The Worst Month for Stocks

Here in Annapolis summer’s fever has broken.

Deep azure vaults high overhead… and refrigerating wafts steal in from the Chesapeake Bay.

All is peace.

Many analysts consider September a month of market peace. Look to October, they say.

October is when the gales blow in.

The Panic of 1907, the Crash of 1929, “Black Monday” 1987 — all came barreling through in October.

October’s reputation is so villainous… so felonious… it has even earned a title:

The “October effect.”

Yet is it true? Has October truly earned its blackened reputation?

Today we haul the accused into the dock, interrogate its record… and pronounce verdict.

Wrongfully Convicted

October’s bankrupt reputation likely owes to a sour string of luck.

And its conviction was based heavily upon hearsay and circumstantial evidence.

October has received a very poor legal representation.

Affirms Stephen Williamson, former vice president of the Federal Reserve’s St. Louis district court:

Stock market crashes have occurred sufficiently infrequently in history that there is not enough evidence on when they are more likely to occur.

The gentlemen and ladies of Yardeni Research further vindicate October of crimes against stocks.

The average S&P October return is not negative in the least, they inform us.

It is, in fact, a positive 0.4%. It is a slender gain — yet it is a gain.

Meantime, Investopedia informs us that more bear markets ended in October than began in October.

Swoons in 1987, 1990, 2001 and 2002 swung around in the year’s 10th month.

The facts are the facts.

Justice, Finally

Thus the presiding judge unseals the jury’s verdict…

“Not guilty,” it reads. And so he dismisses all criminal charges against the month of October — with prejudice.

In conclusion: An innocent man has been pitched into infamy and packed off to prison on wrongful charges.

Let us then — in the highest spirit of justice — clear his blackened name.

Does another month take its place in the gallery of evil? Is there a month truly deserving of October’s label?

The record argues that yes, another month is a menace greater than October. Which month?

That month is September — the month presently underweigh.

The Market’s Worst Month

Market Watch:

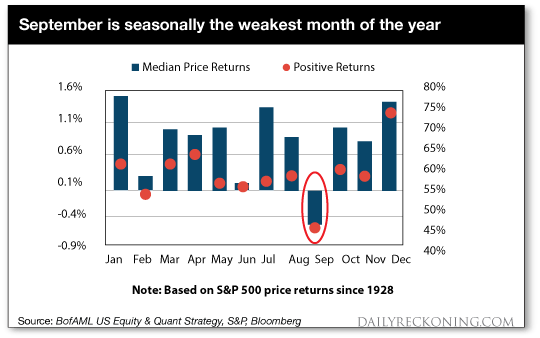

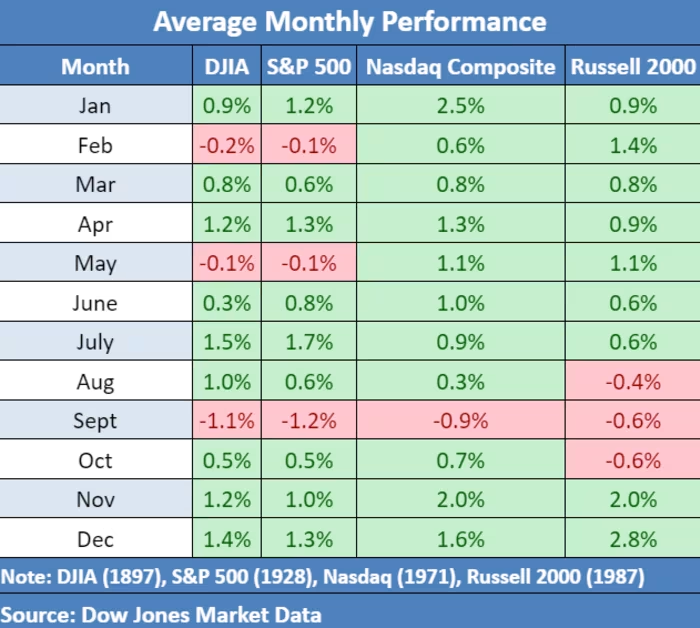

History suggests September is the worst month of the year in terms of stock-market performance. The S&P 500 has generated an average monthly decline of 1.2% and finished higher only 44.3% of the time dating back to 1928, according to Dow Jones Market Data.

The historical performance of the Dow Jones Industrial Average and the Nasdaq Composite also indicates stocks could experience a lackluster period in September, with the two indexes delivering an average monthly drop of 1.1% and 0.9%, respectively.

The Dow has recorded positive returns in September only 41.7% of the time since 1897, while the Nasdaq has finished higher 54.1% of the time since 1971, according to Dow Jones Market Data.

“Since the Dow Jones Industrial Average was created in the late 1890s,” adds financial columnist Mark Hulbert notes, “September has produced an average loss of 1.1%.”

“The 11 other months of the calendar,” adds Hulbert, “have produced an average gain of 0.8%.”

Nor do one or two roguish and renegade Septembers explain it, says Hulbert:

“On the contrary, the month has an impressively consistent record at or near the bottom of the rankings.”

Meantime, Fisher Investments claims September is the lone month to average a negative return since 1925.

The “September Effect”

The facts confirm it. September is the great thief of investor money, not October.

Next to September, we must conclude, October is nearly a month of nectar, a month of honey.

And so today we correct a cruel and libelous wrong.

It is time to replace the “October effect” with the infinitely more deserving “September effect.”

Thus we gird for heavy weather.

Here CFRA chief investment strategist Sam Stovall posts an advisory:

As a result of September’s track record for benchmark beatings, we remind investors to prepare for the possibility of disappointing results for both the S&P 500 and Nasdaq in the month ahead.

Here is the evidence — the red-handed evidence — exculpatory of October and inculpatory of September:

And:

Why September?

What explains September’s slumps? Investopedia:

Several theories exist to explain this historical pattern. One posits that traders, returning to work from summer vacations, rebalance portfolios in September, increasing selling volume and putting pressure on stock prices.

Another theory suggests that bond offerings pick up in September as summer vacations wind down; those bond sales attract money that would otherwise have supported stock prices. Still another blames mutual funds, whose fiscal years typically end on Oct. 31. Funds, the theory suggests, close out losing positions in the last months of their fiscal year for tax purposes.

Just so. Yet we must file a caveat — the Federal Reserve is expected to lower its target rate this month.

Thus Wall Street’s cherished “pivot” is upon us. Perhaps it will fill September’s sails with fresh wind.

This is also an election year. And as Investopedia explains:

Historically, presidential elections have not made September worse for stocks. Stocks have advanced in nearly a third (62.5%) of Septembers heading into a presidential election (15 of the 24 elections since 1925). That’s substantially better than its overall average and only one percentage point below the all-month average. September’s median return in presidential election years is 0.3%.

Thus the current and the cross-current may negate each other.

Mark Twain’s Trading Advice

Do we hazard a prediction of September doom?

No we do not. We have posted too many false advisories in times past.

That is, we have been forced to munch crow many times in the past — without salt, without butter, without lubricating beverages to help it down.

We harbor little appetite for another dose.

Yet if history is a reliable barometer… which we believe it is… September is perhaps the most dangerous month to speculate in stocks.

Along with, as the great scalawag Mark Twain noted…

July, January, April, November, May, March, October, June, December, August — and February.

Comments: