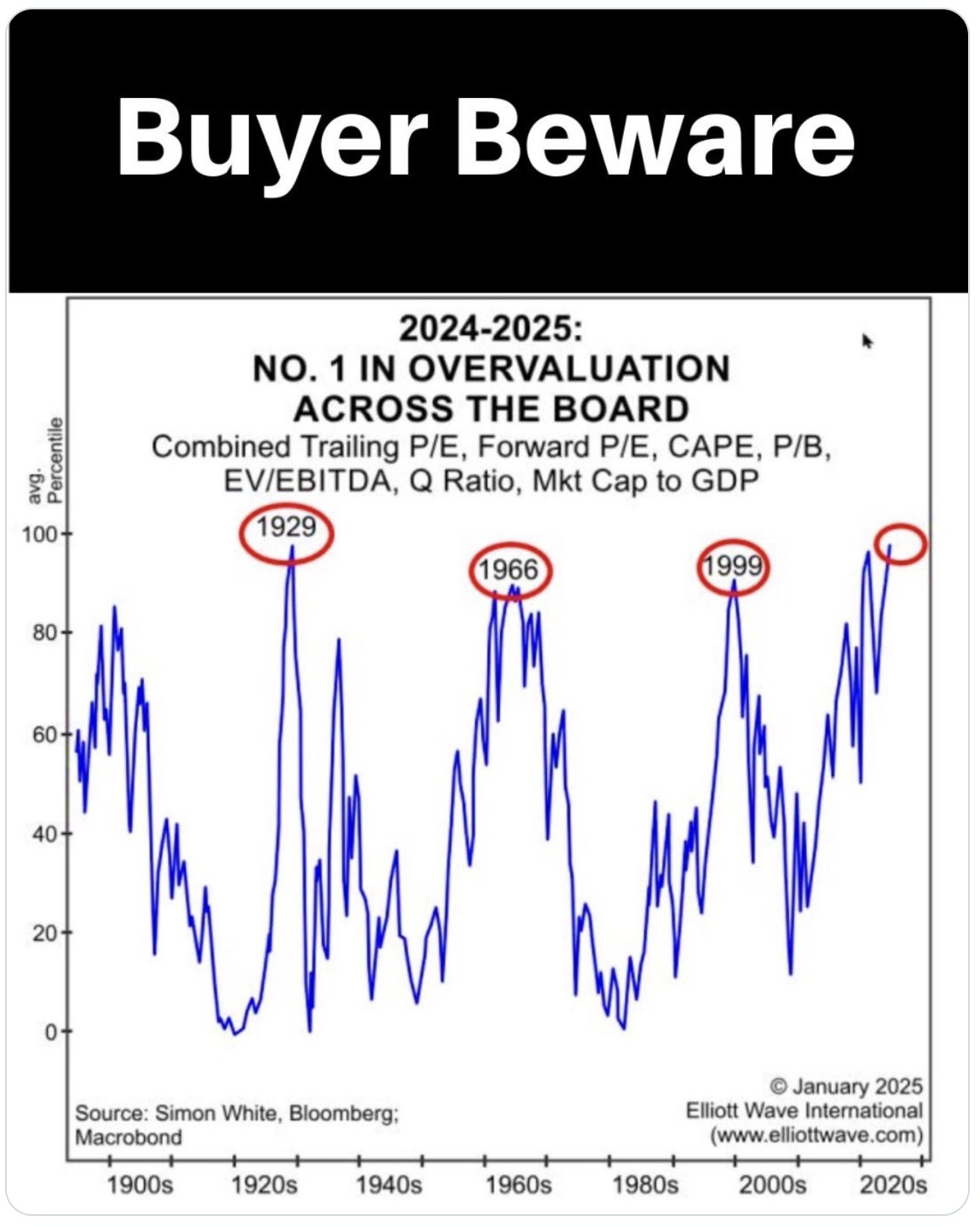

Take a look at the chart below, which combines seven metrics to show just how expensive the U.S. stock market has become.

Source: Elliott Wave International

As you can see, the market today trades at bubbly levels comparable to 1929 and 1999. I just can’t do it.

Of course, stocks could go up to even more ridiculous levels. I’m not ready to short the market yet. But I simply can’t convince my brain that it’s a good idea to buy most American stocks here.

I want to buy stocks at low prices. Stocks with juicy yields that can compound for the next 10+ years.

Finding Compounders in South America

My quest for cheap stocks has led me to South America. Specifically, Brazil.

The largest Brazil ETF, EWZ, currently trades at around 8x earnings with an 8% dividend yield. An entire country ETF offering an 8% yield. Crazy…

Meanwhile, the dividend yield on the S&P 500 is 1.27%.

EWZ trades at 1.5x book value, while the S&P 500 currently sits at 5.01x (a higher multiple means stocks are more expensive).

The difference couldn’t be more stark.

But dirt-cheap prices alone are not always a reason to buy. Emerging markets typically trade at a significant discount to American ones (although the current picture in Brazil is extreme).

Countries like Brazil have currencies which historically depreciate faster than the dollar. This affects total returns.

But all things considered I think Brazil offers an excellent risk/reward equation. Allow me to explain why…

A Commodity-Heavy Economy

Many of the top stocks in Brazil are natural resource producers. Brazil is rich with minerals, metals, and oil.

For example, Vale (ticker: VALE, pronounced Vah-lay) makes up about 8% of the EWZ ETF. Vale is the largest producer of iron ore and nickel in the world. They also operate a large transportation network of railroads, ships, and ports.

Vale currently trades at 8.5x earnings and sports an 8% yield. Even if Brazil’s currency, the real, falls, these commodity exporters won’t be affected much. They’ll still get paid the going rate for their ores and extracts.

The EWZ portfolio also includes banks, oil and gas producers, and at least one interesting tech company, Nu Holdings (NU).

Nu is a fast-growing digital bank which offers credit cards, insurance, and other financial services. The company grew revenue at an impressive 58% over the past year, and boasts a return on equity (ROE) of 21%. With more than 114 million customers, this is a fintech company to watch.

Full disclosure: I just bought a small position in Nu this week and have had a larger position in EWZ for about a month (both positions are down slightly).

Political Concerns

One of the reasons Brazil is so cheap is due to its current leadership. President Luiz Inácio Lula da Silva (Lula) is a hardcore socialist with a questionable moral compass.

Key themes under Lula’s presidency include government expansion, interference with private markets, censorship, and corruption.

However, there is hope for a change in Brazil’s leadership. Presidential elections are scheduled for next October, and with Trump winning here in the U.S., and Milei winning in Argentina, there’s hope for conservative leadership in the country.

Even with Brazil being trapped under Lula for a while longer, I believe EWZ offers an attractive risk/reward here. And 8% yields are hard for me to pass up.

With U.S. markets at such incredibly overvalued levels, it’s time to start exploring emerging markets. Brazil is a fine place to start. Sure, there are risks. But that’s the case everywhere. At least here there are cheap stocks with fat yields.

Watch for more emerging markets coverage coming soon…

Disclosure: author owns EWZ and NU.

Comments: