Trump About to Declare Currency War!

[Ed. Note: Jim Rickards latest New York Times best seller, The Road to Ruin: The Global Elites’ Secret Plan for the Next Financial Crisis (claim your free copy here) transcends politics and media to prepare you for the next crisis in the ice-nine lockdown.]

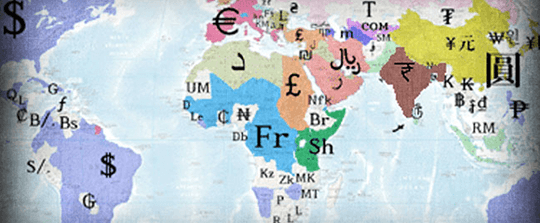

Six years ago in my first book, Currency Wars, I wrote, “There is nothing today that suggests the currency wars will end anytime soon.” Today, those words seem as true as ever.

A currency war is a battle, but it’s primarily economic. It’s about economic policy. The basic idea is that countries want to cheapen their currency. Now, they say they want to cheapen their currency to promote exports. Maybe it makes a Boeing more competitive internationally with Airbus.

But the real reason, the one that’s less talked about, is that countries actually want to import inflation. Take the United States for example. We have a trade deficit, not a surplus. If the dollar’s cheaper it may make our exports slightly more attractive.

It’s going to increase the price of the goods we buy — whether it’s manufactured good, textiles, electronics, etc. — and that inflation then feeds into the supply chain in the U.S. So, currency wars are actually a way of creating monetary ease and importing inflation.

How many times have you heard the Fed say they want 2% inflation? They analyze it over and over and over. They’re desperate to get there.

The problem is, once one country tries to cheapen their currency, another country cheapens its currency, and so on causing a race to the bottom.

Currency wars are like real wars in more ways than one. They can last longer than the combatants expect, and produce unexpected victories and losses. Real wars do not involve all fighting, all the time. There are quiet periods, punctuated by major battles, followed by new quiet periods as the armies rest and regroup.

There are critical turning points where a long-term directional trend is set to reverse. Today’s “winners” (the strong currencies) suddenly become “losers” (the weak currencies), contrary to most expectations and Wall Street forecasts. Today we could be at one of those turning points, which we’ll explore in a moment. But first, let’s see how we got here.

The currency wars of the early 1930s are potentially instructive for what we could be experiencing today. The U.K. devalued the pound sterling in 1931. Soon after, the U.S. devalued the dollar in 1933. Then France, which devalued the franc in the ‘20s, and the U.K. devalued again in 1936.

You had a period of successive currency devaluations and so-called “beggar-thy-neighbor” policies.

The result was, of course, one of the worst depressions in world history. There was skyrocketing unemployment and crushed industrial production that created a long period of very weak to negative growth. This currency war was not resolved until World War II and then, finally, at the Bretton Woods conference. That’s when the world was put on a new monetary standard.

The next currency war raged from 1967 to 1987. The seminal event in the middle of this war was Nixon’s taking the U.S., and ultimately the world, off the gold standard on August 15, 1971.

He did this to create jobs and promote exports to help the U.S. economy. What actually happened instead?

We had three recessions back to back, in 1974, 1979 and 1980.

Our stock market crashed in 1974. Unemployment skyrocketed, inflation flew out of control between 1977 and 1981 (U.S. inflation in that five-year period was 50%) and the value of the dollar was cut in half.

The real lesson of currency wars is that they don’t produce the results you expect which are increased exports and jobs and some growth. What they generally produce is extreme deflation, extreme inflation, recession, depression or economic catastrophe.

But they’re very, very appealing to politicians because they can stand up say, “Hey, it’s good to have a cheap dollar because we promote jobs.” But the reality is, it doesn’t promote jobs. It just promotes inflation.

You’re actually better off with a strong currency because that attracts capital from overseas. People want to invest in the strong currency area, and it’s that investment and those capital inflows that actually creates the jobs. So as usual, the politicians and the central bankers have it completely wrong. But they’re not listening to me or necessarily reading my newsletters.

The period between 1985 and 2010 was the age of what we call “King dollar” or the “strong dollar” policy. It was a period of very good growth, very good price stability and good economic performance around the world.

The United States agreed to maintain the purchasing power of the dollar and our trading partners could link to the dollar or plan their economies around some peg to the dollar. That gave us a generally stable system. It worked up until 2010 when the U.S. tore up the deal and basically declared another currency war to boost U.S. exports. President Obama did this in his State of the Union address in January 2010.

The currency wars have been ongoing ever since, with varying intensity. But with the election of Donald Trump, they look set to enter a new major battle.

Today, the currency wars have brought the U.S. to the cusp of a trade war. President Trump and several of his top advisers in recent days have complained that not only is China a currency manipulator, but so are Japan and Germany. It seems the U.S. is tired of the new “king dollar” phase it’s been in lately, and is willing to take action to cheapen the dollar.

But how can the administration actually do this?

The Fed will not lower rates because it is in a tightening cycle. The Fed will probably be raising rates in March and possibly later this year. That makes the dollar stronger.

China is trying to prop up the yuan but is running out of dollar reserves to do so and will have to devalue before they go broke. Germany might like a stronger euro to fight inflation, but the decision is not entirely in their hands — it’s up to the European Central Bank, and the ECB is still engaged in QE for the time being.

Japan cannot afford a stronger yen, because they have the highest debt-to-GDP ratio of any major economy and are desperate to get inflation. Japan needs inflation to lower the real value of that debt.

If China, Germany and Japan cannot give Trump what he wants in the foreign exchange markets, what options does the U.S. have?

The main option is tariffs, exactly what Richard Nixon did on Aug. 15, 1971.

You may remember that date as the day Nixon ended the convertibility of dollars for gold. But he also imposed a 10% across-the-board tariff on all imported goods as part of his New Economic Plan. Nixon combined the currency wars and trade wars in one policy by hoarding gold and imposing tariffs.

Historically, currency wars do lead to trade wars and, ultimately, to some form of systemic collapse. That seems to be happening again. I’ll be analyzing each side of this coin in the coming weeks.

Regards,

Jim Rickards

for The Daily Reckoning

Comments: