This Hasn’t Happened Since 1933

The United States economy is enduring a phenomenon not witnessed since 1933 — during the hellsent deeps of the Great Depression.

Is it a frightful omen of lean times… a straw swaying in the wind… a looming menace?

We do not know. Yet we hazard it rates an inquiry.

An inquiry, incidentally, the mainstream financial press will not afford it.

What is it? Answer anon.

Let us first direct our gaze briefly to Wall Street…

All Eyes Are on Friday

After a series of defeats, stocks rediscovered their courage today. Each of the major averages reclaimed lost earth.

The Dow Jones Industrial Average advanced 63 points. The S&P advanced 36 and the Nasdaq Composite advanced 193 points.

Yet investors have their eyes on the morrow.

That is when the Bureau of Labor (Misapplied) Statistics issues November’s unemployment data.

Explains CNBC:

Economists polled by Dow Jones expect that 190,000 jobs were added in November, a step up from the prior month. Investors are hoping for signs of cooling in the labor market, leaving the Federal Reserve comfortable with its decision to halt interest rate hikes.

“The market has more than likely gotten ahead of itself in forecasting rate cuts for early next year,” said Alex McGrath, chief investment officer at NorthEnd Private Wealth. “The jobs number tomorrow could dump an ice bath on sentiment.”

An ice bath indeed.

Meantime, gold yielded back $2.20 today. The 10-year Treasury yield slinked slightly forward to 4.129%… for what it is worth.

Oh My!

Yet what phenomenon is the United States economy presently enduring that it has not endured since 1933?

Here is the answer: The money supply — measured broadly — is contracting at a furious gait.

The M2 money supply constitutes saving deposits, time deposits, certificates of deposit and money market funds.

It has grown and grown for well past a century. It has endured some trembles, some slight contractions.

Yet like the federal government of the United States… or its debts… it has expanded nearly inexorably.

We instructed our minions to ransack the historical data.

This Hasn’t Happened Since 1933

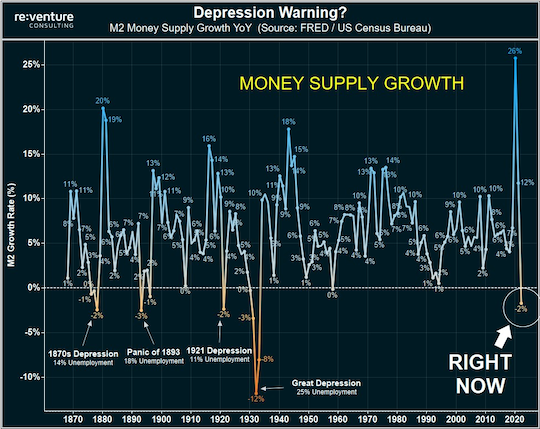

They informed us that the M2 money supply has contracted by at least 2% — on an annualized basis — in six previous instances.

These shrinkages transpired in the years 1878, 1893, 1921, 1931, 1932 and 1933.

Each year coincided with economic frights of one sort or other. And now?

We learn that the M2 contraction exceeds 2%.

Here is the graphic evidence, courtesy of Reventure Consulting:

An Accelerating Contraction

What is more, the contraction rate is itself accelerating.

Mr. Ryan McMaken of the Mises Institute:

Money-supply growth has now been negative for 12 months in a row. During October 2023, the downturn continued as YOY growth in the money supply was at -9.33%…

With negative growth now falling near or below -10% for the eighth month in a row, money-supply contraction is the largest we’ve seen since the Great Depression. Prior to this year, at no other point for at least 60 years has the money supply fallen by more than 6% (YoY) in any month.

Money supply growth can often be a helpful measure of economic activity and an indicator of coming recessions. During periods of economic boom, money supply tends to grow quickly as commercial banks make more loans. Recessions, on the other hand, tend to be preceded by slowing rates of money supply growth.

Just so. Yet it is not so much the direction of travel that riles us. It is rather the pace of travel:

It should be noted that the money supply does not need to actually contract to signal a recession and the boom-bust cycle. As shown by Ludwig von Mises, recessions are often preceded by a mere slowing in money supply growth. But the drop into negative territory we’ve seen in recent months does help illustrate just how far and how rapidly money supply growth has fallen. That is generally a red flag for economic growth and employment.

The fact that the money supply is shrinking at all is remarkable because the money supply in modern times almost never gets smaller.

We must agree. It is remarkable.

M2 has nonetheless withdrawn 13% from its April 2022 summit — remarkably.

Yet perhaps the foregoing analysis lacks… context.

One Gigantic Anomaly

We must consider that the monetary deliriums of 2020–21 were unique madnesses. They lack all precedent.

We refer you once again to the above chart.

And it is true. Never had the monetary sluice gates been flung so widely open. Never has a similar deluge washed over the nation.

It is only natural — then — that money creation returns to some normal semblance once the crisis passed.

Thus the vast contraction may less indicate contracting economic conditions… than merely illuminate the lunatic excesses of the pandemic period.

In this telling we are merely witnessing a normal corrective. The Federal Reserve has merely accelerated the normalization. It has undertaken heroic anti-inflation exertions since March 2022. They have diminished the supply of money.

Yet the facts remain the facts.

In each instance that the M2 money supply has contracted 2% or more — in 1878, 1893, 1921, 1931, 1932 and 1933 — the United States economy was in for heavy weather.

And the M2 money is presently contracting more than 2%.

“The Year of Reckoning”

Will this time prove the exception? Will the United States economy hold against the weather?

As stated at the onset… we do not know.

We have raised false warning flags before. Often, in fact. We will not do it again.

Yet Jim Rickards forecasts that 2024 will be “the year of reckoning.”

He has cited many reasons why. Among them are:

Credit contraction, rising bad debts, increasing jobless claims, collapsing commercial real estate markets, contracting world trade, inverted yield curves and many other reliable technical indicators.

As we are fond to say, climate is what a fellow can expect. Weather is what he actually gets.

It is possible the weather holds. It is possible the Federal Reserve and fiscal authorities will blow away the storm systems.

Yet it is likewise possible they will not.

And the plunging money supply is one reason why…

Comments: