Russia: ↑ Germany: ↓

Happy Thursday!

Boy, oh boy. This wasn’t supposed to happen.

Russia was supposed to be suffering. The West was supposed to be prospering.

Someone at the Office of Unintended Consequences didn’t inform Biden, Blinken, and Nuland that their strategy was asinine.

And ace vassal state Germany just let them do it.

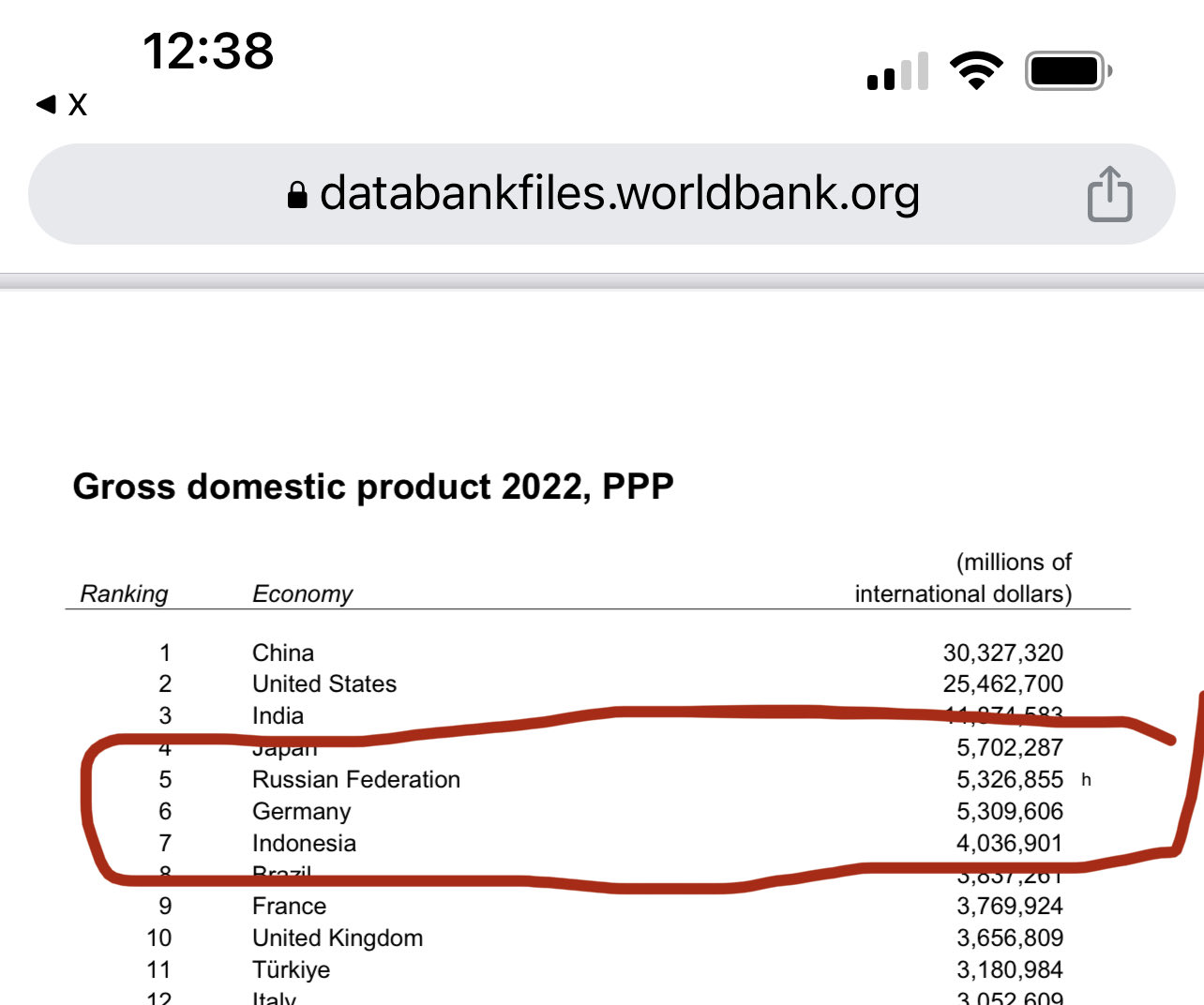

Now, we’ve got tangible evidence sanctions were a strategic failure. By the end of 2022, Russia’s economy surpassed Germany’s as the largest economy in Europe.

They’ve kept the news quiet. You probably didn’t hear about it.

But we’ve got proof. From the World Bank, no less:

Credit: The World Bank

To be fair, Russia’s economy is nearly half the size of Germany’s without adjusting GDP by PPP. But that’s not what most economists look at. They adjust.

Let’s examine what those numbers mean, what PPP is, and why it matters.

But before that, I just had a horrible flashback…

Bodrum, Turkey, September 2015

I’ll never forget it as long as I live. It was boat day at Hans Hoppe‘s libertarian shindig in Bodrum.

On the Sunday before the conference concludes, we go out on boats into the Mediterranean. It’s usually mid-September with gorgeous weather and cool water.

My ship, colloquially known as the Bad Boys, is always stocked full of booze from around the world. It’s a great day, full of mischievous behavior and uproarious laughter.

This particular year Captain America, as we call him, decided to have some fun with our friend, who we’ll call Mad King Lud. Lud is very well endowed. Lud was getting out of the water, climbing up a ladder on the side of the boat, and Captain America was right behind them.

Captain America, who still serves in the US military and is one of the brightest guys I know, maintains a 15-year-old’s sense of humor. He decided to “pants” Mad King Lud. Luckily, I was nowhere near the ladder.

However, I had an unobstructed view from the deck.

I’ll never forget what I saw: Lud‘s pendulous tallywhacker, swinging as if it was one of the Kraken‘s tentacles, nearly knocked out Captain America’s teeth! The good Captain was hanging onto the ladder for dear life, bobbing and weaving the ginormous dong.

Pam was facing me and had her back to the infamous incident. I hugged her as hard as possible so she couldn’t turn around to see what she was missing. I had gotten in the wrong queue when God handed out skinflutes.

I had finally understood what it was to be a flat-chested junior high school girl whose best friend suddenly sprouted double Ds. It was humiliating.

Right now, I suspect Germany feels the same way.

Time To Steel-Man: PPP is Flawed

Peter Thiel uses the term “steel-manning” to describe how you should argue against your opponent’s best arguments to win an argument, rather than his weakest. (It’s supposed to be the opposite of “straw-manning.”)

I would guess that most people would say purchasing power parity (PPP) is highly flawed.

Mish Shedlock just published a post calling PPP “horrendously flawed.” I encourage you to read it, as it compares the US and Chinese economies. After reading it, you’ll have more data to decide your thoughts on PPP.

So what is PPP?

In plain English, every country has a different currency, inflation rates, interest rates, and prices. Purchasing power parity (PPP) tries to correct for this to make better comparisons between countries.

A more formal definition of PPP: an economic theory and a method used to compare the relative value of currencies in terms of their purchasing power. The concept is based on the idea that without transportation costs and other trade barriers, identical goods should have the same price when expressed in a common currency. In other words, the exchange rate between two currencies should adjust to equalize the prices of a basket of goods and services in both countries.

The theory suggests that over the long term, exchange rates between two currencies should adjust to reflect differences in inflation rates between the two countries. Suppose one country has a higher inflation rate than another. In that case, its currency should depreciate relative to the other country’s currency, so the prices of goods and services become more balanced.

There are two main forms of PPP:

- Absolute PPP: This theory states that the exchange rate between two currencies will be in equilibrium when the purchasing power of each currency is the same for a common basket of goods. In other words, the exchange rate should reflect the relative price levels of the two countries.

- Relative PPP: This theory considers changes in the inflation rates between two countries. It suggests that the change in exchange rates over time should reflect the difference in inflation rates between those countries.

The purported advantages of using PPP to “equalize” the comparison of economies are:

Comparing countries’ Gross Domestic Product (GDP) using Purchasing Power Parity (PPP) has several purposes and advantages. But I’ll highlight the top five.

- Accurate Comparison of Economic Size: GDP is a commonly used measure to assess the size of an economy. However, when comparing the GDPs of different countries using nominal exchange rates, the comparison is distorted by fluctuations in exchange rates. PPP-adjusted GDP allegedly provides a more accurate measure of the relative economic size by accounting for differences in price levels and currency values.

- Global Economic Rankings: Using PPP-adjusted GDP allows for a different ranking of countries’ economic sizes compared to nominal GDP rankings. Some countries with relatively low nominal GDP but lower price levels can have higher PPP-adjusted GDPs, reflecting their larger economic capacity when considering local price differences.

- Cross-Country Economic Analysis: PPP-adjusted GDP facilitates cross-country economic analysis by providing a more consistent and comparable measure. Researchers, policymakers, and analysts use PPP-adjusted data to study economic trends, growth rates, and economic development across countries.

- Trade and Investment Decision-making: Businesses and investors use PPP-adjusted GDP data to make informed international trade and investment decisions. It helps them understand the potential market size and consumer purchasing power in different countries.

- Allocation of Resources: International organizations and aid agencies use PPP-adjusted GDP data to allocate resources and assist countries based on their economic capacity and needs.

So, it’s not an altogether useless metric. You just need to know its limitations. And there are loads of them:

- Quality and Availability of Data

- Assumptions and Methodology

- Non-Tradable Goods and Services

- Subsidies and Taxes

- Exchange Rate Volatility

- Quality of Life and Non-Market Activities

- Urban-Rural Disparities

- Homogeneity Assumption

- Dynamic Changes

- Data Collection Challenges

While PPP is indeed a flawed metric, it’s the best thing we’ve got for now.

Sanctions: The Vassal Suffers

According to Politico:

Confronted by a toxic cocktail of high energy costs, worker shortages, and reams of red tape, many of Germany’s biggest companies — from giants like Volkswagen and Siemens to a host of lesser-known, smaller ones — are experiencing a rude awakening and scrambling for greener pastures in North America and Asia.

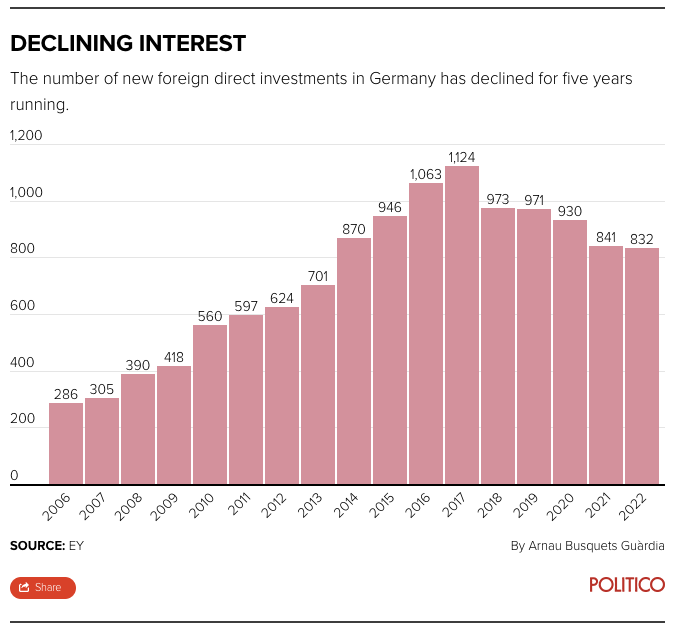

Not only that, but foreigners aren’t interested in the high costs of Germany if they can find comparable expertise in cheaper places:

Credit:Politico

Germany is now drawing comparisons to America’s Rust Belt and the UK’s Midlands. They were once thriving industrial hubs that fell because of mismanagement.

Unfortunately, Germany doesn’t have a diverse economy. Its banking sector is a mess, and manufacturing counts for 27% of its economy. (The US is 11% by comparison.)

Like the rest of Europe, Germany’s demographics work against it.

That’s why its reliance on cheap Russian energy wasn’t to be underestimated. Alas, the USG didn’t give a toss, and the German elites stupidly went along with the poor policy.

Now the country, and perhaps the entirety of the EU, will pay for the mistake.

Wrap Up

Meanwhile, Russia is whistling Dixie, or whatever their equivalent is.

Somehow, despite the barrage of sanctions, blackballing at international institutions, and seizure of its assets abroad, Russia emerges the winner.

Now, by one measure, it’s Europe’s biggest economy.

Comments: