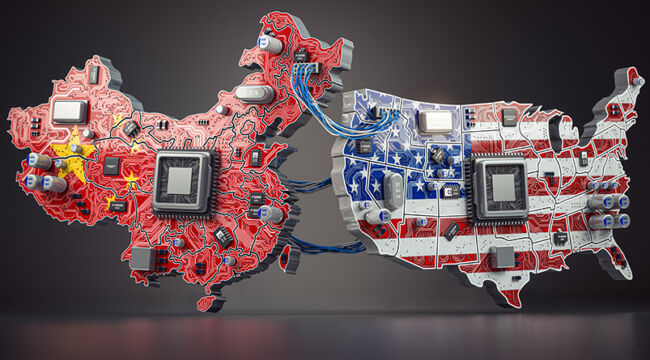

China’s Factories Moving to America?

Treasury Secretary Yellen recently took an airplane to China.

To our everlasting astonishment the aerial machine arrived intact.

It was — after all — “constructed” by Boeing.

In China the American potentate read her hosts a severe lesson… and wagged a lecturing finger in their stern faces.

She bellyached and moaned about Chinese economic “overcapacity.”

China — in Ms. Yellen’s telling — is overproducing and underconsuming.

This condition represents a dreadful menace to the United States. Thus the lady mumbled that:

I am particularly worried about… China’s enduring macroeconomic imbalances—namely its weak household consumption and business overinvestment…

China has long had excess savings, but investment in the real estate sector and government-funded infrastructure had absorbed much of it. Now we are seeing an increase in business investment in a number of “new” industries targeted by the PRC’s industrial policy. That includes electric vehicles, lithium-ion batteries and solar.

China is now simply too large for the rest of the world to absorb this enormous capacity… When the global market is flooded by artificially cheap Chinese products, the viability of American and other foreign firms is put into question.

What Yellen Really Said

Last week we placed within our stable Mr. Andrew Zatlin — “The Moneyball Economist.”

Here he strips the preceding mummery to its nuts, to its bolts, to its washers and screws:

China has built a massive manufacturing base and they continue to build out the factories.

It’s reminiscent of what Japan did in the ’70s and ’80s, which was to rapidly industrialize and get rich quick.

The Chinese government is taking a page out of that playbook. Basically, you make a lot of stuff, you sell that stuff to other people.

Janet Yellen said she’s particularly worried about how China is enduring macroeconomic imbalances. What does that mean?

It means China’s making a lot of money and saving it, resulting in weak household consumption. We want China to have a consumer economy… and to stop building factories that are making cheap products that are overwhelming us.

Quite frankly, it’s all about jobs. If the U.S. is flooded with cheap Chinese products, U.S. companies go out of business and we lose jobs.

And that’s the message from Janet Yellen to China: You’re doing the same thing that Japan did, and we’re going to stop it.

Will Chinese Factories Move to the U.S.?

How did the United States stop Japan??

In the 1980s, Reagan starts pushing hard on Japan. Just like with China, they wanted Japan to boost consumer spending and stop flooding us with their cheap goods.

You know what happened? Japan moved their manufacturing over to the U.S. Honda and Toyota opened production lines here. By 1996 there were three factories that Toyota was running building cars.

Thus Andrew expects China to pursue the Japanese example.

Chinese factories will take ship at Shanghai and offload at the Port of Los Angeles… where they will board trains for the American interior.

Upon arrival American laborers will empty into them.

With these factories comes investment opportunity, says Andrew:

So what’s the investment play here? Power generation. More U.S. factories mean a higher demand for reliable electric generation. I like infrastructure.

Go here for his entire commentary.

The “Evils” of Excess Savings

Treasury Secretary Yellen refers to “excess savings.”

“Excess savings” is a devilish condition that — happily — your editor has never endured.

He can scarcely conceive its terrors.

He would be reduced to purchasing all his goods and services with money in his actual possession.

A credit card would be an unknown. As would monthly interest payments at 23%.

Thus he would shatter the central pillar of American economic life — debt-based consumption.

Pity the forsaken land of excess savings, unblessed by debt. Its debt-to-GDP ratio is not merely zero. It is negative.

Contrast this hell with the debt-blessed American paradise.

United States national debt runs to $34.6 trillion. United States total debt — both public and private — runs to a divine $98 trillion.

And the nation’s debt-to-GDP ratio scales 120%.

Gloria in excelsis Deo!

Then you have those poor Chinese…

Say’s Law

Chinese households, alas, are afflicted with the plague of excess savings. Their owners fail to appreciate the infinite wonders of debt.

They are evidently slaves to Say’s Law — that production must precede consumption.

That is, a man must produce before he can consume.

The government Ms. Yellen represents has long revolted against Mr. Say’s iron law.

It goes along under a sort of Keynesian anti-Say’s law — that consumption precedes production.

She herself rises in active revolt against Mr. Say and his universal law. She does not believe in it.

What does Ms. Yellen believe in?

Ms. Yellen believes in the theory that consumer spending represents 70% of the United States economy.

Let us now proceed to a central assault upon the consumption theory itself — the nearly universal theory that consumer consumption constitutes 70% of the United States economy.

It likely constitutes far less.

Consumption In Only 30% of GDP

Official calculations of the gross domestic product neglect tremendous piles of economic goings-on.

These goings-on include business investment and spending on “intermediate” goods.

These are inputs required for the production of final goods — hence they are intermediate goods.

The steel in the automobile, the sugar in the candy, the wood in the furniture… these are intermediate goods… for example.

Yet their purchase does not classify as consumer spending — else they would be double-counted in the ledgers.

Explains economist Mark Skousen:

GDP only measures the value of final output. It deliberately leaves out a big chunk of the economy – intermediate production or goods-in-process at the commodity, manufacturing and wholesale stages – to avoid double counting.

Now mix in expenditures on intermediate goods. What do we find?

We find that consumer consumption merely constitutes perhaps 30% of GDP. Skousen:

I calculated total spending (sales or receipts) in the economy at all stages to be more than double GDP… By this measure — which I have dubbed gross domestic expenditures, or GDE – consumption represents only about 30% of the economy, while business investment (including intermediate output) represents over 50%.

To emphasize: Consumption represents a mere 30% of the gross domestic product. Not the commonly accepted 70%.

We therefore incline toward the business investment gauge of economic vigor.

And business investment — over 50% of the gross domestic product — has been steadily shedding steam.

Thus we harbor a hearty suspicion about the lovely economic reports in current circulation.

We do not believe them. More tomorrow…

Comments: