Don’t Waste This Bull Market

I hope you had a good holiday weekend. U.S. markets were closed yesterday, but today it’s back to business, and below we’ll discuss how to make some money.

Meanwhile, on my end I spent the past few days doing geology out in the field, in southern Nevada and the Death Valley region of California. I’ll share some insights with you in a moment.

Zabriskie Point Badlands, overlooking Death Valley.

But first, I want to highlight something that my old friend Rick Rule said recently, namely “Don’t waste this bull market.”

“This is generational,” Rick added, referring to long-trend, upward moves in gold, silver, copper and many other metals, materials and energy plays. “And if you do it right,” he said, “you are being handed superb opportunities to create generational wealth.”

So, today I’ll pick up on Rick’s views by highlighting specific sectors that are on the move, and even mention a few company names below. To set the stage, though, we’ll first look at some geology in Nevada and California, and also discuss an upcoming mining conference in Toronto.

Let’s Kick Some Rocks

Every now and again I travel to Las Vegas for a conference, or to meet people from a mining company and go on a site visit. The usual itinerary is to fly out, take a taxi to a hotel, connect with friends, have dinner, talk shop, go to bed, awaken the next morning and get to business.

This means that I either spend all day at some conference venue, or I pack into a truck and head out to an exploration project, if not a development or working mine. Usually, I’m focused and programmed. Either I’m a speaker or panelist, or I’m busy absorbing the details of somebody’s efforts in Nevada’s prolific geology, looking for gold, silver and other metal ores.

It’s all good and I’m not bellyaching. And hey, it’s work, right? But sometimes, I get to “not work,” sort of… That is, this past week I came out West on my own, to meet some old geology friends, head out in the field and just plain see stuff. And see stuff we did…

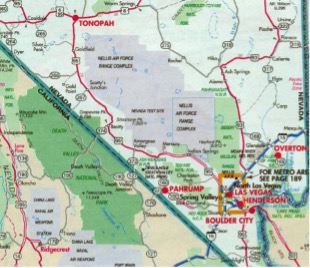

We spent one very solid day out in the rocks east and northeast of Las Vegas, north of Hoover Dam and Lake Meade. And two other solid days – pre-dawn to post-dusk – in the Death Valley region of California, and later down into the Mojave area.

Death Valley, California, and Las Vegas region of southern Nevada.

We looked at sediments, volcanic intrusions, mega-structures and much else. It wasn’t a dedicated trip to see any particular exploration or development project, like something out in the Carlin Trend or Walker Lane. It was more like a university-level geology field trip, although yes, we saw numerous old prospecting sites for gold, copper and much else.

Red-rock country, east of Las Vegas. BWK photo.

Overall, the southern California-Nevada region is a geological treasure house. Indeed, the only reason not to have much more mining there is because some of the best material is located within protected national or state parks, or behind the fences of military reservations, or due to California’s anti-mining politics.

Personally, it was fascinating to brush up on what I learned long ago, and catch up on new ideas in geology. And at the level of Paradigm Press, the effort helped me improve my skillset and get better at finding great ideas for readers.

At any rate, there I was, out in the sunshine, beneath a brilliant blue sky, looking at classic old Nevada rock formations like the Big Spring Limestone, the red Aztec Sandstone and the muddy, brown Chinle Formation.

Your editor walks on an ancient alluvial fan towards uplifted bedrock. BWK photo.

And in Death Valley, I walked the slopes along immense uplift features like faults and related alluvial fans formed in the waters of ancient freshwater lakes, now long-evaporated into borax salt flats.

Boron salt flats in Death Valley. BWK photo.

Along our routes, in some areas we looked at sedimentary features like bedding, grain-size distribution, cross-beds and ripple marks, and discussed what geologists call “paleo-environments,” which means the river basin or flood plain where the sediments were deposited long ago.

In other areas we examined the mineralogy and eruptive history of ancient volcanics like rhyolite and andesite. And we discussed how deep-earth plate tectonics controls so much of the surface structure. For instance, one part of Death Valley is 282 feet below sea level. Yet only 85 miles away is Mt. Whitney, at 14,505 feet elevation, the highest mountain in the Lower 48 states. And obviously, there’s something very geological going on there.

Hawk perched atop a rock. BWK photo.

Overall my past few days were more academic than industrial. But still, by discussing the fabric and structure of rocks at granular levels – how mineral crystals came together to consolidate into the rock we see today – we also hit on ideas of, for example, porosity and permeability that are critical for things like oil and gas migration, as well as mineralizing fluids for ore deposits.

Modern eroded sandstone reveals “hard spots” in the lithic structure. BWK photo.

And keep in mind that rocks we see at the surface were formerly buried until, over geologic time, deep earth forces uplifted them, and erosion wore away whatever was above. Thus, what we see today at the surface is a slice of time; and the idea is to use geology to extrapolate what might be below in other areas, but in similar rocks if not downward extensions of the surface rock formations.

Long-ago when I worked as a petroleum geologist for the old Gulf Oil Co. now part of Chevron (CVX), my then-colleagues and I used to analyze deeply buried sediments in an effort to decipher where were the likely spots for oil and gas accumulation, along with the permeability channels through which fluids would flow at down-hole pressures.

This same sort of analysis came in handy later, when I worked with companies searching for what are called “roll front” uranium deposits; namely, zones where, over time, uranium-bearing fluids flushed their way through porous, permeable rocks (usually sandstones) and left mineralized zones along the way as pressures and temperatures dropped, and uranium and its mineral compounds crystallized out.

Again, something similar happens when magma intrudes upwards from far below, bringing up high-pressure/high-temperature fluids rich in elements like copper, silver, gold and more. In some instances, the metals crystallize out within the magma as it cools, but in other cases the mineral fluids seep out into the pre-existing host rocks, where you’ll find zones of ore deposits.

What I’m saying is that, basically, no matter how long you’ve been kicking rocks as a geologist, there are always more rocks to kick, more examples of how things happen, and more to learn. And learn I did, out in the fields of Nevada and California. And I’m better off for it, and better able to find companies with the best deposits and assets.

Looking Ahead to PDAC

Okay, enough about field trips out West. Let’s look ahead two weeks to Toronto, Ontario back East, and to PDAC, short for the Prospectors & Developers Association of Canada.

This annual event is the grandaddy of all mining conferences, held every year for over a century in Toronto, almost always during the first week of March. And why in early March, you may wonder? Easy, because that timeframe marks the beginning of the end of winter in the Northern Hemisphere.

And yes, as noted, we’re going to make some money in the year to come, and I’ll tell you how in a moment. But I don’t want to neglect mentioning that I’ll be at PDAC with another colleague from Paradigm Press, Matt Badiali, also a geologist and now editing a newsletter called Real Wealth Insider.

Generally, my approach to PDAC is to visit companies I know and follow, as well as look out for new plays that are coming into scope.

Of course, I’ll check in with large gold miners like Barrick Mining (B) and Newmont Mining (NEM), along with Agnico Eagle (AEM). And I’ll stop by to hear the pitch from big names like Rio Tinto (RIO), BHP and Glencore (GLNCY).

But the prime focus on my end will be companies on the small end with solid growth ahead. For example, back in 2017 I met with a small copper-gold play called K92 Mining (KNTNF) and came away impressed. I recommended shares at $0.37; the company shares now trade at over $20, for something over a 50-bagger. I’d like to do that again, for sure!

Then there’s Western Copper and Gold (WRN), another Yukon-based company with a copper-gold porphyry exposed at surface, and in many ways a 100-year mine life although the company’s reports don’t officially say it in so many words. But Rio Tinto owns over 19% of WRN’s shares, and that ought to mean something.

Definitely, I’ll have a talk with the people from Alaska-based gold miner Contango Ore (CTGO), especially following news of its eventual merger with Dolly Varden Silver (DVS), active and strong in the Golden Triangle of Northwest British Columbia. This marries up CTGO, with its strong current cash flow, with DVS which requires more exploration and development but avoids shareholder dilution.

In other sectors and metals, I’m looking forward to catching up with old friends at uranium and rare earths producer Energy Fuels (UUUU). I’ve followed and recommended the company for several years, and it has delivered great returns to shareholders.

Also in the rare earth space, I’ll see Ucore (UURAF), which is finishing up its processing facility in Alexandria, Louisiana to provide magnet-and related high-spec materials to U.S. industry, especially defense providers.

And these are just some of the names from PDAC, but certainly ones I like. They’re not official recommendations and we track no portfolio here in the Morning Reckoning. But they’re good. So watch the charts, await down days, always use limit orders if you buy, and never chase momentum.

Historic Times Require… Geology!

Finally, let’s return to Rick Rule and his optimism about making money. We’re in a generational, resource bull market. I’ve been waiting many years for this, through thick and thin but mostly thin. And here we are, on the inside looking out, versus outside looking in. At root, we’re at an intersection of three historic events:

- Long-term, massive, heedless government overspending has wrecked the foundation of legacy currencies. Anymore, few governments can sustain long-term interest payments plus associated inflation. Thus, old-fashioned precious metals – gold and silver – are remonetizing.

- Meanwhile, new technology, both civil and military, is building out. Examples include new power grids and data centers, as well as breakneck, worldwide procurement of advanced military systems. One way or another, we have unprecedented levels of new demand for “real” assets, certainly metals and energy resources.

- And these two foregoing phenomena now confront two generations of underinvestment in basic industries like mining, energy production and refining. And the current setup is for a future of chronic material shortages in the face of rising demand, hence pricing power for companies that produce these things.

Bottom line: it’s time for resources. Hard assets such as mines, ores and minerals represent true value that will last, no matter what politicians do with the currency. Prudent investors will move funds to mining, because that’s where things are happening, now and even more so over time.

And that’s all for now. Thank you for subscribing and reading.

Comments: