The Untold Story Behind Silver’s 30x Move

In 1970, silver traded at around $1.60 per ounce. By its peak in 1980, it reached $49.45. A handsome 30x return.

The story of how it got there is full of intrigue and conspiracy. We’ll get to that. But first, a little background is in order.

Monetary demand for silver had collapsed after the U.S. and other countries stopped using it in coins in 1965. Before that, America’s dimes and quarters were 90% silver. Other countries soon followed suit.

After governments ended their silver coinage, the market was flooded with stockpiles of the metal. Savvy collectors also bought up silver coins and melted them down. This temporarily boosted supply and depressed the price.

But inflation, and demand for hard money, was quietly building. In 1971 Nixon terminated the gold standard. From that point on, fiat money was completely free from the restraints of hard assets.

The dollar was no longer convertible to gold by foreign governments, and our coins were now made of copper and nickel rather than valuable silver.

Cornering the Market

Enter three brothers: William, Lamar, and Nelson Hunt. The three were sons of oil tycoon H.L. Hunt.

The brothers had substantial wealth, and were getting concerned over the effects fiat money would have on the United States.

They believed silver was criminally undervalued. In 1970, when silver was around $1.50 per ounce, they began to build a position.

First, they bought bullion and stored it in vaults. Eventually the brothers got more aggressive, buying silver futures contracts, using leverage liberally.

By 1974 silver reached $6.40/oz. But then it entered a brief bear market, falling back to as low as $3.80.

The Hunt Brothers bought the dip aggressively. But by the end of 1977, the price of silver had barely budged. It was stuck around $4.90 by the end of the year. At the end of 1978, the price was around $6.20.

By this point, government stockpiles were largely exhausted. The U.S. government had sold a remarkable 3 billion ounces of silver.

Precious metals were no longer part of the monetary system, but individuals began to create their own personal hard-money policies by buying silver and gold. And of course, the Hunt brothers were buying and holding all the while.

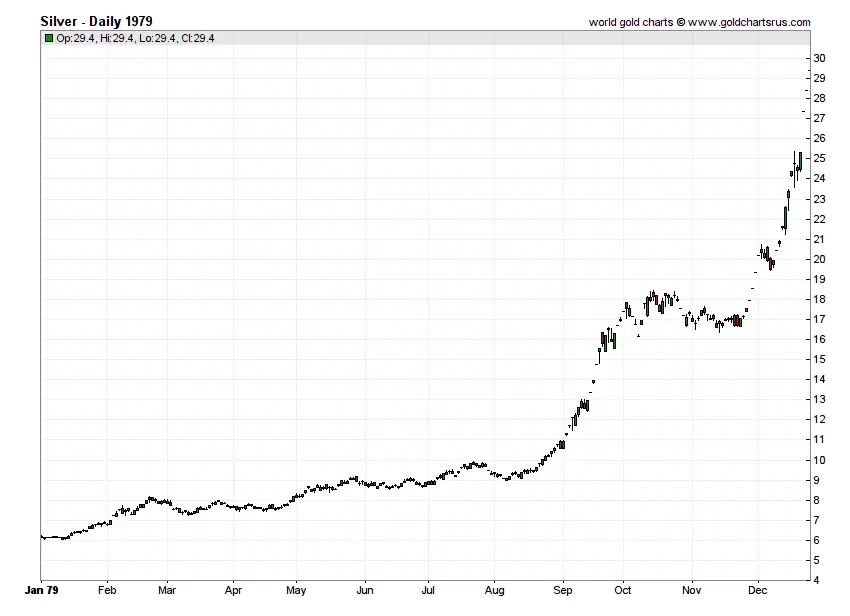

In 1979, silver absolutely exploded higher. The price rose from around $6/oz to $25/oz.

Source: SD Bullion

By January 1980, things had gone completely bonkers. Silver doubled in price again, from $25 to nearly $50. That was the peak for that cycle.

The Hunt brothers certainly played a big role in this runup, but their role is often exaggerated. It’s no coincidence that inflation peaked around 14% in 1979. It wasn’t just speculation driving the price higher.

Americans were desperate to find an asset that would protect their wealth. Silver fit the bill nicely.

The Fall

All told, the Hunt Brothers acquired roughly 200 million ounces of silver via bullion and futures. Ultimately it was the futures contracts which would be their downfall.

The brothers bought vast quantities of silver futures on the COMEX exchange. This allowed them to buy huge amounts of silver with relatively little capital.

But in 1980, the COMEX put the slap down on their operation. With silver around $50, the exchange made a drastic move. They declared that traders could no longer buy silver contracts. They could only sell or liquidate.

COMEX also raised margin requirements for silver contracts. This forced the brothers to put up more cash, fueling a margin call cascade.

It was a complete disaster for silver longs. Silver crashed from $49.45 to $16 by the end of 1980.

The Hunt brothers were sued by regulators and lost the majority of their fortune. All because they wanted more “juice” in their position.

A Better Silver Squeeze

The Hunt brothers take the blame for the silver bubble, but in truth they were part of a larger movement.

They weren’t the only ones who loved hard money and despised fiat currency. The 1970s silver squeeze was, in truth, far more decentralized than it is portrayed in pop culture.

The mistake the Hunt Brothers made was getting involved in futures contracts with leverage. COMEX, and other futures exchanges, can change the rules at any time. It says so in their terms of service.

In some ways, the Hunt Brothers caused the bubble and the crash. Without their involvement, silver would likely have taken a much smoother and more sustainable path.

The next silver squeeze will not be accomplished using silver futures or margin. It will be accomplished by millions of individuals who are fed up with fiat money buying physical silver bullion.

Physical silver cannot be manipulated like futures contracts. Unless the government restricts the buying and selling of silver bullion, which is highly unlikely, there’s not much they can do.

Silver bulls should continue to buy and accumulate silver bullion (and high-quality physical ETFs like the Sprott Physical Silver Trust – PSLV). This next silver squeeze will be driven by demand for the real thing. Not paper speculation.

Today silver remains well below its 1980 and 2011 highs near $50. Even as we are entering a period which will undoubtedly be chaotic and full of money printing, silver remains dirt cheap.

My price target for silver is $120 by 2028. Mined silver is barely growing, and recycling remains sluggish.

Meanwhile demand from industrial users has never been higher, and is only set to grow. Every year the market gobbles up around 160 million ounces more than is produced.

Investment demand is just beginning to wake up, and will surely grow over coming years. This is set to be the real difference maker in the supply/demand equation.

Eventually the stocks of above-ground silver will dry up. And when that happens, a $120 price target might look conservative.

It’s an explosive setup. So we believe the bull market in silver has only just begun.

New readers and those who wish to read more can find more of our silver coverage below:

Comments: