The Great Gold Leasing Conspiracy

For decades, we gold bugs have whispered about a grand conspiracy.

The theory is that governments and central banks have suppressed the price of gold and silver. The purpose of this manipulation would be to prop up fiat currencies by limiting the gains in precious metals.

After all, if gold and silver are flying higher, it makes fiat currencies look bad by comparison.

The best evidence of such a scheme is arguably Fed Chairman Alan Greenspan’s statement to Congress that, “central banks stand ready to lease gold in increasing quantities should the price rise.”

Gold Leasing

Jim Rickards wrote about gold leasing in his book, The New Case for Gold. Here’s an excerpt from the chapter titled “Paper Manipulation”:

“A central bank can lease gold to one of the London Bullion Market Association banks, which include large players like Goldman Sachs, Citibank, JPMorgan Chase, and HSBC. Gold leasing is often conducted through an unaccountable intermediary called the Bank for International Settlements.

Historically, the BIS has been used as a major channel for manipulating the gold market and for conducting sales of gold between central banks and commercial banks. … The BIS is the most nontransparent institution in the world. … The BIS is the ideal venue for central banks to manipulate the global financial markets, including gold, with complete non-transparency.”

Why would central banks lease their gold out? Officially, so they can get a small amount of income. But some of us believe it also helps suppress prices.

Ideas about a gold price suppression scheme mostly revolve around leasing, as well as “paper gold” and “paper silver”.

Paper here sometimes refers to bullion futures contracts traded on exchanges like the COMEX and LBMA. “Paper” metals can also refer to unallocated or “pooled” gold accounts, where many people might think they own the same piece of (possibly leased) gold.

In this section we’re mostly going to talk about gold futures. In total, there are hundreds of ounces of “paper” metal traded for every ounce of real physical bullion in a vault. Most of the time, physical metal never changes hands or is delivered. The paper gold and silver are simply traded back and forth, then settled in cash.

However, recently this has begun to change. A few weeks back I wrote about the kerfuffle at the Bank of England vaults, where gold withdrawals are backed up. An unusual number of traders were demanding physical delivery. Deliveries that normally take a few days were taking up to 8 weeks.

Apparently the Bank of England gold squeeze has eased somewhat, for now. But there is still plenty of unusual activity. Here’s an excerpt from recent Reuters reporting:

In London, this activity thinned liquidity in the OTC market, which the LBMA oversees, and prompted a race among London bullion market players to borrow gold from central banks, which store their bullion in the Bank of England’s vaults.

A “race to borrow gold from central banks”? Why do they need to borrow (lease) it? Where did all the physical metal go?

China’s Gold Hoard

If there was a scheme to suppress gold prices, why is it ending now? What changed?

In my view, the primary difference today is China. Over the past few decades China has secretly bought thousands of tons of gold. Officially, the country only owns around 2,200 tons. But some analysts think they may actually own up to 20,000 tons of bullion (more than twice U.S. reserves).

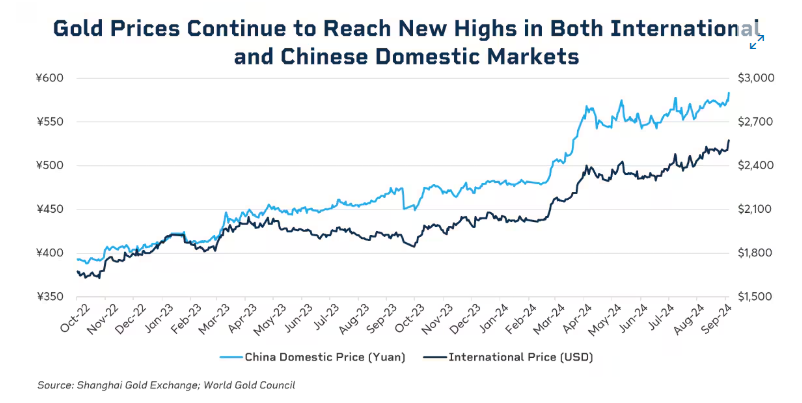

Today there are major gold exchanges in China, primarily Shanghai, which compete with the LBMA and COMEX. And in my view, Chinese buying is basically driving the price higher today. Take a look at the chart below, from CME Group, which shows how prices were rising first in China, and then being followed by New York and London.

Source: CME Group

The “Shanghai gold premium” is a relatively new phenomenon. To me, it looks like the decades-old scheme to suppress the price of gold and silver may be unravelling.

If that’s the case, the rest of this decade could be lucrative for longs.

This story is extremely complex, with dozens of angles, and I’m determined to keep digging into it. Stay tuned.

Comments: