Rate Cut Rally in 2024

My friend and erstwhile colleague Greg Guenthner wrote a peach of a piece for Tuesday’s Morning Reckoning.

Despite the three months of choppy descent we experienced after the averages topped out in late July, last month’s drop shouldn’t have set off any alarm bells.

Not only are pullbacks and downside moves perfectly normal events, there are also seasonal trends the market has closely followed this year — specifically how the S&P performs during a pre-election year.

Earlier this year, I showed you the pre-election year cycle roadmap, specifically how the S&P tends to top out during the summer months in the pre-election cycle and remain in a range until a year-end push.

One important caveat when dealing with seasonality data is it’s the trend that counts. And for the entire year, the S&P is more or less following these seasonal trends. Is it a perfect match? Absolutely not. But our composite continues to offer a general idea of what we should expect heading into 2024.

I couldn’t agree more. And as far as Presidential cycles are concerned, 2024, an election year, is poised for a big rally. In fact, election years produce rallies 82% of the time.

But a specific confluence of events is occurring right now that confirms Greg’s technical hypothesis and bolsters it.

This is despite the general economy getting smacked in the mouth.

Let me build the story for you.

Things You Already Know

Debt is Out of Control

Of course, you’ve been hit over the head with the national debt nearly every day. Heck, I know I write about it enough.

But the truth is we’ve gone parabolic on our debt now, just like all those “alarmist” Austrian economists said we would.

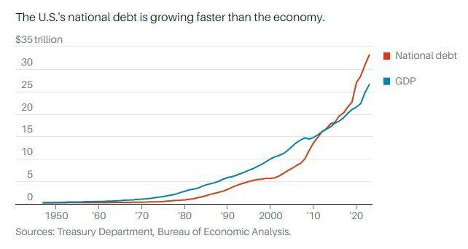

So awful is the US national debt, it’s growing faster than the country’s GDP.

Credit:@SchumanKimm

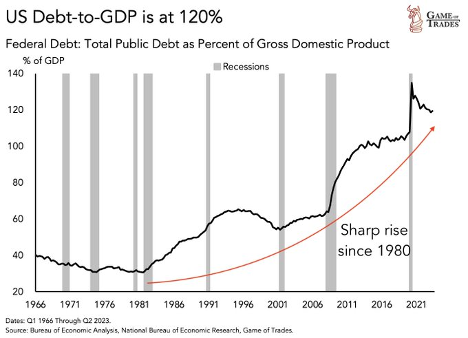

The debt-to-GDP ratio is Greek-like.

Credit:@GameOfTrades_

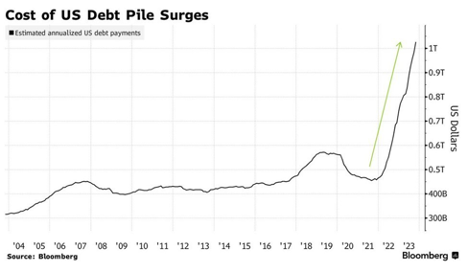

These are the debt payments on that national debt:

Credit:@WallStreetSilv

Yes, that’s a trillion dollars pissed away on interest payments. That’s higher than the defense budget. Hard to believe, I know.

And that’s the problem. With elevated interest rates, the US government can’t afford the payments. Something has to be done. But we’ll get back to that in a moment.

Of course, with rates on the up, that’s exerted pressure on the dollar.

Dollar Has Rallied Hard

Since July, the USD has roofed it. It’s only starting to level off.

But it’s not just the Fed. It’s the all-important Eurodollar market. As eminent colleague Jim Rickards wrote in yesterday’s Daily Reckoning:

Eurodollars are dollar-denominated deposits held at foreign offices of major banks, and therefore fall outside the jurisdiction of the Fed and U.S. banking regulations.

The Fed actually has very little influence over the global dollar market and the exchange value of the dollar. The old currency metrics of balance of trade and moves in capital accounts are leftovers from the world of fixed exchange rates, which have been gone for decades.

What drives the dollar is the Eurodollar market, as conducted by the world’s largest banks in London, New York and Tokyo. It’s here where global liquidity and interest rates are actually determined.

The Eurodollar market needs a constant supply of depositors parking their money in offshore offices of major banks.

Right now, this market is in contraction.

Derivatives are being unwound, balance sheets are being trimmed and interbank overnight lending is being financed with collateral.

And these banks are demanding the best collateral. They won’t accept corporate debt, mortgages or even intermediate-term U.S. Treasuries. The only acceptable collateral consists of short-term U.S. Treasury bills, the shorter the better. This means 1-month, 3-month and 6-month bills.

Those are denominated in dollars, of course. In order to get the bills to post as collateral, banks have to buy dollars to buy the bills. This has created enormous demand for dollars. And that partly accounts for the strength of the dollar.

So, we have high debt, high rates, and a strong currency. Next are some things you may need to be aware of.

Things You May Not Know

Unemployment is Getting Worse

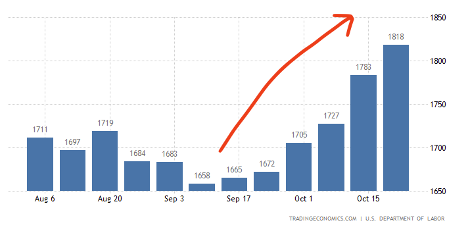

Sure, the unemployment rate is still historically low. And initial jobless claims are also still pretty low. But continuing claims are starting to blow out.

Credit:Trading Economics

High levels of continuing jobless claims indicate a sluggish job market, limited job opportunities, or structural issues within specific industries.

If employment was the last domino to fall before a recession, consider that done now.

The Fed Has to Cut Sooner, Faster

It was always “higher for longer,” but the bond market no longer buys it.

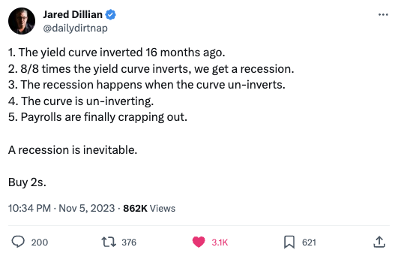

Jared Dillian, editor of the Daily Dirtnap, tweeted:

Credit:@dailydirtnap

Porter Stansberry retweeted Dillian and added:

Correct. And the real concern isn’t the recession, it is how corporate balance sheets & regional banks are going to weather big reductions in consumer spending. Stocks at 25X earnings with 10-year rates at 4% aren’t going to react well to double-digit declines in revs.

But Dillian wrote to buy 2s. What does that mean?

The Bullish Steepening

We’re seeing the 10-year yield come down. That means investors are buying US Treasury 10-year notes. (There’s an inverse relationship between price and yield. As investors buy, the price goes up, and, as a result, the yield goes down.)

What Dillian and many other investors think is that the Fed will be forced to cut harder and sooner. Thorsten Polleit mentioned this in my interview with him. Next Tuesday, we will air that on our brand-new Paradigm Press YouTube Channel.

If the Fed starts to cut hard, the “short end” of the curve will drop dramatically, and dramatically more than the ten-year yield has fallen.

That would “un-invert” the yield curve, potentially putting 2s (shorthand for 2-year yields) lower than 10s (10-year yields). The yield curve would then be normal or upward-sloping.

We call this a bullish steepening because bond buying creates this type of steepening. Hence, buying, and therefore higher bond prices, make this bullish.

Great, but what does that mean for the rest of the asset classes?

What This Means For Assets in 2024

If the Fed panics and cuts quickly – the opposite of the panicking hike it did during 2022 — then stocks, bonds, real estate, gold, and crypto can all roof it.

Rate cuts would mean a weaker dollar, and that’s filip for US asset prices.

Of course, stocks and bonds like lower discount rates. In our clown world, economic bad news is good news for the stock and bond market. It means Nanny Fed has brought back the punch bowl.

Gold has no yield and will find it much easier to compete against bonds offering lower yields. The same goes for crypto, which would probably price in a “disaster premium,” and rightly so.

Real estate will also benefit from lower cap rates.

As 2024 is the last year in the election cycle, all this is perfectly plausible.

So the last thing you want to be now is short. And you certainly don’t want to panic and sell on economic bad news.

Wrap Up

Hold. Hold on for now.

Things will look like they’re about to fall off a cliff.

But there Jay Powell will be to rescue us — well, his rich buddies, but we’ll benefit as well — from the impending doom of a sell-off.

The punch bowl will be brought out, and there’ll be drinks all around — if you’ve kept your nerve.

I can’t wait for the new year myself!

Have a lovely day.

Comments: