2026: A Monetary Tsunami

Fudai is a quiet fishing town in coastal Japan.

When the devastating 2011 tsunami hit, Fudai was the only village in the area left intact.

It wasn’t luck. This miracle was due to preparation.

In the 1970s Fudai’s mayor, Kotoku Wamura, proposed a floodgate to stop tsunamis. Many called him crazy. They said it was a waste of money.

But Mayor Wamura remembered the devastating waves of 1933, which killed more than 400 people in Fudai.

So he pushed on, and eventually got the floodgate built, blocking a key valley. It was 51 feet tall and robust enough to survive a devastating wave, which it did.

Fudai floodgate, Iwate province – Source: Wikipedia

Kotoku Wamura, the mayor who built the floodgate, didn’t live to see all the lives his work saved. But without that wall, thousands more would have died on March 11, 2011.

Constructing Financial Floodgates

For much of the past 50 years, gold and silver were seen as relics of the past. Irrelevant shiny rocks from another era.

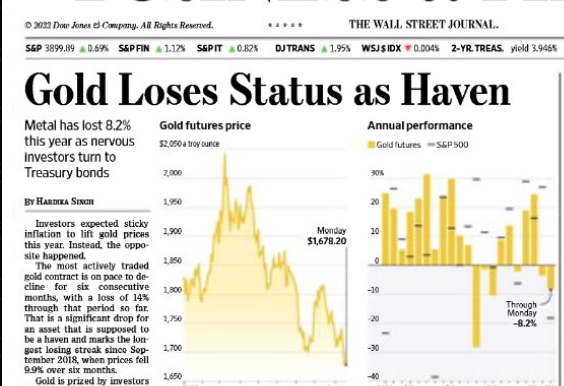

Mainstream news told us precious metals were worthless. “Pet rocks”. Even as recently as September of 2022, the Wall Street Journal ran a headline proclaiming “Gold Loses Status as Safe Haven”, written by one Hardika Singh:

Gold is up about $2,800/oz since that article was published. This is your reminder to ignore mainstream financial news.

Gold investors have done quite well over the past 25 years. In 2000, gold traded as low as $265/oz. But it’s been a frustrating journey at times. In 2011 gold hit $1,800, and a decade later it was trading around the same price.

But now gold is shining brightly, trading over $4,400 as I write. And I see no reason why it won’t continue for the next 5-10 years.

Silver is finally beginning its moment in the sun too. It’s trading over $69/oz as I write this. But it still has a lot of catching up to do. We’re only $20 over the 1980 high.

Gold and silver miners also have a lot of catching up to do. They’re currently priced as if this precious metals bull market is a blip, a fad. If you believe it will continue over coming years, as we do, they should do very well going forward. Miners have become absolute cash flow machines, and the outlook remains bright.

I haven’t sold anything yet. Miners, ETFs, vault holdings, nada. These investments act as a personal floodgate. If you ever need them, you’ll really need them.

And with the trajectory the world is on, a tsunami is inevitable. This wave will come in the form of money printing and inflation at a scale that will shock the world.

We’re approaching a historic financial and monetary reckoning. Over the coming decade we will see multiple sovereign debt crises, including an almost certain one here in the U.S.

We’ll get through it, but it’s not going to be fun or easy.

Those with the means to should prepare by holding gold, silver, and miners for at least the next 5 years. If you’re not in a position to hold precious metals investments, my recommendation is to prepare with skills. Learn or perfect a trade. Start a garden and perfect the craft. Such skills can come in just as handy in a crisis as hedges like gold and silver.

Hold Strong

I understand the urge to take profits after such a runup. But the bull market of the 1970s shows us how profitable these cycles can be.

The 1970s bull market was driven by the U.S. ditching the gold standard in 1971.

Yes, there were serious corrections along the way, but metals and miners absolutely soared, protecting savvy investors from the ravages of inflation.

We are set to experience a sea change of similar magnitude to the 1970s, as the “miracle” of fiat money turns sour.

As we have highlighted in the past, the 1970s wasn’t a time of crushing debt loads. Debt-to-GDP was only around 35%, while it’s over 120% today. We also had a far more favorable demographic picture, with baby boomers nearing their prime earning years. Today the baby boomers are retiring and won’t be in the workforce to generate outsized income and taxes.

If you’ve been holding precious metal investments for a while now, congratulations. But don’t pop the champagne yet. This bull cycle isn’t close to over.

The real threat lies ahead. A tsunami of inflation and money printing. Don’t neglect your hedges just because a small breaker hit.

Comments: