Trade Wars Move Markets

American steel producer Cleveland-Cliffs (CLF) skyrocketed 15% higher in trading earlier today.

Century Aluminum (CENX), also based in the U.S., has jumped 10% higher as I write this.

And United States Steel Corporation (X) moved up 4% by midday.

These moves were a direct result of President Trump’s new 25% tariffs on steel and aluminium imports, which were announced over the weekend.

This is what we mean when we say this trade war will create winners and losers. And it’s just getting started.

Canada In Trump’s Crosshairs (Again)

I’m genuinely starting to feel bad for my Canadian friends. First, they’ve had to live under Trudeau’s rule for nearly 10 years. That alone was a nightmare.

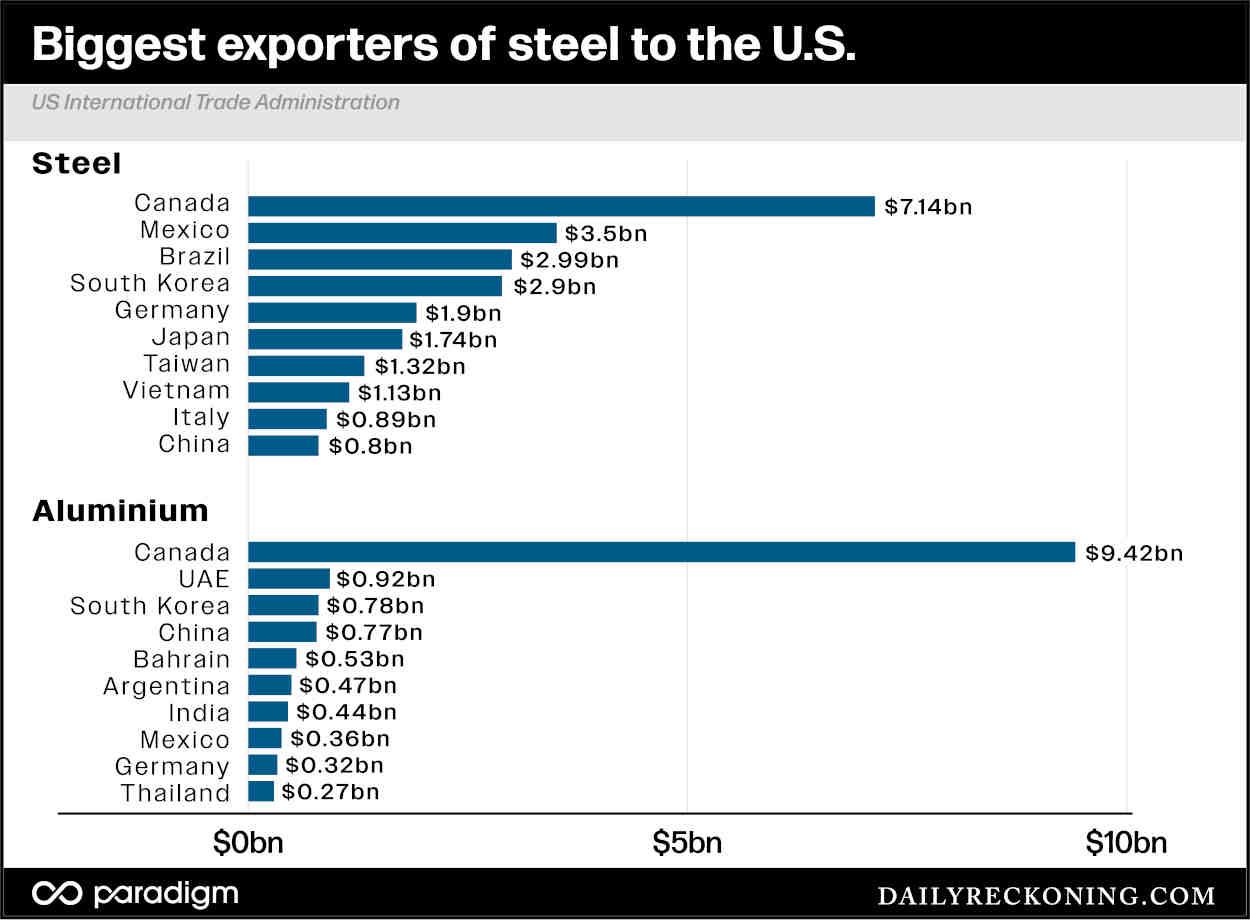

But now this trade war isn’t going well for our friendly northern neighbors. Once again, Canada stands to be most affected by Trump’s 25% tariffs on steel and aluminum:

As you can see, Canada has a lot to lose from these new industrial metal tariffs. Far more than anyone else.

From the chart above, it’s also worth noting how little steel and aluminum are imported from China today. China currently produces half of the entire world’s steel, for example.

So why are we importing so little from Asia? Because there were already tremendously high tariffs, up to 200%, on Chinese steel. These are “anti-dumping” duties designed to counteract the rock-bottom prices offered by China’s steel firms.

In 2018, Trump introduced broad 25% tariffs on all steel and aluminum, but those measures excluded Canada and Mexico. It looks like they will not escape so easily this time around. And China will likely continue to be cut off from U.S. metal markets.

China Retaliates

In response to Trump’s trade salvos, China has announced 15% tariffs on American energy products including liquified natural gas (LNG) and coal.

This is on top of the severe restrictions China has placed on critical rare metal exports to the U.S., including gallium, antimony, and many others. In some cases China controls 98% of the market for these materials, as we discussed last month.

The U.S. is currently seeking alternative sources for these rare metals. But it will likely take a decade or more to begin production at scale.

I believe that eventually, Trump will make a deal with China. I’d imagine that we may even have to restore their access to top-tier GPUs and other key AI hardware. We shall see.

But it’s almost certain that many of these tariffs will “stick” for the long run. And no country besides China is in a decent negotiating position.

I imagine President Trump will make a deal with China, and will largely get what he wants from the rest of the world. The implications for investors will prove to be tremendous.

Comments: