9.0 Magnitude “Bondquake”

There’s good news and bad news today.

Bad news first…

Not 1 in 100,000 Americans have a clue about what’s really going on under the surface of the financial markets this week.

They see tariff headlines, talking heads, Trump tweets, whipsaw markets… but they don’t have a clue as to the “underwater earthquake” that just happened on Monday.

Good news…

If you want to be in the top 99.9% of understanding what’s REALLY going on in the marketplace this week — something NO ONE in the mainstream media will cover (because they don’t understand it) — then sit tight.

Senior Analyst for Jim Rickards and our in-house expert on fiscal policy and the inner workings of the bond market, Dan Amoss is here to unleash the story.

Dan explains how reckless bond traders played a major role in Trump’s decision to put the pause on most tariffs. Then he breaks down what the Fed’s response might be.

This “boring bond stuff” is absolutely critical to understand going forward.

Here’s Dan…

There’s a dangerous trade threatening Wall Street. It sounds complex but could be compared to flipping houses.

It’s called the Treasury basis trade. Hedge funds love it because when it’s working, it feels like free money. But when it goes wrong… chaos.

It almost blew up Wall Street earlier this week.

Here’s how it works.

Imagine you’re a house flipper. You find a house selling today for $100,000. You know someone’s already agreed to buy a similar house from you in three months – for $102,000. You buy the house now, lock in the future sale, and pocket the $2,000 difference.

Now imagine you don’t have the $100,000. So you borrow it. You go to a lender, give them the deed as collateral, and promise to buy it back later, with interest. That’s the essence of this trade.

In this basis trade, the house is a U.S. Treasury bond. The future buyer is a Treasury futures contract. And the short-term loan you use to finance the purchase? That’s called a repo loan. It’s a fancy way of saying: “lend me the cash now, I’ll give you the bond, and I’ll buy it back later.”

This trade is very popular. Estimates put the size of these bets at around $1 trillion – double what it was just five years ago.

Because the price gap between Treasuries and futures is often tiny, hedge funds use leverage. A lot of it. Up to 50 to 100x. That’s like putting down a $2,000 deposit on that $100,000 house, hoping the leveraged speculation coincides with a steadily rising house price environment.

But lately, people are understandably nervous about the Trump administration’s bold policy changes to global trade.

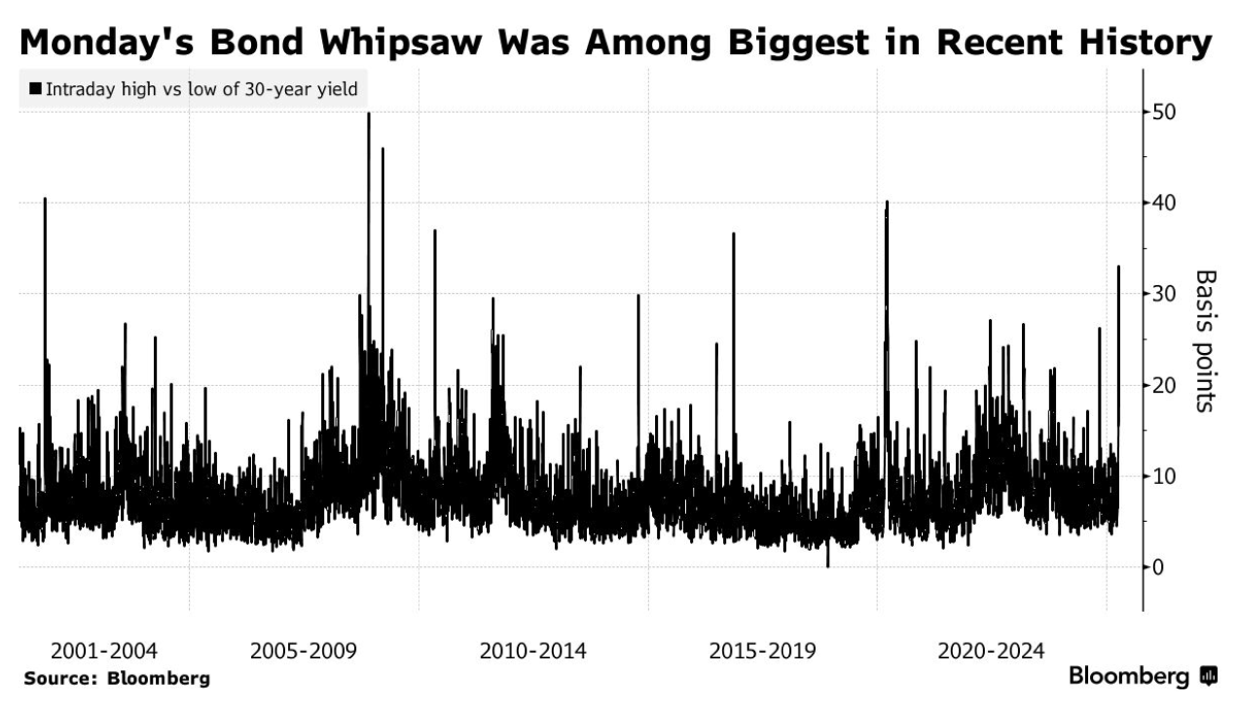

Long-dated Treasury yields have surged. The 10-year rose as much as 22 basis points in a day. The 30-year yield jumped even more. It was the kind of move that reminded portfolio manager James Athey of March 2020, when the basis trade blew up.

“It looked like in March 2020 when we got these wild moves, possibly relating to the basis trade,” Athey told Bloomberg News. “Last week we had not seen any signs of hedge funds getting stopped out of the bond futures basis, but suddenly you’re seeing yields spike.”

He’s not alone. Ed Al-Hussainy, a rates strategist at Columbia Threadneedle, said the unusual spread movement between 30-year swap rates and Treasuries showed that something was breaking down. “That is consistent with the basis trade unwinding at the 30-year point,” he said. “That’s where most of the juice is.”

The juice, in this case, refers to leverage.

And when something goes wrong – like repo financing getting tight or futures prices breaking away from bonds – the trade unravels fast.

Funds rush to close positions. They sell bonds to repay loans. But everyone’s doing it at once. That drives bond prices down and yields up in a self-reinforcing spiral.

Tim Magnusson at Garda Capital thinks we’re not at crisis levels – yet. But even he admits liquidity has been “horrible” during this latest bond selloff.

That’s what’s spooking regulators. They saw this movie in 2020. Then, a wave of forced selling overwhelmed the Treasury market. The Fed felt the need to step in with trillions. Buy bonds. Backstop repo. Calm the panic.

Now, as volatility returns and yields surge, some market watchers wonder if we’re on the edge again.

When the Fed Starts to Sweat

Now picture this: the basis trade is crowded again. Too many players chasing too little spread. Treasury liquidity starts to dry up. Bid-ask spreads widen. Dealers can’t move bonds without taking losses. Suddenly, the “deepest, most liquid market in the world” is creaking.

The Fed watches this closely. It sees funding markets tighten. Hedge funds begin to tap every repo line they can find. Stress shows up in futures margins. A few funds get squeezed and dump positions. Prices gap lower. The system gets jittery.

The last thing the Fed wants is a Treasury market crash. That’s the backbone of everything – mortgages, corporate debt, global reserves. If that market breaks, everything else breaks with it.

So, the Fed will step in if conditions get bad enough.

Maybe not with a bang, but a whisper. First it floats trial balloons through the usual media channels. Then comes the press release. Maybe even a surprise rate cut after an emergency meeting. And a renewed “commitment to ensuring the smooth functioning of the U.S. Treasury market.”

Sound familiar? It should. This playbook is well-worn. The Fed won’t say it’s bailing out hedge funds. It’ll say it’s supporting financial stability. Technically, both can be true.

But the message is clear: the Fed is willing to ease again if funding markets seize.

That sends a signal to everyone: lower rates are back on the table.

Comments: