Thank God the Bridge Collapsed!

We sense — at times — that we dwell among unrealities.

Today is one such time.

Reports a certain Gregory Mannarino in Trends Journal:

Despite a world economy contracting at its fastest pace on record, stock prices are rising at a staggering pace. Here in the United States alone in just the first three months of the year, the stock market has hit a new record TWENTY TIMES!

The Dow Jones Industrial Average registered 37,697 on Jan. 3.

Today it verges upon 40,000 — a nearly 6% advancement within four months.

Has the United States economy advanced nearly 6% within the past four months?

By every indication it has not.

Shouldn’t the Stock Market Reflect the Economy?

Tradition says a nation’s stock market is the mirror of its economy — not a perfect mirror perhaps — yet a mirror.

The Federal Reserve has wrecked that mirror into millions and millions of fragmented shards… strewn upon the trading floor.

Today the stock market is a mirror not of economic realities — but of monetary realities.

It is an economic anti-mirror. Mr. Mannarino:

Beginning this year, multiple corporations have announced, and continue to announce, mass layoffs… [indicating] a rapidly slowing economy.

With ongoing nonstop round after round of continuing bad economic news, stock investors are betting on central banks lowering rates despite inflation continuing to rise.

[It’s] the promise of more easy money.

Thus poor economic news is grand financial news.

Thank God the Bridge Collapsed!

We hazard Wall Street inwardly thrilled to the destruction of Baltimore’s Francis Scott Key Bridge.

That is because its destruction will work substantial economic wreckage.

Mr. Martin Armstrong of the eponymous Armstrong Economics:

Around 4,900 trucks, carrying around $28 billion in goods, must be rerouted due to the bridge collapse. It is the second-busiest strategic roadway in the U.S. for hazardous materials. These hazardous materials include diesel fuels… Fuel prices will rise, fertilizer prices will rise. The bridge was built to handle hazardous materials like propane, nitrogen, highly flammable materials, large cargo materials and more.

Then there is the agricultural impact to consider:

The timing could not have been worse for American agriculture.

Baltimore is the largest entry point for all large agricultural and construction equipment, and this will have a ripple effect across U.S. agriculture in general. It has been noted that this collapse occurred during the peak of planting season for the Midwest region as the ground has begun to thaw. Our entire food supply is at risk.

And what about Baltimore Harbor employees heaved suddenly into idleness?

Over 15,000 people are employed directly through the port, and 139,000 have indirect jobs in connections. All of this amounts to $3.3 billion in personal income, as noted by Axios.

Analysts are saying this will cripple Baltimore, but it will send ripple effects throughout the entire U.S. economy.

And so there is greater joy on Wall Street. The destruction will further induce the Federal Reserve to “pivot.”

Let’s Blow All the Bridges!

Shall we collapse all the nation’s bridges and shutter all its ports? Why not?

Imagine the monetary and fiscal stimulus that would come issuing.

Imagine its levitating effects upon the stock market.

It is already aloft under the Federal Reserve’s elevating influence. As we have reported recently:

Despite Federal Reserve “tightening”… financial conditions are presently looser than a harlot’s virtue… as Wall Street anticipates Mr. Powell’s prostitutional rate reductions.

In reminder:

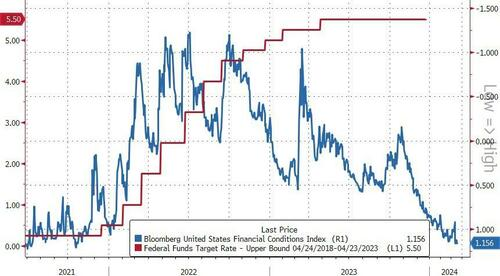

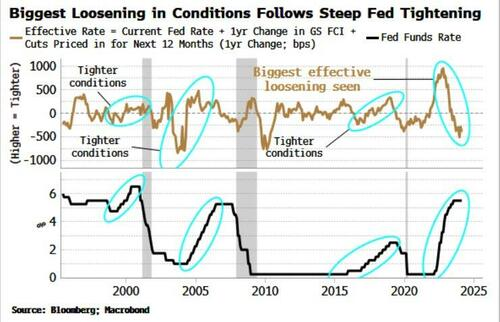

Source: Bloomberg

Source: Bloomberg

Three rate reductions are in prospect this year.

And so Wall Street is presently rubbing its hands in frenzied anticipation, its lips grinning from right ear to left ear, its eyes bulging from its skull.

An Unjust System

We are heart and soul for the free enterprise system.

Let a man present his talents and abilities before the free and open market.

Let him wrest what he can from its ruthless yet honest combats.

For this man has earned his take. Let it be the lion’s take.

Yet as we are heart and soul for the free enterprise system… we are heart and soul against the manipulated system.

There exists a force within the liver and lights that cries out against it. This force demands a square accounting.

The manipulated system is — as we see it — actively arrayed against a square accounting.

It is, in brief, an unjust system.

It rewards not authentic talent, not authentic ability… but inauthentic talent and inauthentic ability.

Thus the manipulated system is a form of welfare.

It is welfare not for the indigent but the stockholder.

And the manipulated system — the welfare system — is the present system.

Honest Competition

We have never denied the manipulated stock market can be lucrative.

Nor would we deny that bank robbing can be lucrative. Or that hitmanning can be lucrative.

We have merely questioned its authenticity… and its justice.

The stock market should be a free and open joust. Bull and bear, bovine and ursine, let them meet on fair and neutral ground.

There they can settle their quarrels under honest competition.

A scrupulously impartial judge should referee the bout. His lone concern should be the equal application of martial justice.

He must hold the scales even.

And may the winner emerge fair and square, his hand raised in honest victory.

Should it be the people’s champion — the bull — so much the better.

But should the heelish bear walk out victorious, well then…. the heelish bear walks out victorious.

The bear would win because he was the superior pugilist.

Justice, that is, would be served. What we have instead is injustice…

A Rigged Fight

The Federal Reserve is not a neutral referee in this bout. It is rather an active participant, in active conspiracy with the bull.

Before the bout it packs his gloves with iron. And once the bout commences?

If the bull strikes beneath the belt, if he bites in the clinches, if he punches after the bell has rung…

This rogue referee instantly loses his powers of vision. He sees nothing.

And if the bear smites the bull down to the canvas, witless, leaving him to take the count?

Then this corrupto stretches the count until the sprawling bovine can regain the vertical… and his wits:

“O-o-o-o-o-o-n-e… … … … t-w-o-o-o-o-o-o… … … … t-h-h-h-r-e-e-e-e-e-e… … … …” all the long way to 10.

Meantime, should the bear absorb but a glancing blow, the official declares him loser by technical knockout, the victim of a mighty clout.

What we have, then, is not a contest of one against one. We have instead a travesty of two against one.

The badly used bear is denied all chance of victory.

“Fīat Jūstitia Ruat Cælum”

Yes, the speculators roar their approval. They applaud this holocaust of justice.

They do — after all — have a wager on the outcome.

Yet our sympathies go the other way.

We lean naturally in the underdog’s direction… and away from the lawless overdogs.

“Fīat jūstitia ruat cælum” is the cry on our lips — “Let justice be done though the heavens fall.”

One day, we hazard, justice will be done. Yet how much more injustice must the underdog endure?

Give him his chance, we say. Else we will never know the rightful winner.

And we wish to know… though the heavens may fall…

Comments: