Striking Gold in Toronto

They booed the U.S. national anthem the other night at the Rogers Center in Toronto. Canadians are mad about those Trump tariffs that kick into gear today, March 4th.

And despite being in Ontario – aka “Massachusetts West” in terms of politics – this was a throng of WWE fans. That is, the arena was filled with people whose tastes run towards professional wrestling. Not exactly a bunch of lefties, eh?

The Saturday night crowd roared when the singer belted out Oh Canada. But when she crooned The Star-Spangled Banner? Well, not so much which is putting it nicely. In fact, the background was a cacophony of jeers. And as the chanteuse arrived at the part about “the rockets’ red glare,” the hostility within the crowd also reached a crescendo. Oh man, they are well and truly pissed off up North.

Memo to Trump: when you lose Canadian WWE fans, you are losing your base, the people you’ll need when this place becomes the 51st state. Which (kind of) brings me to the topic for today, which is making money in mining, especially in gold and gold mines. Read on, my friends…

Why I Love the First Week of March

I love the first week of March, for two reasons:

Number one is that, to me at least, this part of the calendar signals that the bulk of winter is behind us. Okay, we might still get a cold blast or two of Arctic wind or Lake Effect snow. But it’ll pass. Seasonally, the Northern Hemisphere is warming, which leads to reason number two…

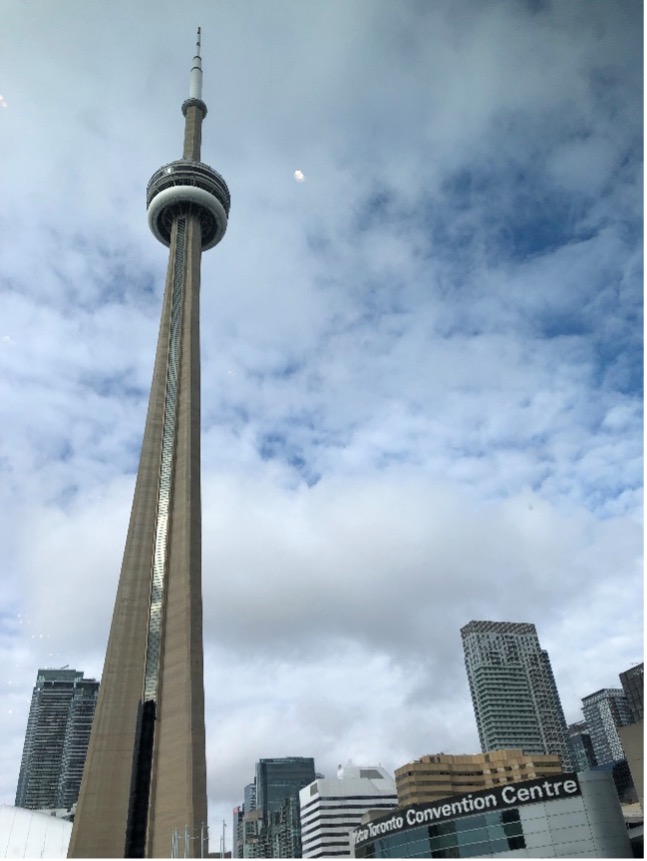

Second, I like early March because every year I attend the world’s largest mining conference, here in Toronto, in the vast convention complex adjacent to the above-mentioned Rogers Center and in the shadow of the awe-inspiring CN Tower.

Toronto Convention Center; where, beneath the CN Tower. BWK photo.

This gathering of miners is the modern version of a century-old tradition. That is, in early March many of the people who search for minerals and build mines get together in Toronto.

It’s just before the spring thaw, which means that only the few and hardiest are out in the still-frozen fields and bogs. Everyone compares notes. Who has exploration progress? Who else is doing what? Who has intriguing mineral claims? Who is buying? Who has the best story to sell? All this, and more.

It’s the annual gathering of the Prospectors & Developers Association of Canada (PDAC), and it’s not just a bunch of Canadians in from the wilds anymore. Now, PDAC has global reach, with over 35,000 attendees from pretty much everywhere.

While I’m here, I walk, talk and listen. I catch up on a couple of dozen companies that I follow and find new ones to watch. And I figure out how to make money for the rest of the year and far into the future.

Mining People are Optimistic

“The biggest problem you guys have,” said a senior rep from a major global bank to a roomful of mining company executives, “is that you have too damn much money.”

I heard it with my own ears. In a jocular sort of way, the banker was reminding the miners to enjoy the good times. Prices are up for what the diggers pry from the ground and process in their mills: gold, silver, copper and an array of other metals and materials.

Recently over $2,900 per ounce, gold speaks for itself. Silver is strong as well. Copper is over $4.00 per pound, although Mark Bristoe, CEO of Barrick Gold would like to see $5.00 soon and likely will. Name the metal, and it’s a very long list, and there’s not enough to go around. More people are demanding metal than supplying, which is a recipe for higher prices.

Here are a couple of points on that last item. First, the world is growing, and people want things that require high purity metals. Central banks want gold, which has driven the price. Electronics and other industries require silver and copper, driving prices there. Other industries need metals that range from antimony to zinc, and much in between, which leads to another point.

We’re at a global inflection where under-investment in exploration, development and new mines and processing has caught up with us all. There’s a generation of industrial neglect behind us.

Whether it’s rebuilding the grid, or constructing new power plants, erecting new housing across the developing world, building data centers, churning out electric vehicles, creating armies of robots for factories and more… the demand is there, and supply is short.

It brings us back to that banker and his comment about the miners and their money. Shareholders want dividends and buybacks. While mining execs want to plow new cash flows into long-neglected exploration programs, and rebuild the mine, mill and refining complexes.

Right now, being a miner with money is a nice problem to have. Bankers like you. Share prices are rising, although much of the broad market still has not caught on to what’s really going on. And managers have flexibility on how to spend to maintain and grow the business.

What Should You Buy?

Readers have asked what to buy in the mining space. And there’s plenty out there; many ideas. Just note the caveat that we’re not offering personal financial advice, and we save most of the ideas for paid newsletters. That said, here are some general recommendations.

First, own physical gold and silver. We’ve discussed it over and over. Despite what you learned in college economics, gold is money! No, you won’t buy groceries with gold coins (because you can buy entire sections of the grocery store with a single ounce). But you’ll preserve wealth over generations. This applies to silver, too, aka “poor man’s gold.”

As mentioned above, one key reason that gold prices are up is that central banks are rolling their excess dollars into yellow metal. They have been buying gold, yes; but not buying mining shares, so the mining plays remain undervalued. And that’s in the process of changing.

If you’re new to the space, there’s nothing wrong with a professionally managed gold fund, meaning a basket of names that someone else manages. Save yourself some headaches. Let someone else pick stocks.

One of the biggest funds is the VanEck Gold Miners Fund (GDX), at $13 billion market cap. And there’s a junior miner version as well, GDXJ, just under $5 billion under management. So you have size, diversity of portfolio, and strong liquidity in and out.

Another pair of funds in the same space is run by the Sprott group of Toronto, again with superb professional management because Sprott is deeply wired into the overall mining space. Those names are Sprott Gold Miners ETF (SGDM), with about $275 million under management. And the junior miner version, SGDJ, which runs about $125 million in net assets.

In an environment of rising gold-silver prices, profits are flowing and again, much of the market has not yet caught on. Looking ahead, I expect a general lift to the overall sector, benefitting the funds such as those above.

When it comes to specific names, I’ll stay big and general. Look at Newmont (NEM), $47 billion; Barrick Gold (GOLD), $30 billion market cap; and Kinross (KGC), $13 billion market cap.

Again, these are well-known plays that receive intensive coverage in the business and trade press. I have a long list (make that a very long list) of other gold-silver companies in the intermediate and junior space, but again, those are for other newsletters. Stay tuned for more details on that.

Meanwhile, don’t neglect other mining plays in other metals, certainly copper. Plus, I must add that many of the biggest copper plays are also gold and silver producers; Freeport McMoRan (FCX) comes to mind.

Obviously, for reasons of space here, I can’t go into detail about any of the above-named ideas. But in general, the takeaway from PDAC is that the mines and mineral sector is moving. Cash is flowing, profit margins are growing. There’s a sense of great optimism. The tide is rising, so consider boarding this boat.

Meanwhile, Trump’s tariffs will create dislocations. Yes, tariffs will create uncertainties. But at the end of the day, people and nations across the globe need metal to run their economies. We’re in the early days of a strong market for well-run companies. And there’s money to be made.

That’s all for now. Thank you for subscribing and reading.

Comments: