Tesla’s Existential Threat

Tesla shares are now down more than 50% from their all-time high. And as I write this, shares are down about 4% on the day.

In the midst of this market chaos, yesterday a friend texted me, saying, “I’m thinking about buying more Tesla here.”

Historically, big pullbacks in Tesla have turned out to be excellent buying opportunities. But I had to tell him that I don’t believe the risk/reward is favorable here.

In fact, Tesla could have a lot more downside. Just because a hot stock is down 50% doesn’t mean it can’t go down another 50%, and even another 50% after that. Such is the nature of parabolic stock moves.

We have to remember that even after the 50% pullback, Tesla is still one of the best performing stocks in history. Even today, Tesla shares are still up 139x from its $1.58 (split-adjusted) 2010 IPO price.

And despite the 50%+ drawdown, Tesla isn’t cheap by any means. It currently trades at an eye-watering P/E ratio of 119. And over the past 12 months, revenue has only increased about 1%.

Fellow car maker Toyota Motors trades at a P/E of just under 8. So Tesla is more than an order of magnitude more expensive than Toyota. And Toyota’s sales increased by 6.9% over the past year.

From a fundamental analysis point of view, this indicates that either Tesla shares are extremely overpriced, or the company has an ace up its sleeve.

Justifying the Premium Valuation

Tesla trades at such a premium because the market currently views it as more of a tech stock than a car maker. The market seems to believe there’s a good chance that Tesla launches its robotaxis (fully self-driving cars) in the near future. Personally, I’m not a believer in this vision.

Tesla is attempting to do self-driving cars with cameras and computers alone, while everyone else is using LiDAR and radar (more advanced and expensive hardware). If Elon’s company can pull it off, they’ll have a significant cost advantage. But I do not believe they’re going to be able to pull off a truly self-driving car with cameras and computer chips alone.

Competitors such as Google’s Waymo rely heavily on LiDAR and advanced mapping, while Tesla is trying to pull off a lower-cost, more adaptable version of self-driving software.

Elon Musk has said Tesla will launch their first robotaxi service this year, so we should know soon how realistic this vision is. If Tesla’s robotaxi offering ends up disappointing the market, the stock pullback could accelerate. Of course, if I’m wrong, and it works, the opposite could be true.

The other x-factor supporting Tesla’s premium valuation is Optimus, the company’s humanoid robot project. And don’t get me wrong, this sector has tremendous potential.

But Tesla isn’t alone in working on humanoid robots. China’s Unitree Robotics recently beat Tesla to market with their G1 Humanoid Robot, which starts at just $16,000.

In more than one way, China has become an existential threat to Tesla.

China’s Fierce EV Competition

It’s not just robotics where China is leapfrogging the competition. Over the past 10 years, China has quietly built up a monstrous automobile manufacturing capability.

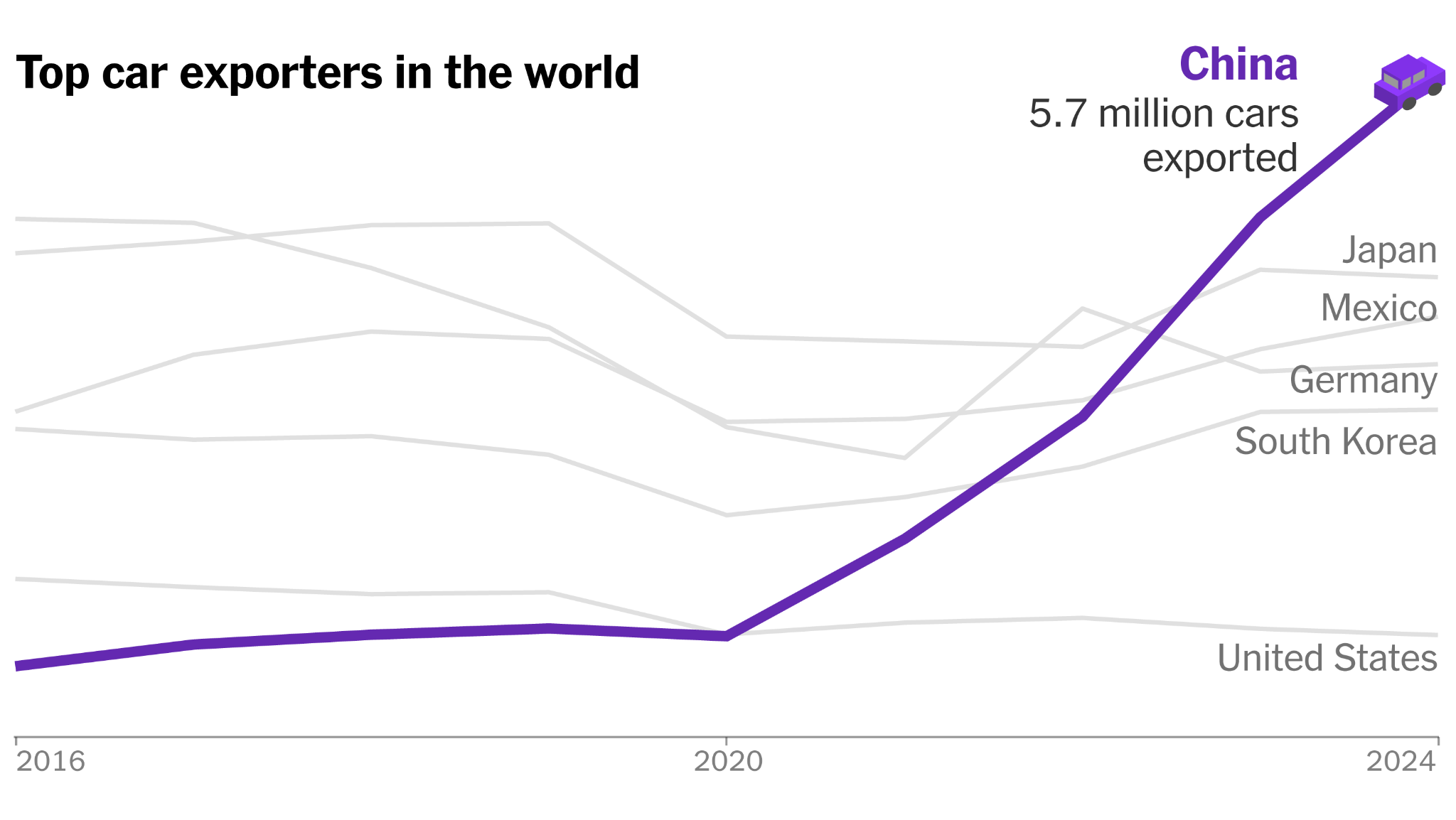

The chart below is from a New York Times article detailing the dramatic rise of China’s car market. It shows how in the space of just 5 years, China has shot to the top of global auto export charts.

China’s rapid rise is unprecedented in the auto world. The country specializes in electric vehicles (EVs), which is what makes them such a serious threat to Tesla.

Just a few years ago, Tesla was the dominant global EV maker. This is no longer the case. A swarm of Chinese manufacturers are now competing with Tesla in the global market.

Stiff 100% tariffs will keep Chinese autos out of U.S. markets, but in the rest of the world, China is racing ahead. For Tesla shareholders, this is a real and present danger.

Can Elon Pull it Off?

Elon Musk is the greatest entrepreneur of our time. If anyone can turn the ship around, it’s him.

But the situation is daunting. Tesla shares are still trading at a massive premium to other car makers. Sales are slowing, and competition is rising.

Tesla does have a chance to grab a big piece of emerging markets like self-driving cars and humanoid robots, but once again, the competition in these areas is going to be cutthroat.

In short, it’s going to be an uphill climb from here. Personally, I’m steering well clear of Tesla shares, despite the 50% discount.

Comments: