Peace in Ukraine: Investor Implications

After 3 terrible years of fighting, the war in Ukraine may finally be nearing its conclusion.

Last week Presidents Trump and Putin had a 2+ hour phone call which apparently went well. Both leaders expressed a strong desire to end the war, and more than that, expand bilateral relations.

On the battlefield, Russia is on the verge of pushing the last of Ukraine’s forces out of its Kursk region. It is almost certain that President Zelensky had hoped to trade Kursk for Russian-occupied lands, likely including the Zaporizhzhia nuclear power plant.

If and when Russia succeeds in clearing Kursk, it will be a major disappointment to the Ukrainian side. President Zelensky clearly would like to regain some of his lost territory as part of any peace deal. But it is increasingly looking like Putin is not open to negotiation on this point.

Ukraine is losing the war, low on troops and equipment, and experiencing widespread electricity blackouts and brownouts.

While I am sure President Trump will work to get Ukraine the best deal possible, at this moment it appears Putin holds most of the leverage.

Today, let’s look at the implications of a hypothetical end to the war for investors.

Implications for Europe

Up until the outbreak of war in Ukraine, Europe was heavily reliant on Russian natural gas and oil.

The continent was particularly dependent on Russian natural gas pipelines, which offered reliable flows at unbeatable prices. This gas was the lifeblood of Germany’s dominant industrial sector.

Following the mysterious explosion of the Nord Stream pipeline, and closure of most other flows, Europe was forced to import expensive liquified gas from the United States and elsewhere. This liquified version of natural gas is about 4x more expensive than via the old pipelines.

Now that the war appears to be winding down, industrial titans in the EU are salivating over the possibility of renewed access to cheap Russian gas.

In other words, the end of the Ukraine War could give Europe’s struggling industrial companies a major boost. And German stocks are indeed showing renewed signs of life, with the largest German ETF (EWG) up 20% since the start of this year.

Implications for Warfare

The war in Ukraine will be a landmark in the history of battle technology.

I’m speaking, of course, about drones. Cheap, accurate, and deadly. War will never be the same.

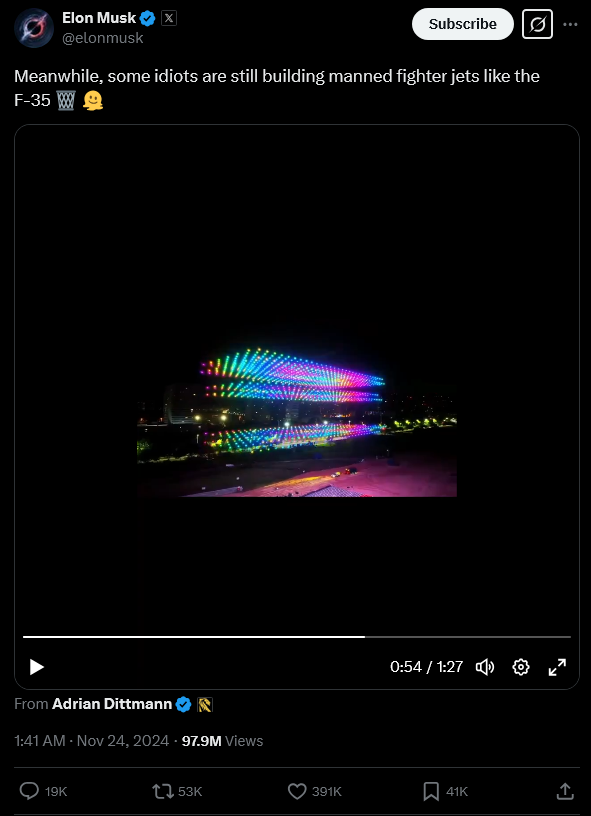

Elon Musk is going so far as to hint that fighter jets are essentially obsolete compared to drone swarms. His post on X, below, got nearly 400,000 likes.

Source: X

What does this mean for old-school military contractors like Lockheed Martin and Northrop Grumman, which are the lead contractors on the F-35 project?

Are traditional jets truly on their way to being obsolete? I suspect there’s a good chance of it over the next decade or two. At the very least, their role is significantly diminished.

And so far, the big boys like Lockheed and Northrop have not impressed with their drone offerings. Here in the States, the lead is being taken by private startups like Anduril.

America’s legacy military-industrial-complex might be in for a very rude awakening in this new, drone-centric world. The end of the war would be bad enough for their bottom lines, but a complete sea change in how war is conducted won’t be a welcome change either.

Implications for Gold

One of the most significant lasting impacts of this war, no matter when it ends, will be on gold and the dollar.

When Russia invaded Ukraine, it had overlooked the fact that its central bank had about $300 billion worth of U.S. Treasury bonds parked in European banks.

These funds were quickly frozen and seized by Biden and other Western powers.

As the world digested this information, global central banks came to the realization that their dollar-based assets were not as sound as they had once assumed. If they make the wrong move, or anger the wrong U.S. President, their assets could be frozen.

Eventually this led to a major policy change at central banks worldwide. They began to favor gold over dollar and euro-based assets. Gold is apolitical, and if stored properly, cannot be arbitrarily seized.

I believe this has been a primary factor in the gold bull market we have experienced over the past 2+ years.

And even if President Trump makes a deal with Putin, and returns the assets, who is to say that a future U.S. President wouldn’t abuse their power? As much as we’d like to think America will never have another president like Biden, we must admit it is a possibility.

No, Biden’s seizure of Russia’s central bank assets have changed the game for the foreseeable future. Gold is far more attractive than it was before, while fiat currencies are less so. I don’t see this changing even if the war in Ukraine ends tomorrow.

Gold is back as a reserve asset, and its importance is only set to grow over the coming decades.

Comments: