The Biggest Credit Bubble in History

Economist Richard Duncan is credited with fabricating the term “creditism.”

Many still insist ours is a capitalist system. Yet Mr. Duncan tells them to have another guess.

He argues that the capitalist system went into the grave when the gold standard went into the grave.

They share a common plot.

Credit — that is, debt — took over. Credit is king of the post-capitalist system.

All economic growth, in this fellow’s telling, requires the unceasing expansion of credit.

If credit fails to expand at the requisite rate, economies will wither and gutter.

Creditism Has Taken Hold

Central banks, meantime, must keep the spigots set to the maximally opened position… to keep the show going:

When the world stopped backing money with gold in the late 1960s, our economic system changed in a fundamental way. In this new age of fiat money, credit growth drives economic growth, liquidity determines the direction of asset prices and the government controls both through aggressive policy intervention to ensure the economy does not collapse.

Mr. Duncan does not endorse or applaud the post-capitalist system, the creditist system.

He merely acknowledges the reality of it, as a man must acknowledge — for example — gravity, mortality or the inherent rascality of politicians.

He may shake his fists against cruel fate all he pleases. Yet he is powerless before it.

Here you have Mr. Richard Duncan.

He realizes creditism has produced booms and busts and the devil and all other disorders to which a credit-based monetary system is prone.

Today Mr. Duncan bears grim news. He likewise bears “good” news.

Bad News First

First the grim:

Total credit in the United States hit $100 trillion during the third quarter, a 100-fold increase in 60 years. This must be viewed as history’s greatest credit bubble.

Should this credit bubble pop now, the resulting debt deflation depression would bring about a catastrophic economic and societal collapse that our civilization would not survive.

Horror would succeed horror in fantastic cascades:

The collapse would begin with the private sector defaulting on its debts again. Without government intervention, ALL the banks would fail (as they almost did in 2008). And without government intervention in the form of deposit insurance, everyone’s bank deposits would be entirely wiped out.

Most corporations and small and medium-sized enterprises would go bust. Unemployment would skyrocket to 30%, 40% or higher. Consumption would crash. Investment would cease.

The size of the economy would shrink by more than 50%. Most stocks and pension plans would become worthless.

A Collapse of Civilization

Here Richard completes his dismal sketch:

That would result in hunger and, most probably, political revolution within the United States… International trade would more or less end. The global economy would implode.

Starvation would be widespread around the world. Revolutions and wars would ignite in all corners of the planet… In short, our civilization would collapse, and most people wouldn’t survive…

That is how things would play out if our $100 trillion credit bubble pops and the government fails to intervene.

The very contemplation of it converts our spine to an icicle.

If your own spine does not endure an identical phase change you are one stoutheart — believe it!

Yet Richard counsels us to take heart.

We noted above that Richard bears “good” news. What is it?

We refer you once again to this passage:

That is how things would play out if our $100 trillion credit bubble pops and the government fails to intervene.

The “Good” News

The “good” news, Richard argues, is that the government will in fact intervene — as it intervened in 2000 and 2008:

Luckily for us, however, that scenario is very unlikely because the government will intervene whenever necessary to keep the bubble inflating just as it did in 2008 and 2020.

That is, the government will intervene to undo the evils its prior intervention spun forth… which itself was a reaction to the evils its earlier intervention spun forth.

Imagine a medicinal drug. It is a formidable agent, yet it presents adverse reactions.

It may resolve a serious heart malady, for example. Yet the medicine that cures the heart sickens the liver.

The patient under consideration then requires a liver medication to effect the necessary repairs.

Alas, the liver medication sabotages the spleen. A conundrum!

The beleaguered patient is subsequently prescribed medication to restore splenetic order.

Yet the dose unleashes horror upon the heart — the very heart that was previously fixed.

Before long the patient is a sad caricature of a man, his body set at war with itself through repeated medical intervention.

Economic Quacks

Now imagine an economy under the treatment of central bank intervention.

To cure a stock market collapse, quack Dr. Greenspan manufactured a housing sickness.

To cure the housing sickness quack Dr. Bernanke manufactured another sickness — a stock market bubble — only larger than the previous bubble.

If this bubble ruptures Chaos and Old Night would result. The central bank must therefore keep the credit flooding in.

The result is an even larger bubble, ever-expanding.

If this larger bubble ruptures the result would be Chaos and Old Night times two, times three, times four.

Only additional credit floods can prevent the bursting.

On and on the sordid business goes.

Yet a question arises: Merely because prior interventions “succeeded”… will the next intervention succeed?

More Distorted and Imbalanced Than Ever

Each intervention manufactures greater distortions and imbalances than the previous.

The 2008 distortions and imbalances exceeded the 2000 distortions and imbalances.

And today’s distortions and imbalances vastly exceed 2008’s distortions and imbalances.

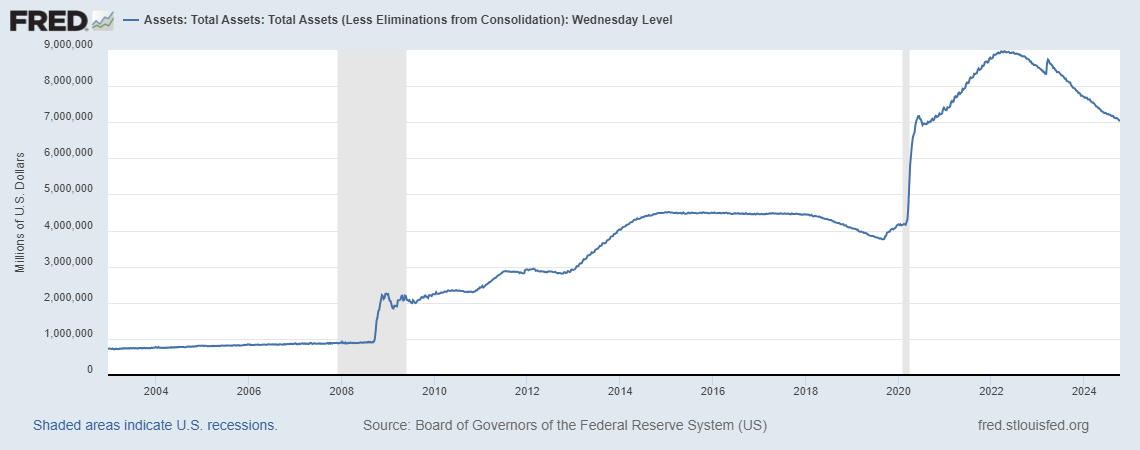

To get your hands around today’s distortions and imbalances, consider the Federal Reserve’s balance sheet.

Compare its present ghoulish dimensions to those of 2002 and 2008:

The thing endured something of a culling following the lunacies of the pandemic. It nonetheless remains multiples of its pre-2008 settings.

Everything Has a Limit

In the natural order of things, limits exist. Certainly the balance sheet of the Federal Reserve confronts limits. What is that limit? We do not know.

Yet the laws of economics will not be forever put off and conned. Trees do not grow forever into the sky. Nor do central bank balance sheets — not in our estimation at least.

If only the Federal Reserve mustered the courage to sit upon its hands in 2000. Perhaps a Great Financial Crisis would have never existed.

If only the Federal Reserve mustered the courage to sit upon its hands in 2008. Perhaps the greatest credit bubble in history may not have formed.

Yet in each instance the courage to sit still would not come issuing. They yielded instead to the cowardice of intervention.

And it has set us upon our current garden path. Jim Rickards:

Each crisis is bigger than the one before and requires more intervention by the central banks.

The reason has to do with the system scale. In complex dynamic systems such as capital markets, risk is an exponential function of system scale. Increasing market scale correlates with exponentially larger market collapses.

This means a market panic far larger than the Panic of 2008. Today, systemic risk is more dangerous than ever because the entire system is larger than before.

Why? Look merely to interventionism:

The problem with any kind of market manipulation (what central bankers call “policy”) is that there’s no way to end it without unintended and usually negative consequences.

Once you start down the path of manipulation, it requires more and more manipulation to keep the game going. Finally it no longer becomes possible to turn back without crashing the system…

All it does is set the stage for a bigger crisis down the road.

We fear we are far down that roadway. Creditism has taken us here.

“Inflate or die,” says our co-founder Bill Bonner, in summary of central bank policy.

Yet ultimately “inflate or die” reads “inflate and die”…

Comments: