Why Silver Will Smash Through $50

Silver is trading at $47.98 per ounce as I write this.

The all-time intraday high here in the U.S. was $50.36 way back in January of 1980. That was the peak on New York’s COMEX (commodity exchange).

However, silver has never closed a trading day above $50. And that’s the official measure of an all-time high.

Once silver briefly surpassed $50 in 1980, New York’s COMEX essentially killed the momentum. COMEX executives decided that since the Hunt brothers were cornering the market, they would restrict trading to sell orders only.

And they jacked up margin (loan) costs for speculators, causing a cascade of selling. We covered this in detail in The Untold Story Behind Silver’s 30x Move (recommended reading).

In 2011, we got near $50 again, hitting $49.82. COMEX once again decided to increase silver margin requirements, making it more expensive for traders to maintain long positions.

Fast forward to today, and we’ve come a long way in a short time. Silver is up nicely from $29.14 at the beginning of this year.

This is fairly typical for silver bull markets. Moves can be abrupt, almost violent.

Some traders on X (formerly Twitter) are speculating that silver will once again fail to close above $50 during this bull cycle.

And in the near-term, we are due for a pullback. And it’s possible that COMEX will try to hold back the breakout with another hike of margin requirements.

But today I will explain why silver is set to smash through that $50 wall like the Kool-Aid Man.

A Different World

Compared to both previous silver runs to near $50, this one is a different animal.

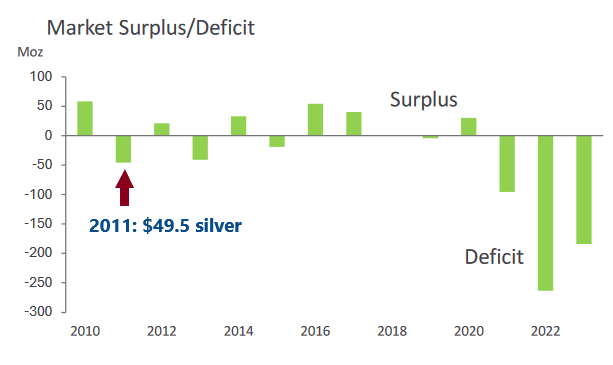

First of all, silver is far more scarce. In the chart below, from last year’s Silver: So Much Bigger Than 2011, I showed the annual silver surplus or deficit from 2010-2023. This is simply the difference between annual silver demand and supply.

Source: Silver Institute

As you can see, today’s silver deficits are huge compared to 2011, which barely reached 50 million ounces. Recent deficits have consistently been over 100 million ounces, and reached a stunning ~250 million ounces in 2022.

In 2024 the deficit was around 150 million ounces. And I expect 2025 to be another big deficit year. Stockpiles are dwindling as demand soars.

During the 1970s silver bull market, annual silver deficits peaked around 60 million ounces.

The best silver deposits have already been mined, and almost all silver today is produced as a byproduct of mining other metals.

Meanwhile, the world is gobbling up much more silver than ever before. A primary source of demand is for solar panels, which require massive amounts of pure silver.

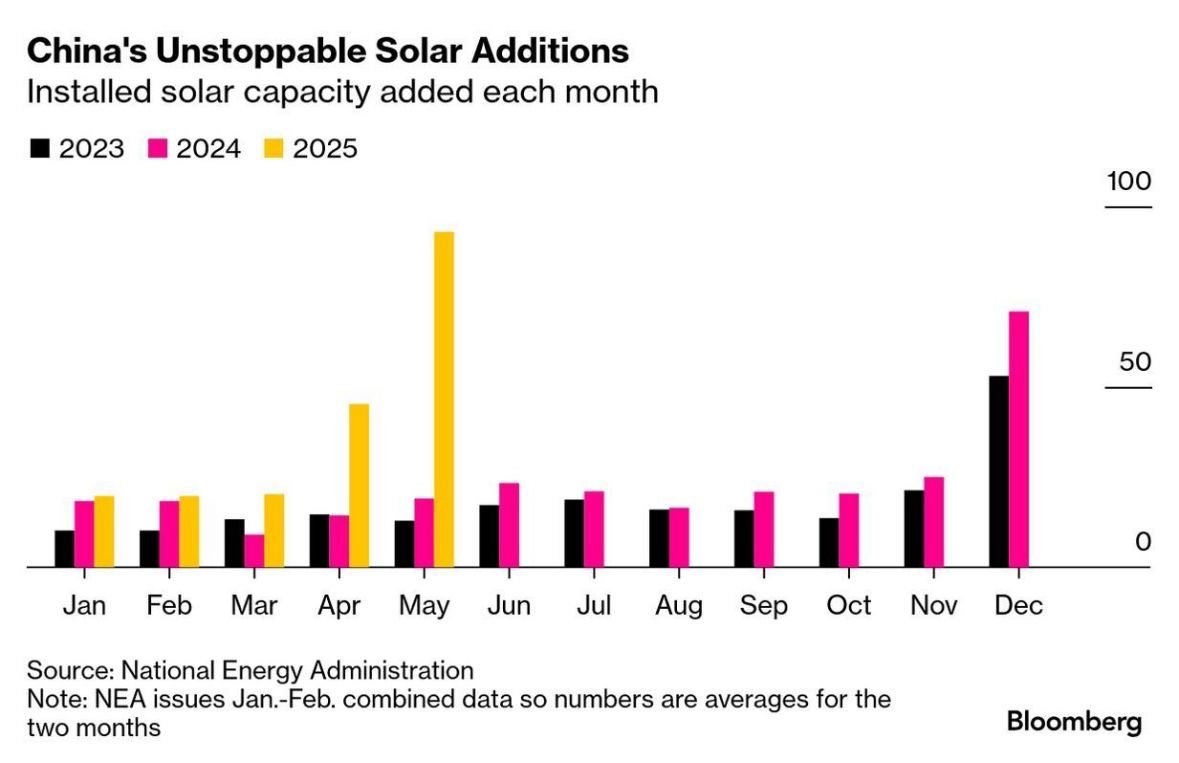

Back in August we posted the following chart, which shows China’s massive solar buildout.

By our calculations, China’s solar installations in May alone consumed a remarkable 65 million ounces of pure silver! It’s hard to find fresher data in the months since, but from everything I read, China’s unprecedented solar campaign continues. By 2030 China’s solar output alone is set to pass total electricity production in the U.S.

China is also a major source of investment demand for silver today. That was not the case back in 1980, or even in 2011, really. The country has far more savings and investment capital than it did during either previous silver bull cycle, and Chinese citizens now love buying silver.

Sprinkle in Booming Investment Demand

Silver is a fascinating metal. Part industrial necessity, part monetary asset. However, over recent years investment demand (coins and bars) has lagged industrial.

However, now that silver is rocketing higher, that should change. Even mainstream media is now beginning to understand what is being called “the debasement trade”.

Yesterday, a Bloomberg headline read “Gold, Bitcoin Surge on Concerns Over Global Debt Pile”:

Growing fiscal concerns in some of the world’s biggest economies are adding momentum to a so-called “debasement trade,” as investors flock to the perceived safety of Bitcoin, gold and silver while pulling away from major currencies.

It’s good to see the financial networks getting caught up on what’s happening.

As a result, generalist investors are suddenly aware of what’s happening with precious metals. The early adopters from that crowd are starting to buy. And that’s a great thing for those of us who are already positioned.

Even if you haven’t bought yet, it’s not too late. There’s a good chance that silver will dip over the next week, after its incredible parabolic move.

Any pullback to the $43 level or so would be a very nice buying opportunity. Or, if you’re planning to buy in stages (dollar-cost averaging), there’s nothing wrong with starting today.

I fully expect silver to surpass $150 in the next few years. And depending on how bad inflation and currency wars get, we could be headed to $250 and beyond.

If the dollar somehow collapses faster than expected, or there’s a major bank crisis, all those price targets become not just attainable, but conservative.

Just be prepared for some volatility if you are new to silver. It’s a spicy asset to own, but undoubtedly one of my favorite hard assets.

The next 5-10 years are going to be wild ones. Owning physical silver and miners are one of my favorite ways to prepare for the chaos ahead.

Comments: