Sticky Inflation Means Gold Will Keep Rising

How much gold do you own? The correct answer is: “Not enough.”

Don’t you wish you had some of these? This is a $20 gold coin from 1914, the first year of the Federal Reserve. And back then, just over 110 years ago, gold was $20 per ounce.

U.S. $20 gold coin, St. Gaudens, minted 1914. Courtesy U.S. Treasury Dept.

Today’s gold price is over $2,900, which means that the purchasing power of a dollar over the past century-plus has shrunk by a factor of 145x. In other words, a single dollar back in 1914 is the equivalent of $145 today. This is why people and institutions (certainly central banks) are buying gold. And it’s why gold deserves a place in every portfolio.

Let’s dig into what’s happening with gold, what it means, and how to deal with it.

Gold Prices Have Been Rising for Quite a While

On Jan. 20, 2025, when Donald Trump was inaugurated, an ounce of gold was quoted at $2,740. Now, a month into Trump’s second term, that same metal will set you back over $2,900, a rise of not quite 7% in just a few weeks.

But don’t blame the rising gold price on Trump. Hey, after only a month in the Oval Office, this is not (yet) Trump’s economy. Many Biden administration legacies still cast shade, along with a long, deep history of federal-level misallocation of the nation’s economic power, if not the country’s money. Although yes, for sure, Trump or not, the price movement of gold foretells continuous inflation, so be prepared.

The underlying problem is that inflation is embedded in the monetary system. It’s structural, or call it “sticky” inflation, to use an economic term made famous by no less than the Fed itself. And by many indicators, inflation is not going away any time soon.

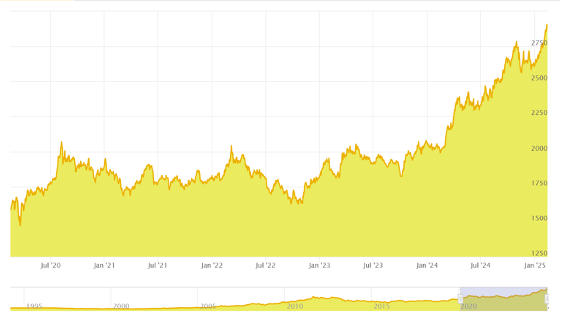

Looking back over just the past few years, inflation and gold prices have been rising. Here’s a chart to illustrate:

Gold Price, past five years. Courtesy JM Bullion.

As you can see, the price of gold began its recent, upward breakout in mid-2023 during the Biden administration. And gold has been on an uptrend ever since. So, by the beginning of this year the price of gold was already headed north. And we can only imagine how much higher the price of gold might be right now if Trump had not won the November election.

Sticky Inflation

Meanwhile, recall the inflation of the Biden era, aka “Bidenflation.” In truth, it was stagflation, meaning the mix of a stagnant economy and elevated inflation.

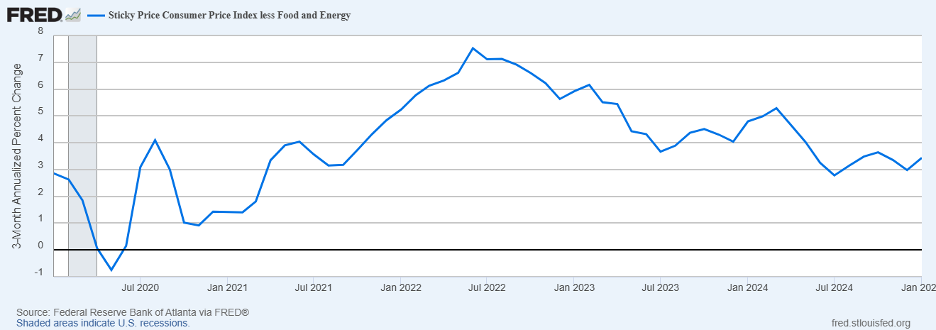

Here’s a chart of those “sticky,” monthly price index moves over the past four years to remind you of what happened, courtesy of the St. Louis Federal Reserve Bank.

Sticky price levels, five-year chart. Courtesy FRED.

From 2021 onward, price levels went up consistently. Now, we’re living with all that cumulative inflation, a long-term hit to your purchasing power that exceeds 20% over the past four years.

Stated another way, if you feel poorer, the chart above illustrates how your dollars don’t go as far at the grocery store. For the past four years, inflation shrank the value of what’s in your wallet and bank account.

What’s worse is that official statistics tend to understate the reality of inflation. Government number adder-uppers often fudge towards the low end. Still, whatever numbers you follow, it’s clear that we’ve had inflation in the 3%–5% range for a while, and it feels like it when you buy a pound of bacon, or new tires, or get a quote to fix the roof.

The U.S. economy finished 2024 with an official rate of inflation about 3.5%. Yet the Fed’s target goal for inflation has long been 2%, so it’s clearly not under control. There’s inflation momentum out there, with more hits yet to come.

Again, keep in mind that all these inflation numbers are before Trump has submitted his first budget proposal. In fact, the federal government is running on last year’s continuing resolution to spend-spend-spend. Trump has nothing to do with it, although he and his new bestie Elon Musk are scouring the budget for items to cut and people to lay off.

Is Draining the Swamp Inflationary?

Trump doesn’t get a complete pass, however. Look back to the blowout federal spending in 2020 under Trump 1.0, during the first year of the pandemic. The President took some very bad advice, to be sure; but he was still the captain of the ship and went so far as to insist that U.S. Treasury checks bear his signature. So, Trump owns a chunk of past spending and current debt.

But then in 2021, along came the Biden administration which opened the Treasury spigots even wider, and a flood of dollars spilled into a contracted economy. And that was the monetary kill-shot, some might say.

Consider how, by 2021, unemployment was widespread and productivity was down.

Likely, you recall shortages at every stage of supply chains, problems with just about everything. Remember the empty store shelves? How about the lack of toilet paper? The list is endless.

Foolishly, Biden injected about two trillion dollars of vaporware Fed-bucks into this very contracted economy, which truly lit the flame of inflation. There was too much money chasing too few goods and services.

Now, we have President Trump and his tenacious assistant Elon Musk, busily draining the federal swamp, ripping like a tornado through the massive federal bureaucracy in Washington. And hey, they’re getting things done!

Elon Musk and President Donald Trump. Courtesy Truth Social.

Team Trump is on a roll, cutting budgets and closing down entire departments. This is exactly what Trump campaigned on, and he’s off to a fast start.

However, the bulk of government spending is on relatively fixed expenses like Medicare, Medicaid, and Social Security. Yes, waste can be cut from these programs but there’s only so much which can realistically be cut.

But let’s get back to gold, the price of which is controlled by events far beyond the powers of even the Mighty POTUS.

Central Banks Drive Gold Prices

The price of gold is set by supply and demand. As for availability, the supply of physical gold is metal above ground plus whatever new metal gets mined each year.

Rising gold prices reflect the growth of money supply, an economic term for the amount of currency issued by central banks. The gold price mirrors inflation caused by central banks.

Thus, it’s clear why wealthy people and deep-pocketed institutions, especially central banks, have been buying gold. They want to preserve wealth. Thus, demand is rising.

Which brings us to the point that, for the past three years, many central banks have bought gold. No, the U.S. Fed wasn’t buying, sad to say. That hidebound institution disdains monetary gold.

But over the past years, other central banks bought gold big time and are still in the market. For example, the central banks of Russia, China, India, Turkey, Indonesia, the Philippines and many more.

In the words of the World Gold Council in 2024, “central banks continued to vacuum up gold at an eye-watering pace.”

Kitco News explains that “central banks look to diversify away from the U.S. dollar.” Bones of contention with the dollar include a lack of confidence in the Fed’s interest rate manipulations, continuing inflation, and overall geopolitical instability.

More and more, central banks are accumulating gold as a long-term store of value and inflation hedge. Gold is an effective portfolio diversifier with no default risk to physical holdings.

Building a Gold Stash

Now, let’s get closer to home, meaning our portfolios. I believe it’s important to own gold in different forms: physical metal, ETFs, royalty companies, and gold miners.

Physical speaks for itself. Store where you can find a safe site. This should be a multi-decade program for building generational wealth. You simply buy and hold and only spend when it’s truly necessary.

Gold miners are also an attractive way to get exposure. And right now, I believe they’re cheap compared to bullion. You see, central banks are the primary buyers in today’s gold market, and they only buy bullion, not miners. There’s a big opportunity here we’ll be exploring further in the coming weeks.

The entire precious metals sector is dramatically under-owned by investors today. Gold and silver investments account for less than 1% of global assets. The thinking appears to be, why buy a gold miner when you can buy soaring tech stocks?

There is far too much money chasing overbought sectors like tech.

If just a small amount of frothy market cap rotates into precious metal and mining shares, we’ll see massive upswings.

The average investor has almost zero exposure to gold and silver, and that means prices have abundant upside potential.

So no, it’s not too late to get into the gold space. Not even close.

Comments: