A Tale of Two Crashes

During the crash of 2020, we got a brief but beautiful buying window in precious metals.

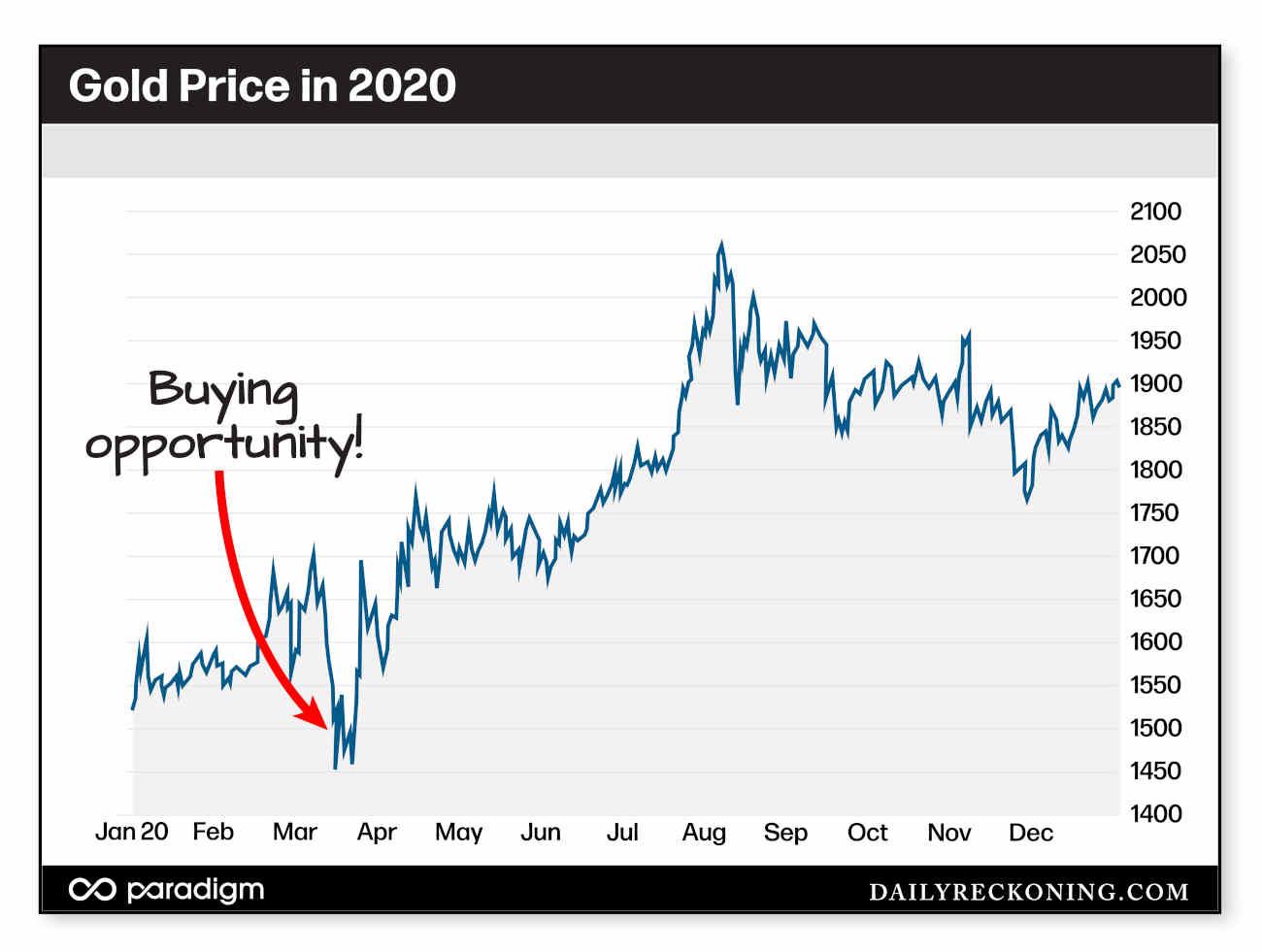

In March of 2020, during the COVID collapse, gold suddenly dropped from $1,700 per ounce to $1,450.

Here’s a chart showing the price action of gold in 2020. Note the buying window in March (when it appeared the world was ending).

It was a brief window, fueled by pure panic in markets. It made no sense for gold and silver to sell off, yet they did. Quite similar to our situation today.

For about a week in 2020, we had the opportunity to buy gold at 15% off during the spring. Silver, meanwhile, dropped about 37% during the COVID crash. Miners of both metals fell sharply.

Investors who bought the dip in gold, silver, and miners during that chaotic time would profit handsomely over the coming months and years.

Silver went from $14/oz on March 16th 2020 to $28/oz in August 2020 a few months later. Gold soared from $1,450/oz to over $2,000/oz by August, and over $3,000 today.

The Global X Silver Miners ETF (SIL) went from around $18 in March of 2020 to over $52 in August of that year. SIL trades back down around $34 today.

Currently silver is down about 15% from recent highs and gold is down about 5% from all-time highs. We may not get as big of a pullback in bullion prices as we did in 2020, but it’s likely that we go at least a bit lower from here.

I don’t know if we’ve seen true capitulation (throwing in the towel) in stocks yet. Which means there could be more cascading effects from selloffs yet to come. This could mean the bottom in precious metals may not be in yet. But I suspect we’re getting close.

It’s important to remember that the world has changed since 2020. Let’s not forget that in 2022, when Russia invaded Ukraine, the West seized $300 billion of Russian reserves. Ever since central banks worldwide have been on a gold-buying spree. So at least in gold, we may not see a 15% pullback like we did in 2020. This 5% pullback could prove to be the last chance to buy gold at discount before the bull run resumes.

Regardless, we are approaching fire-sale prices on mining stocks, and bullion is always attractive in this type of environment. I have begun buying both metals and miners, as detailed on Saturday. But I’m also saving some cash in case the discount gets larger.

Same Fed, Different Reactions

In 2020 the Federal Reserve and U.S. government unleashed unprecedented monetary and fiscal stimulus.

Trillions of dollars was pumped into the economy to keep everything afloat. Gold and silver were major beneficiaries. I fully expect things to play out similarly this time around.

President Trump just posted on X and Truth Social that, “the slow moving Fed should cut rates!”. I believe he’ll get his wish soon. Along with stimulus checks and QE.

One key difference, this time, however, might be how the S&P 500 and Nasdaq react to the inevitable Fed and government stimulus.

In 2020, U.S. stocks were also a major beneficiary of money printing. The Nasdaq and S&P 500 soared to new all-time highs over and over again. In late 2022, AI re-fueled the bubble and set off another 2 years of huge gains for tech.

Will something similar happen this time around? Call me skeptical.

The outlook for the American economy has changed. We are entering a “taking our medicine” period. Now is not the time to buy the dip on the Mag 7. Tech stocks, and the S&P 500 as a whole, remain overpriced to a ridiculous degree.

The outlook for U.S. stocks is murky, at best. Stalwart growth engines like Apple and Tesla are finally feeling the pain, and I don’t see how their scenarios improve anytime soon. Both these bellwethers face major headwinds from the trade war, and their valuations remain extremely stretched.

So yes, lower interest rates and more QE (money printing) are inevitable. But U.S. stocks may not react the way they did in 2020. This could be a moment where all the tech dip-buyers finally learn that what goes down sometimes stays down for an extended period.

Meanwhile, the future has never looked brighter for gold and silver. I’m looking to increase my portfolio allocation to precious metals from about 16% today to 20% or more over the next year.

Things could get much worse in stocks. At a time like this, I want safe assets which will preserve my purchasing power. That’s precious metals.

Eventually the time will come to buy the dip in U.S. stocks, but we’re not there yet. Not even close.

Comments: