Oil Stocks are Running on Fumes

Oil prices are falling, but oil stocks are not. That’s a great setup for short sellers and a terrible one for buyers.

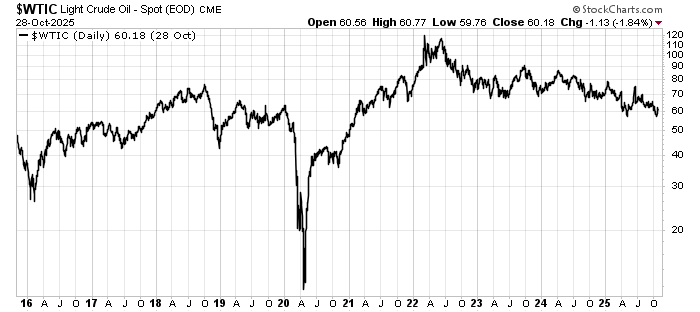

According to data broker Statista, the breakeven price for most U.S. oil producers is between $61 and $70 per barrel. The current oil price is below that today. That means we are in the pain zone for oil producers.

The last time we saw oil prices this low was 2021:

Longtime natural resource investors know to buy when commodity prices fall. That’s when you can usually find bargains among the producers. But it requires patience. Commodity prices always lead the producers.

We saw that clearly in the mining sector over the past year. Gold prices soared, but it took a beat before investors moved into the miners. The setup in oil is the opposite.

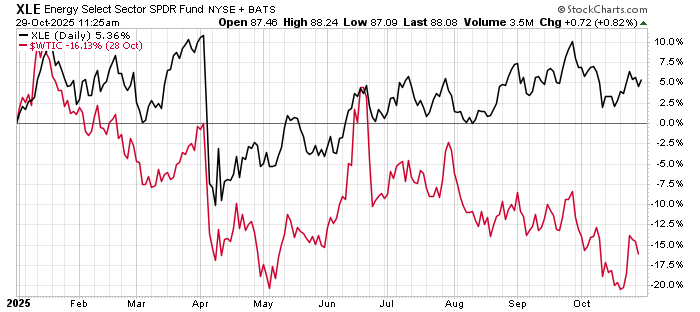

Oil prices are now at four-year lows, but the stock prices aren’t down…yet. The Energy Select Sector SPDR Fund is still within 9% of its 52-week high.

That’s not cheap:

The XLE fund holds a basket of the major oil companies. About 48% of the fund is in three major oil companies: Exxon Mobil, Chevron, and ConocoPhillips. It also owns refiners like Valero, pipelines like Kinder Morgan, and service companies like Schlumberger.

It is an excellent representation of the whole oil industry, which is why we use it as a bellwether for these stocks. When the market hates oil, the XLE collapses. When it loves oil, XLE soars.

In 2021, the oil price rose from $47 per barrel to peak around $82 per barrel. The XLE started the year at around $32 per share and peaked at $51 per share. The current price of XLE is 73% higher than the fund’s peak in 2021. And that was with oil prices at $82 per barrel…

That’s what we mean by stocks lagging commodity prices. In the chart above, the red line is oil prices. Throughout most of the year, oil prices performed better than XLE. Remember, these are stocks that profit from oil prices. They should outperform the commodity. And eventually, they do.

We will see the same thing going down. The commodity price fell 16% so far in 2025, but the stocks are up 5%:

But that doesn’t mean these stocks won’t go down. Oil is a cyclical market. The best opportunities come when there is blood in the spreadsheets. Blood as in declining profits. And we see that starting.

For example, ExxonMobil’s 2024 revenue was $339 billion. Its trailing 12-month revenue today is $329 billion. That’s down $10 billion or 3%. It’s not earth shaking yet. But it is like a rock hitting the windshield. That chip is going to spread. That’s what we expect to see in the oil stocks over the next couple of quarters.

These stocks are holding up because the market doesn’t believe oil prices will remain low. But they endured underwhelming returns over the past two years. The XLE rose just 2% in the past year and 9% in the past two years.

That means money invested in the Dow Industrial average outperformed XLE by double digits (it’s up 13% in the past year and 46% in two years). That means the biggest stodgiest stocks in the market lapped XLE investors. That must sting a bit.

Investors should be heading out. The catalyst will be fourth quarter earnings. When these companies must report earnings that miss expectations, we will see investors move money to other sectors. And if oil prices remain low through the start of 2026, the rout will be on.

That adds up to more downside risk than upside potential right now. If you like to short stocks, the oil producers look ripe for the picking.

We won’t start looking at oil stocks until the XLE breaks through $70 per share. It needs a major correction before we go long.

Comments: