The “Wall of Worry” Climb Is Over

Stocks aren’t climbing a wall of worry.

Instead, they’re standing atop the wall, arms swinging overhead in triumph, while exuberant pikers chisel away souvenir bricks with their tiny hammers.

Sounds like fun, but someone’s bound to get hurt.

The Nasdaq 100 (QQQ) hit a new all-time high today, and the S&P 500 (SPY) is within 1% of doing the same.

Meanwhile, bombs are dropping. Tariff deadlines are approaching. And of course, there’s the Big Beautiful Bill.

Don’t get me wrong, I like new all-time highs just as much as the next trader (perhaps more). But this rally doesn’t smell right.

For starters, the April selloff wasn’t that long ago. The S&P 500 just entered one of its most challenging periods of the year.

Plus, the debt ceiling and reciprocal tariffs come to a head next month, punctuated by an FOMC meeting on July 30.

That sounds like a terrible recipe for new highs. Let me explain…

A Breakneck Pace

I expect the Nasdaq 100 and S&P 500 to experience selling pressure in the coming weeks.

Plenty of price memory exists at the February highs. Investors who ticked the top earlier in the year will gladly jump at the opportunity to break even following the spring selloff.

I applied the same reasoning last month when several speculative runners were hitting their all-time highs.

As of today, two of the three tickers I mentioned on May 20 are trading lower (ONON -11%, HIMS -29%), while wild stallion Palantir PLTR is up roughly 14%.

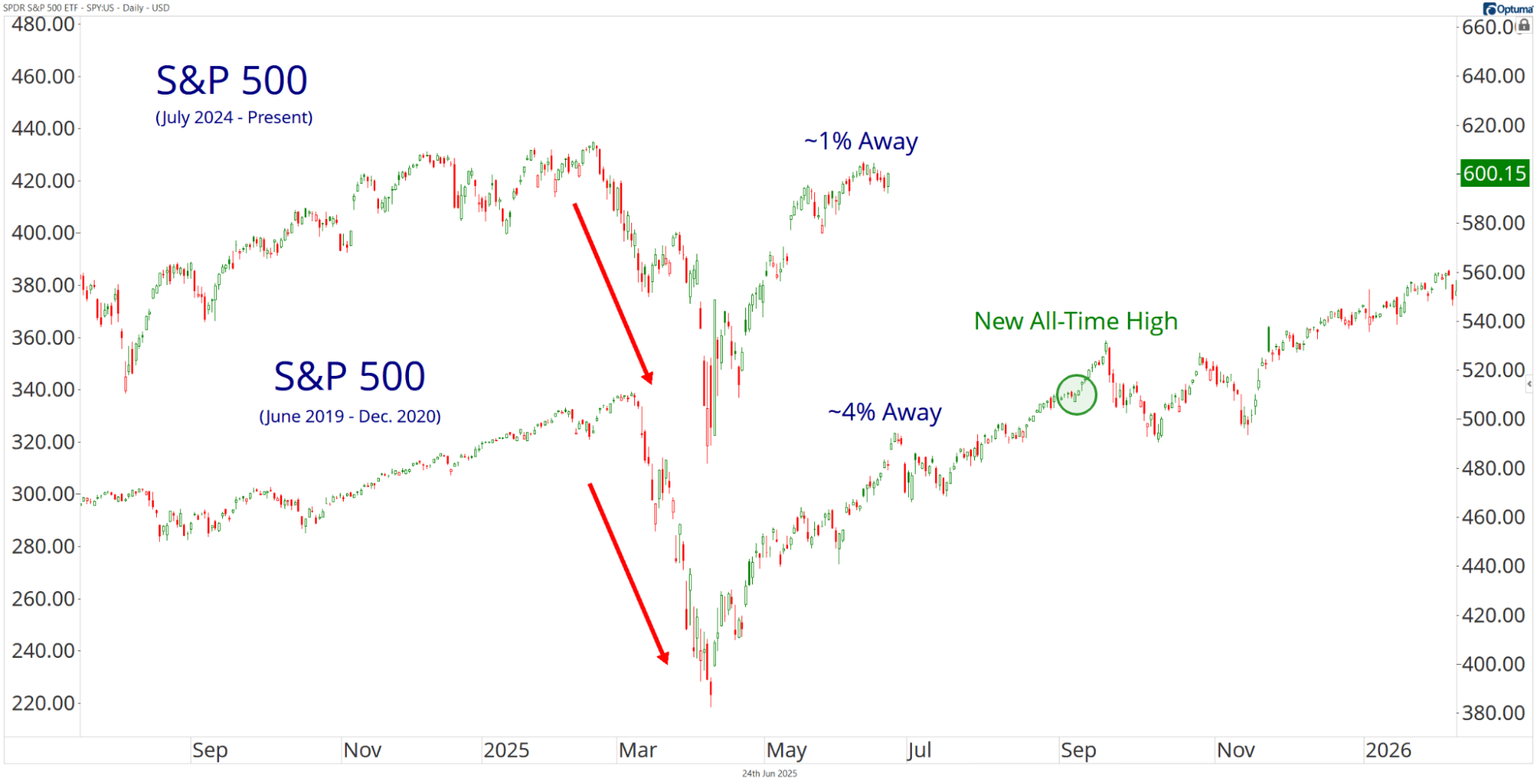

PLTR may be trading on another plane, but the broader market is undoubtedly due for a correction. Check out SPY’s 2020 V-bottom overlaid with this year’s recovery:

It took the SPY 152 calendar days to print a new all-time high.

Rewind a couple of years to the Trump Tariff 1.0 selloff in 2018, and the U.S. benchmark went 124 calendar days before notching a new record close.

Today, SPY finished within 1% of its highest daily close in history, and it’s only been 77 days since the April lows!

The COVID pandemic recovery traded approximately 4% from the prior highs at a similar point before quickly turning lower.

To be clear, I’m not sounding the bear market alarm. I like buying high and selling higher.

However, the pace of the rally concerns me. Stocks are ripping at an unsustainable breakneck speed, and downside risks will only grow until the bulls take a break.

Historic Weakness

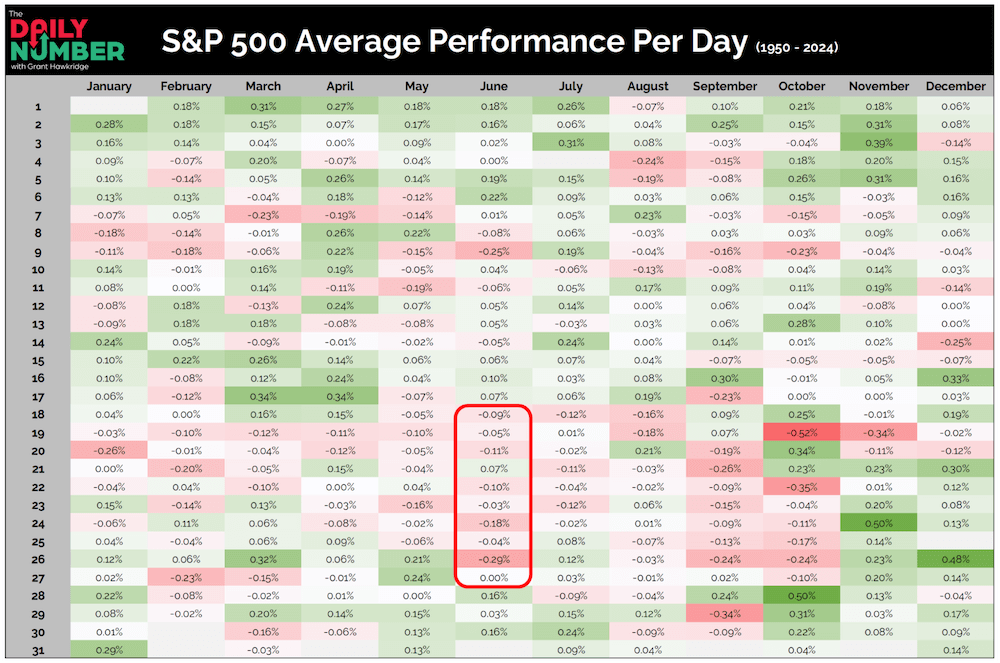

Earlier this week, one of my favorite analysts, Grant Hawkridge, highlighted the S&P 500’s bearish seasonality in The Daily Number. (I highly recommend checking it out.)

June 18-27 has belonged to the bears for the past 77 years. This year, the historic selling pressure runs from last Thursday through this Friday.

Here’s the table he provided with June 18-27 outlined in red:

Last Thursday and Friday, SPY closed lower by -0.20% and -0.50% respectively. However, yesterday it swung higher by almost 1%, and today the S&P 500 soared even more.

The bearish seasonal signal is turning out to be a real dud. But we still have a few more days left on the calendar.

In fact, the S&P 500’s fifth-worst trading day of the year since 1950 falls on June 26 – this Thursday. Perhaps sellers will finally show up in full force.

Either way, risks run high as U.S. fiscal policies potentially take effect…

A Big Beautiful Dilemma

A key piece of legislation dubbed the Big Beautiful Bill is slotted to hit Trump’s desk next week.

The bill proposes the largest tax cut in history, broad spending cuts, and a highly contested increase to the U.S. debt ceiling.

Before the president can sign the bill into law, the legislation must pass the Senate and go back through the House.

It’s been a few years since my eighth-grade Civics class, but it seems like a lot of negotiations need to occur between now and the proposed July 4 deadline.

Sounds like more uncertainty to me, followed by Liberation Day tariffs taking effect July 9. (Double Whammy!)

If that’s not enough, the FOMC will release its decision regarding the overnight interest rate at the end of the month (Wednesday, July 30).

Fed Chairman Jerome Powell reiterated this afternoon that the committee is in no hurry to cut rates. As of today’s close, fed fund futures are pricing in an 18% chance of a 25 bps cut next month vs. an 81% probability they leave the overnight rate untouched.

I imagine it will be another nothing burger of an announcement, focusing on Powell’s press conference and forward guidance.

Of course, a lot could change in a month.

I don’t know what will happen on Capitol Hill in the coming weeks. The same goes for the Middle East and the NYSE floor.

Instead of guessing what comes next, let’s focus on the facts…

The stock market averages have recovered at an accelerated pace, while stiff seasonal headwinds pick up and economic uncertainties linger. That spells downside risk.

I’m not flipping the book short or calling the next bear market. Bullish bets continue to work.

However, you don’t want to be left holding a large position as the market turns south.

Comments: