A Nation of Rent-Serfs

Ideologies sound wonderful in the abstract, but run aground in the granular real world. The dominant ideology in the world today isn’t a political ideology, it’s the ideology of the market.

In this ideology, the market is presented as the ideal problem-solving mechanism, as the interplay of supply and demand and the free flow of capital and labor will automatically fill unmet demand with new supply and provide competition that increases quality and reduces costs.

Let’s consider how the market functions in the real-world U.S. housing market. Take a mixed-use neighborhood of single-family homes with a scattering of low-rise rental buildings. It’s desirable but still affordable to buyers and renters alike.

Enter the bubble economy, the global model for the past 30 years in which unlimited credit is dirt-cheap to corporations and financiers as central banks suppress interest rates to “bring demand forward” by making it cheaper to borrow money to buy assets and products.

This pumps up asset prices as low-cost capital sloshes around the world looking for low-risk cash flows to buy and places to park excess capital that will appreciate as global capital competes for the lowest-risk, most desirable assets.

Neighborhoods Are Reduced to Commodities

Real estate in desirable, low-risk locales is an ideal place to park this excess capital. Global capital has no need to rent the flats and homes being snapped up for appreciation; indeed, renting the flats and homes is viewed as troublesome and not worth the hassle.

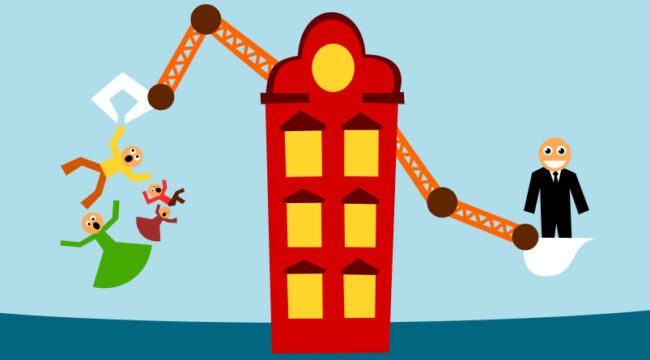

So global absentee owners start buying properties in the desirable neighborhood. These buyers have zero interest in the livability of the neighborhood or the residents; it’s strictly an investment based on the Prime Directive: maximize the return on capital by any means available.

To capital, properties in the neighborhood are commodities, interchangeable with millions of other properties around the world: We own flats in Zurich, Paris, Bangkok, Singapore, Barcelona and Miami.

Next, corporations discover rents in desirable neighborhoods generate profitable cash flow, so corporations start buying single-family homes and converting them from owner-occupied to rentals. These corporations act as a cartel, operating much like a monopoly as they all have the same access to unlimited credit and the same goal of maximizing return on capital.

Then the short-term rental market generates strong demand by investors large and small for vacation/rentals, which are initially highly profitable: Those with surplus equity/credit/capital hear of stupendous profits being raked in by absentee owners of short-term rentals, and they join the bidding war of global capital and corporations for homes and rental properties.

Artificial Scarcity

Now half the housing stock of the neighborhood is owned by absentee owners and corporations, all guided by a single raison-d’etre: maximize the return on capital by any means available. Now that 25% of the housing stock has been removed from owner-occupancy and long-term renter/residents to serve the short-term rental market, there’s a scarcity of homes to buy or rent.

Another 15% is empty by design, as the owners are overseas investors solely interested in owning real estate in the U.S. as a low-risk place to park some of their excess capital.

So 40% of the neighborhood’s housing stock has been removed from the market for residents, the equivalent of 40% of the housing burning to the ground.

This artificial scarcity enables the corporate owners to jack up rents to nosebleed heights, and the few non-corporate owners of rentals quickly follow suit. Now the “market rents” are double what they were prior to the arrival of non-resident “market forces.”

As home prices soar, residents who work for a living cannot compete with the unlimited credit lines of corporations and overseas wealth, and so those seeking to own a home must look elsewhere farther afield, or give up the dream of owning a home and resign themselves to life as a rent-serf, barely able to pay the sky-high rents charged by corporations and absentee landlords.

Sucking the Soul out of Neighborhoods

Meanwhile, the conviviality and livability of the neighborhood have been destroyed. The short-term rentals are plagues, as non-resident visitors think nothing of hosting loud parties, ruining the lives of working neighbors. The neighborhood is now dominated by transients, empty dwellings and rentals crammed with people who can’t afford to rent their own flat.

With rents and home prices now unaffordable, the city is pressured to allow the construction of high-rise condos by corporate developers. The handful of subsidized below-market-rate condos are quickly snapped up, and the market-rate units are purchased by investors, to be left empty (a place to park excess wealth) or as short-term rentals.

The construction of the condo did nothing to alleviate the artificial housing scarcity as only the few subsidized units are affordable to wage-earning residents.

The destruction of the neighborhood is all perfectly logical within the confines of the market: Capital was allocated to maximize profits by any available means, and so the market worked perfectly.

Hmmm…

The problem with the market is the market doesn’t care about livability or the quality of life or the neighborhood as a social structure, for these are non-market factors. The market views places and people as commodities, interchangeable on a global scale: We own flats in Zurich, Paris, Bangkok, Singapore, Barcelona and Miami. They’re all commodities to be bought and sold to maximize the return on capital, nothing more and nothing less.

What’s missing in this distorted reduction of life to commodities is housing is fundamentally shelter, and an essential human need. Housing isn’t merely an asset that generates cash flow or an asset that serves as a place to park excess wealth. It is first and foremost shelter.

But in the market, “shelter” has no meaning except as a source of demand that is no different from the demand generated by capital for cash flows, profits and low-risk places to park excess capital for appreciation.

This is how the U.S. housing market has been transformed by the tyranny of the market: Unleash the powers of unlimited credit and excess capital on a limited, essential resource such as shelter and this is what we end up with — artificial scarcity, rent-serfs and half-vacant neighborhoods owned by absentee landlords solely interested in maximizing the return on their capital.

Here we see housing per capita in the U.S. has reached a new high — yet there’s a scarcity of housing. If this is mystifying, please consider the drivers of artificial scarcity.

Like what you’ve read? Go here for more.

Comments: