The Bubble is Bursting

In 2000, Sun Microsystems was one of the hottest stocks in the world.

Sun seemed to have everything going for it. They were a leader in computer hardware, and offered cutting-edge software solutions. They were an integral part of the fast-growing internet ecosystem.

Shares soared from $5 to $64 at the peak in 2000. The company’s market cap reached $200 billion, and the price/sales ratio reached 10x (price/sales is the ratio between a company’s market cap and its revenue – higher means more expensive).

By 2002, Sun Microsystems shares had crashed 90%. That year CEO Scott McNealy penned a famous letter titled “Dear Mr. Shareholder”.

In it, McNealy chastised investors for running Sun’s stock price up to such ridiculous levels. Specifically, he singled out the 10x price/sales number, and explained exactly what such a valuation implies:

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I have zero cost of goods sold, which is very hard for a computer company.

That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes which is very hard. And that assumes you pay no taxes on your dividends which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate.

Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

Eventually Sun Microsystems was acquired by Oracle for $9.40 per share. That’s down 85% from its 2000 high.

Bubblier Than 2000

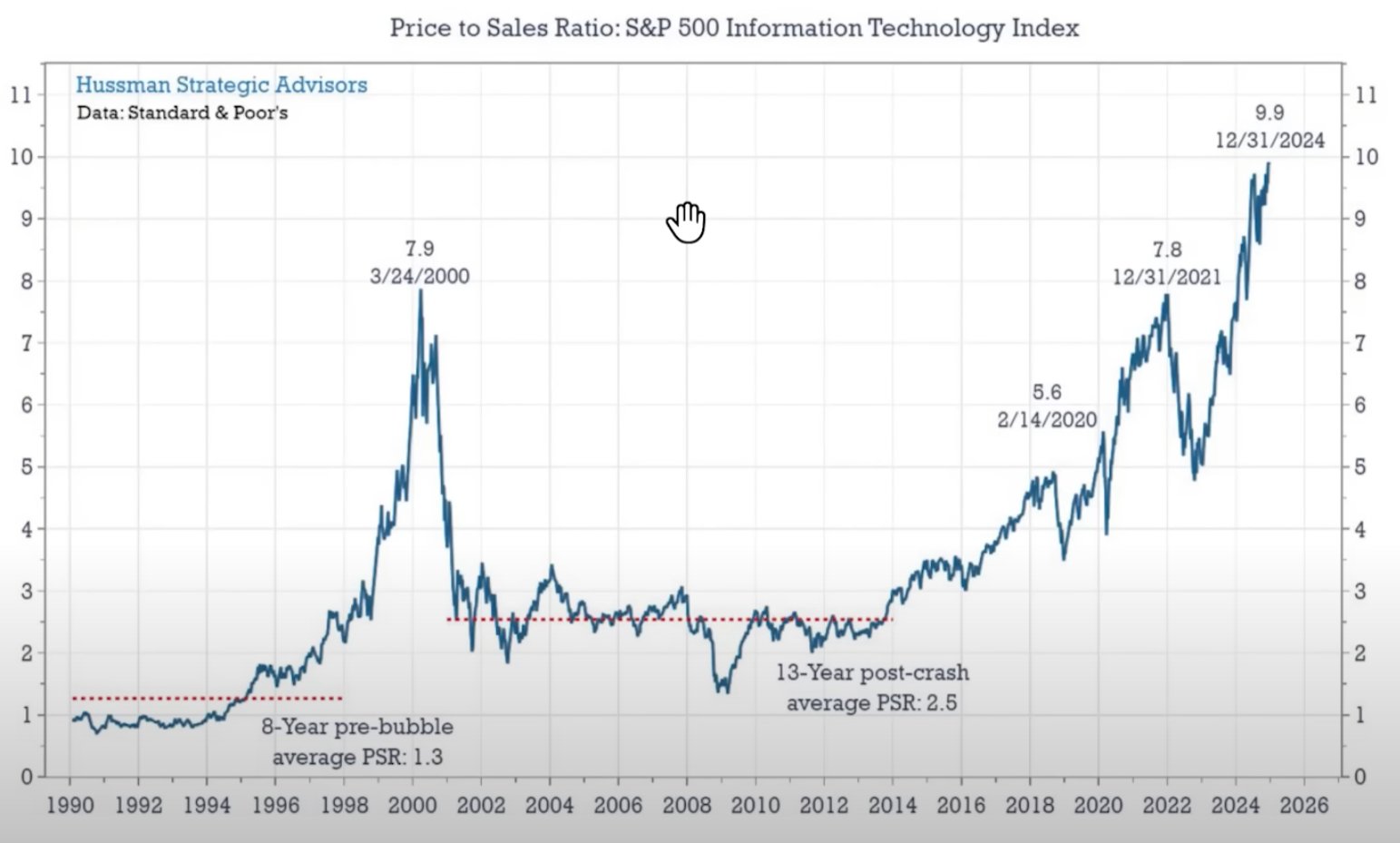

As of the end of 2024, the S&P Information Technology index traded at a 9.9x price/sales ratio. Take a look at this chart:

Source: Hussman Funds

After the recent pullback, the index is probably trading at “only” 8x or 9x sales. The point remains the same. The market is wildly overvalued, especially tech.

There are outliers like Palantir (PLTR), which trades at an eye-popping 69x price/sales ratio, even after its recent fall. That’s almost 7x higher than Sun Microsystems at its 2000 peak.

Palantir is a solid company, but it’s one of the most overpriced stocks I’ve ever seen.

Rickards’ Warning

In late January, Jim Rickards penned an article for us titled “A U.S. Recession is Coming”. In it, he laid out the case quite clearly.

Markets are at or near all-time highs based on every available metric: P/E ratios, the CAPE ratio, market cap/GDP ratio, concentration risk, etc. This stock market bubble is amplified by indexing, investor complacency and analyst euphoria. When such conditions have existed in the past, they have always been followed by market crashes of 50% to 90% unfolding over several years. Examples include the Dow Jones Industrial Average (1929), the Nikkei (1989), NASDAQ (2000), and the S&P 500 Index (2008).

We are now positioned for an historic crash. The specific cause does not matter – it could be war, natural disaster, a bank or hedge fund collapse or other unexpected event. What matters is the super-fragility of the market when the trigger is pulled. This is why Warren Buffett has over $300 billion in cash and why central banks are buying gold.

And now the bubble falters. As I write this at 11:00 am on Monday March 10th, the Nasdaq is down 3.6% on the day.

If the bubble is popping, it’s still early in that process. As Jim noted above, major crashes involve 50-90% downturns. Right now the Nasdaq is only down about 14%. It could have a lot farther to fall.

The hottest stocks typically fall the hardest. Think NVIDIA, Microsoft, Meta, Tesla. They are all fundamentally sound companies, but they trade at crazy prices.

Just like Sun Microsystems in 2000, today’s tech valuations are utterly unsustainable.

Bubbles can be fantastic money-making opportunities. But it looks like this one is drawing to a close.

So if you’re still sitting on major tech gains (or losses), it might still be a good idea to take some off the table. Sure, there’s a chance that the market turns around and soars to new highs. But at this point, that looks highly unlikely.

As I explained in The Pain Begins, it appears that Trump has decided to accept short-term market pain for long-term economic gains. We can’t look to Trump to save the market. He’s fully focused on saving the real economy.

The market looks to be headed significantly lower. This week we’ll review strategies to navigate this new era.

Comments: