Trump's "Clean House" Mandate

On Wednesday morning, I awoke feeling more optimistic than I have in a long time.

The campaign was surreal. President Trump’s last-second head tilt to avoid the assassin’s bullet. The spurious lawfare assaults. Lies about collusion with Russia.

And how about Elon Musk’s emergence as Donald J. Trump’s No. 1 backer? RFK Jr.’s MAHA (Make America Healthy Again) movement, too. And the last minute endorsement by Joe Rogan.

Even Ron Paul’s possible involvement in shrinking the federal government!

Source: X.com

The thought of Elon Musk and Ron Paul teaming up to eliminate government waste is simply delightful.

On Tucker Carlson’s election night livestream, Elon noted that there are now more than 450 federal agencies.

He continued:

And it’s getting to the point where basically everything’s illegal. You just can’t get anything done. And these become real costs to people. They’re hidden costs, but they’re very substantial. It’s very hard to build new housing if you’re burdened with massive requirements that don’t make any sense.

It drives up the housing cost, it slows down new housing starts. So we need to let the builders of America build.

I truly hope President Trump follows through on his promise to create a Department of Government Efficiency (DOGE), with Elon Musk in charge and Ron Paul advising.

The wave of deregulation and belt tightening would be a cool rain after a scorching drought.

What an election it was!

The Hard Work Begins

By electing President Trump, America may have likewise dodged a bullet.

Deregulation should be relatively straightforward. With control of Congress and a fat stack of executive orders, President Trump should be able to make remarkable progress in this area, and quickly. This alone will be a major boost for the economy.

But now comes the hard part.

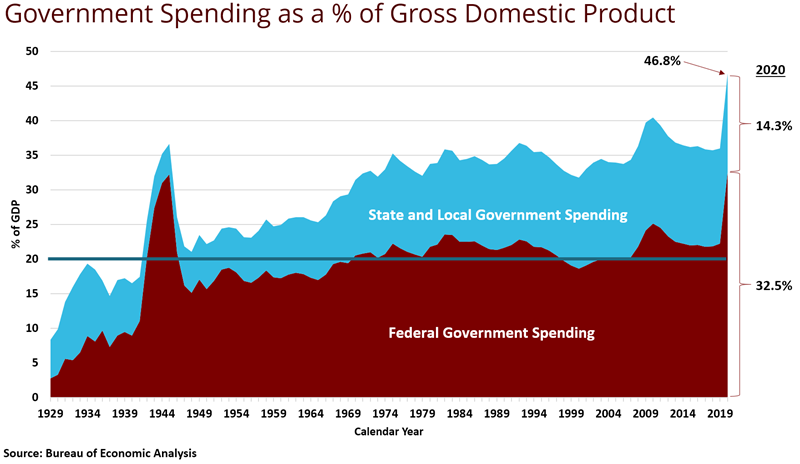

Slashing government spending will be tricky. In 2020 state and federal government spending peaked at 46% of U.S. GDP.

Source: Texas A&M

The ratio has dropped a bit in this post-COVID period. But it’s still around 37%. That’s up from less than 10% in 1929.

Government spending accounting for more than a third of the entire economy is beyond absurd.

This beast is out of control, and taming it will be a herculean challenge. Government now accounts for so much of our economy that slashing it could crash markets and cause a major depression.

Yet, it would dramatically improve efficiency and put us on a more sustainable path. Cleaning house would force the economy to re-cast itself in a free-market fashion. It’d be a great move in the long run.

But such a move will require a readjustment period which may not be all that pleasant.

So will Mr. Trump continue his “clean house” campaign if it causes the stock market to crash? Will the GOP stand firm as the nation “takes our medicine”?

I don’t know. I hope so. It has to happen eventually or we end up like Weimar Germany. And it almost certainly has to happen now, or we will pass the event horizon of the debt black hole. We may have already, but addressing the problem is critical either way.

Ending the War in Ukraine

I do believe President Trump will bring about an end to the Ukraine war. But it may not be as easy as we would like to believe.

Russia is in a strong negotiating position. They are winning on the battlefield and their economy is doing surprisingly well under the harshest sanctions since Napoleon’s Continental System.

Would Putin agree to freeze the war along current lines? Or does he want more? Does he want Odessa, Sumy and the rest of the Donbas, specifically? We shall see.

Donald J. Trump is an excellent negotiator, but so are Vladimir Putin and his foreign minister Sergey Lavrov.

Hopefully, I am wrong here and the war ends quickly. There’s certainly been enough bloodshed on both sides. But there’s a chance it stretches on for months or longer.

To lighten the mood after darkening it by talking foreign policy, I’m going to close with one of the funnier posts I saw on election night.

Source: X.com

Next week, I’ll return to writing about investing. There is much to discuss when it comes to gold and silver in particular. It looks like we might get the pullback many of us have been waiting for.

Comments: