Silver: The Closer Metal

In the world of horse racing, many of the all-time greats have been closers.

A closer is a horse that starts off slow, then surges on the back half.

Many of the best racehorses of all time have been closers. Zenyatta, for example, is a mare that won a remarkable 19 of her 20 races.

Zenyatta – Source: LA Times

Zenyatta was an iconic closer. In one noteworthy race, she reached a peak of 40 mph down the stretch. The equine was famous for starting races slow, but finishing with incredible speed and power.

Humans love closers. In horse racing, baseball, business, and more. There’s something about the strategic insight to save energy for the last part of a contest we inherently admire.

The Closer Metal

Silver, my favorite shiny metal, is poised to be an epic closer. In this bull market, gold has led during the early part of the cycle.

The main reason is simple. Central banks initiated this bull market, and those guys only buy gold.

But we shouldn’t ignore silver. Here’s a chart showing how silver (blue line) has performed vs gold (yellow line) over the last 65 years.

Source: Veroni by Visual Capitalist

As you can see, silver has outperformed gold significantly during previous bull markets (1970-1980 and 2000-2011).

But this bull market has been different. Gold has led the charge. It’s gotten so crazy that the current gold-to-silver ratio is now around 90:1 ($3,431 vs $37.44). So it currently takes 90 ounces of silver to equal one ounce of gold.

Gold-to-Silver Ratio

Source: GoldSilver.com

According to this classic metric, silver remains deeply undervalued compared to gold. At the peak of the last bull market, in 2011, the gold-to-silver ratio reached a low of around 30:1 ($49.50 silver vs $1,500 gold).

If the gold:silver ratio reached 30:1 again, and gold stayed at the same price, the price of silver would rise to about $114 per ounce.

Currently, about 8 ounces of silver are mined for every ounce of gold. So the fact that the price ratio is 90:1 suggests there could be significant room for the ratio to shrink. All it will take is more demand for silver, and that is definitely on the menu, as we will explain.

I believe silver is set to lead from this point going forward.

Silver Demand Grows

For thousands of years, silver was money. But over the past century, it has evolved into an industrial precious metal. For decades it was used in photo processing, medicine, and other sectors. Now the bulk of industrial demand comes from solar panels and electronics.

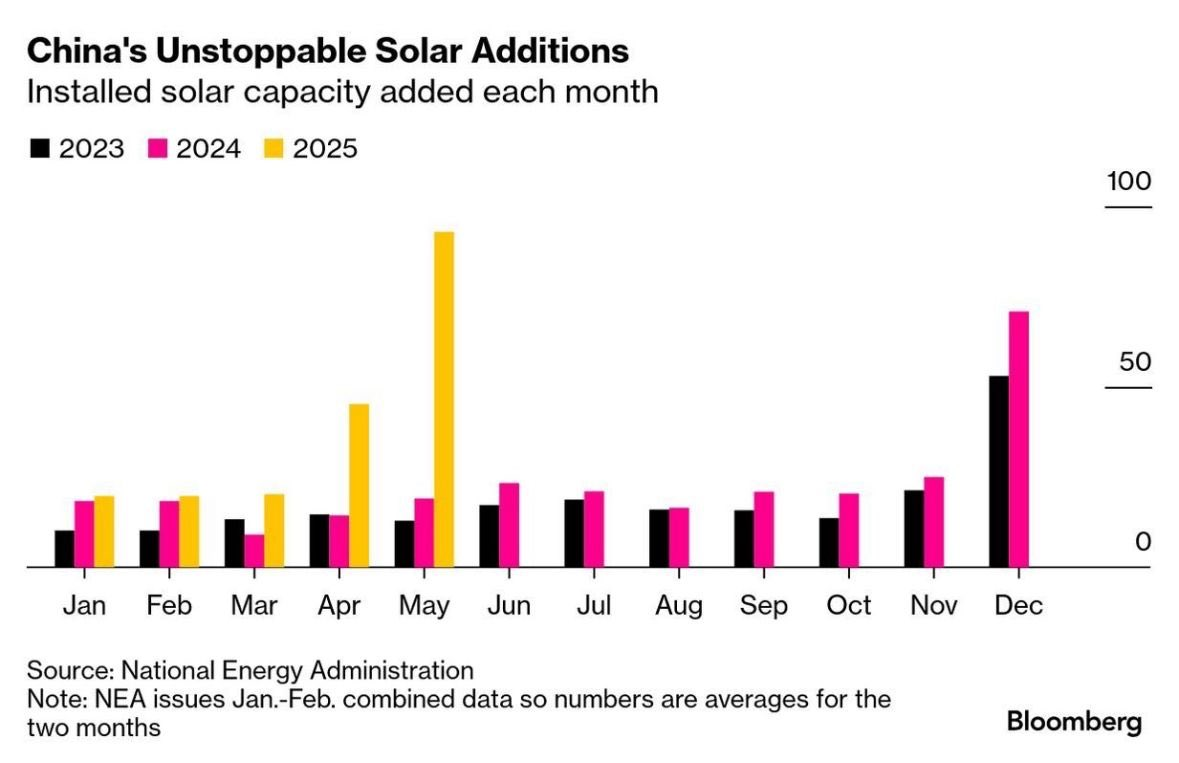

Each gigawatt of solar power requires roughly 700,000 ounces of pure silver. And in China, solar power is booming.

Source: Bloomberg

In May of 2025 alone, China added 93 gigawatts of solar capacity. This is completely unprecedented. That’s approximately 65 million ounces of silver required for China’s solar buildout in May of this year.

Electric vehicles, phones, and even weapon systems also require large amounts of silver. It’s the best conductor of electricity in the world. As the world continues to electrify, demand should continue to grow.

Silver demand from investors is still a relatively small piece of the overall picture. But it’s growing, especially in Asia. Silver fever hasn’t hit American investors yet, but it will eventually. Once silver regains its role as a personal monetary asset, I expect fireworks.

The metal remains $12.50 below its all-time high of around $50/oz. Compared to gold, it’s simply cheap here.

Ways to Play It

Silver bullion is always a good bet. But miners also continue to look attractive. One easy way to get exposure to miners is with the Amplify Junior Silver Miners ETF (SILJ).

For members of Strategic Intelligence, Jim Rickards and Dan Amoss have an active silver miner pick which looks excellent.

If this precious metals bull market were a horse race, I’d say we’re coming around the first turn. About a quarter of the way through the race. Silver is starting to pick up steam and I’m betting that it outperforms for years to come.

In this most recent bullish move, silver nearly broke $40/oz. It has since pulled back to around $37.34/oz, and I’m a buyer at these levels. I view a breakout above $50 as inevitable, and that’s when the generalist investors will rush in. It’s best to be positioned before that happens.

Silver will continue to be volatile, but the risk/reward looks excellent. It could pull back more, but any such moves should be treated as buying opportunities.

Comments: