A Speculator's Paradise Turns Sour

The paint isn’t even dry on the freshly-split NVIDIA shares and the financial media is already crowning it as the next big addition to the Dow.

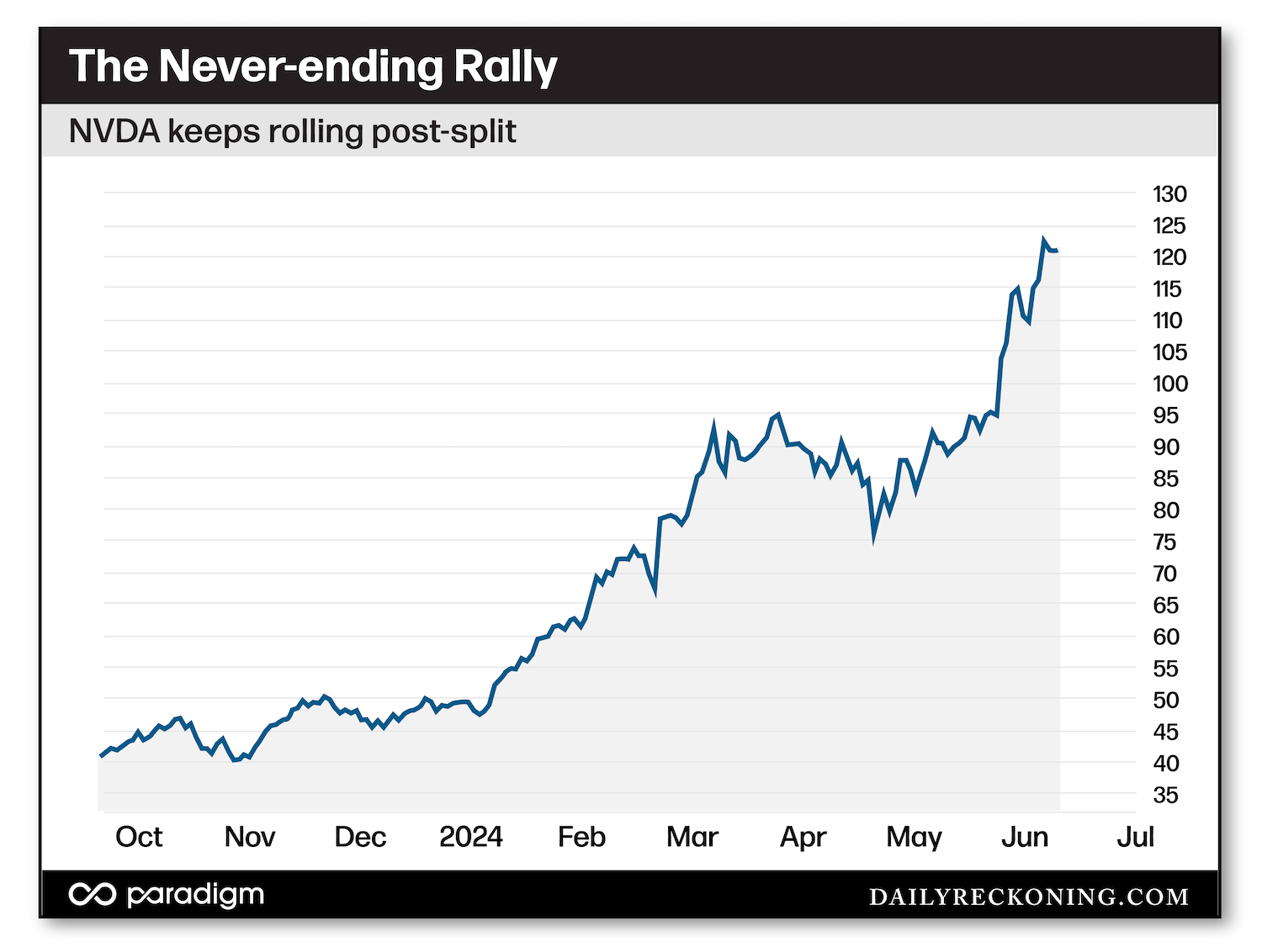

It’s all just speculation at this point. But if NVDA keeps pace with its historic run, it would certainly be a welcome addition to the industrials. After all, NVDA just casually added another trillion bucks to its market cap as it stacks up a gain of nearly 40% over the past four weeks. As the crypto kids like to say, number go up.

Speculators have no problem chasing NVDA higher as summer approaches. Sure, there are other distractions — mainly a meme-stock resurgence that’s bubbled up over the past several weeks. But even GameStop (GME) and other potential squeeze trades have hit the skids.

Aside from whatever semiconductor is hogging the attention on any given day, the market’s gotten pretty darn quiet… perhaps tooquiet. Daily trading volume continues to dwindle this month. And the S&P has gone 328 trading days without a 2% one-day decline, CNBC’s Michael Santoli notes. That’s a crazy stat — and the third-longest streak of its kind so far this century.

Volatility is nowhere to be found.

Or, maybe we’re simply not looking in the right places…

Markets are funny sometimes. We can examine the major averages and the VIX and assume not much is happening. But there are more than a few stocks out there posting big moves higher and lower. As the Wall Street Journal reported over the weekend, individual stocks are “going haywire” while the averages flatline.

In fact, we’ve experienced “far more stocks with 10% swings in a day over the past three months than at almost any other time when the market can barely get above an average move of 0.5%,” the WSJ explains.

Simply put, speculators feeling the FOMO are chasing a rotating group of hot stocks while the broad market continues to churn.

Can the Historic NVDA Rally Continue?

These aren’t the easiest market conditions to navigate. While I still believe there are viable long ideas out there, I’m preparing for some jolts as we get deeper into summer trading. We’re not only dealing with extremely low-volume summer trading this week, we also have to deal with a Fed meeting and another key inflation report (CPI) on Wednesday morning.

Plus, investors continue to chase NVDA shares following Monday’s split. I’m on high alert that we’re dealing with a potential sell the news event as speculators pile into this stock following a historic run.

To be clear: I’m not predicting disaster this week, or even a big move lower. But I am paying close attention because I want to be prepared if stocks start to slip.

I know, I know… I’m sick of all the NVDA talk, too. But it’s the main driver of this year’s market gains — and it’s managed to fuel the averages with a virtually parabolic rally that refuses to die.

As we’ve discussed during NVDA’s rise, I don’t believe “calling tops” is a repeatable edge we can exploit in the markets. These major market rallies can last a lot longer than we think, even turning bearish moves into buying opportunities (Remember the dreaded reversal day posted in early March? NVDA has now rallied as much as 40% following a choppy consolidation.)

As always, I don’t think it’s wise to attempt to quick-call a major crash in NVDA shares (or any other semiconductor stock, for that matter). Stay on the lookout for downside action — but don’t load up on the short side without confirmation that a move lower has started.

Keep Your Head on Straight!

It’s almost impossible to tune out the irrational decisions of others — especially when everyone only pays attention to the reckless speculators who are winning big in this market.

You can do everything by the book: develop a trading system, hone it for years, and adhere to top-notch risk management practices. You insist on obeying your stop losses. You don’t chase rumors or speculate on low-quality stocks.

Meanwhile, an anonymous speculator on a message board posts a screenshot of a massively profitable YOLO trade that netted a 10,000% return.

The next day, you tune in to a livestream hosted by a celebrity trader decked out in bandages, sunglasses, and a headband to discuss the development of his GameStop trade that has the potential to net hundreds of millions of dollarsin the coming weeks. He already got rich pulling this same stunt a few years ago. Now, he’s back at it as he attempts to stick it to the man yet again…

Of course, these are insane people doing insane things. Don’t get me wrong — Roaring Kitty is no dummy. But it would be completely naive to assume that everyone who follows in his footsteps will find a pot of gold at the end of the GameStop rainbow.

Just remember: for every Roaring Kitty, there are thousands of broke traders who bet it all… and lost!

You can’t allow these lotto ticket plays to affect your better judgment. I like to say the best thing about trading is the market will always provide another opportunity. The bell will ring tomorrow, next week, and next year. There will be big winners — and big losers. It’s all out there for the taking if you put in the time and effort.

You can sit around wishing you put 100% of your trading capital in NVDA on Jan. 1. Or, you can focus on doing the work and following your trading process to help find the consistent winners that will lead to long-term trading success.

The choice is yours…

Comments: