[CHART ALERT]: 3 Predictions

School starts soon, so I’m hitting the road with the fam in a few days to spend our last precious hours of summer vacation at the beach.

In just a couple weeks, the dog days of summer will give way to homework, carpools, and soccer practice. We’ll also (hopefully) enjoy a reprieve from the oppressive heat and humidity that’s currently blanketing the East Coast.

But for now, we’re stuck in the summer doldrums.

Back in the day, all the major market players were nowhere to be found in August. Junior traders and interns manned the turrets on Wall Street while wealthy fund managers escaped to the Hamptons for the month. The adults would return after Labor Day weekend to clean up the mess… and the real trading would begin once again.

I’m not so sure this is the case anymore in the modern era of 24/7 trading. Sure, the market probably attracts fewer eyeballs in August. But it’s downright impossible to imagine any of the pros completely disconnecting from daily market updates. After all, the WiFi at the beach house is probably faster than at the office…

Plus, shifting trends still matter — even during what’s usually a low-volume, low-volatility month.

August has been busy this year – mainly because of the abrupt market rotation we’re witnessing right now. We’ve talked at length about some of these rotation themes into energy names for the past couple months. We also explored some energy over tech ideas in last week’s issue as the Energy Sector ETF (XLE) posted a major breakout.

It’s funny how investors will get stuck on a particular market theme — even when it begins to roll over. The herd mostly ignored the quiet rallies in the energy sector in favor of explosive tech gains this summer.

I get it — these were the monster trades of the first six months of the year. Many of the big, recognizable names were stair-stepping higher every single week. If you wanted to make money, you’d bet on the tech leaders and snapback growth names.

The market is clearly changing. The tech sector is taking its lumps, while energy stocks are breaking out the upside. But some folks will continue to pound their heads against the wall, betting on tech as it steadily sinks lower.

Tech and energy aren’t the only major trends evolving in August. In fact, we’re already beginning to see several substantial shifts from the historic first-half rally.

So, what does the second half of 2023 have in store for us as Labor Day and fall trading approach?

Today, I’m going to show you three confusing, perplexing, and downright maddening charts that could be shaping up for big moves in the fall. Then, I’ll offer up a quick prediction on which way they might break.

Let’s get started…

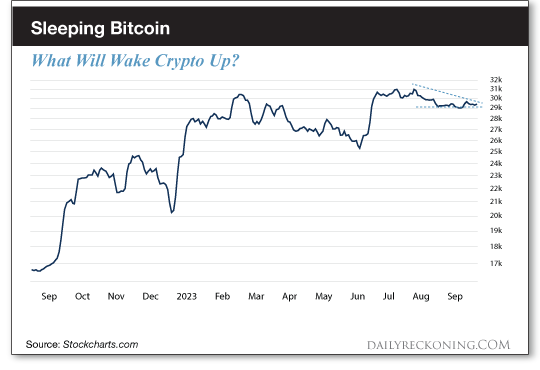

Can Bitcoin Bounce Back?

Bitcoin is dead.

No, it hasn’t crashed. But price fluctuations have completely dried up in what used to be an extremely volatile asset.

Crypto has a history of late-night, holiday and weekend moves. But this is the calmest I’ve seen the price of Bitcoin in a very long time. It’s not budging at all, did absolutely nothing over the weekend, and continues to flat line in the mid $29K range.

Bitcoin has remained in a consolidation range since its June rally. During that one magical week in June, Bitcoin rallied more than 20% to break above $30K. Since then, it has essentially gone nowhere aside from a couple of fake-out moves.

Perhaps more importantly, Bitcoin and the tech-growth trade do not seem to be on speaking terms anymore. These assets have traded hand-in-hand for the past couple years. But Bitcoin failed to extend its rally along with tech heading into August. And it didn’t post a sharp pullback along with tech to kick off August, either.

Prediction: Bitcoin gets its act together and posts another surge higher at some point during the third or fourth quarter, possibly after an ugly move lower. I don’t love this guess, but I have to give Bitcoin the benefit of the doubt because it remains locked in a longer-term uptrend.

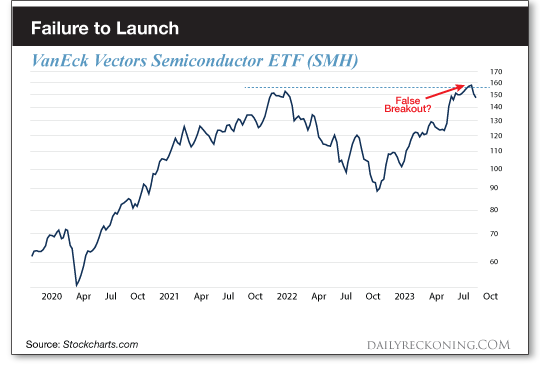

Will These Tech Stocks Lead the Market Lower?

Semiconductors have proven themselves as important market leadership once again this year. Powered by NVDA and other hot names in the group, the VanEck Vectors Semiconductor ETF (SMH) has rallied as much as 60% since January.

But August has not been as kind to the chips.

Semis took a major hit to start the month — and the timing couldn’t be worse. After breaking above their 2021 highs, SMH has abruptly fallen back into its range, potentially flashing an ugly false breakout.

Prediction: Failed moves like this can cause some serious pain as late buyers are scared out of their positions. Taking market rotation themes into consideration, I’m guessing it will take several weeks and more downside action before we see semis firm up and make another attempt at holding above 155.

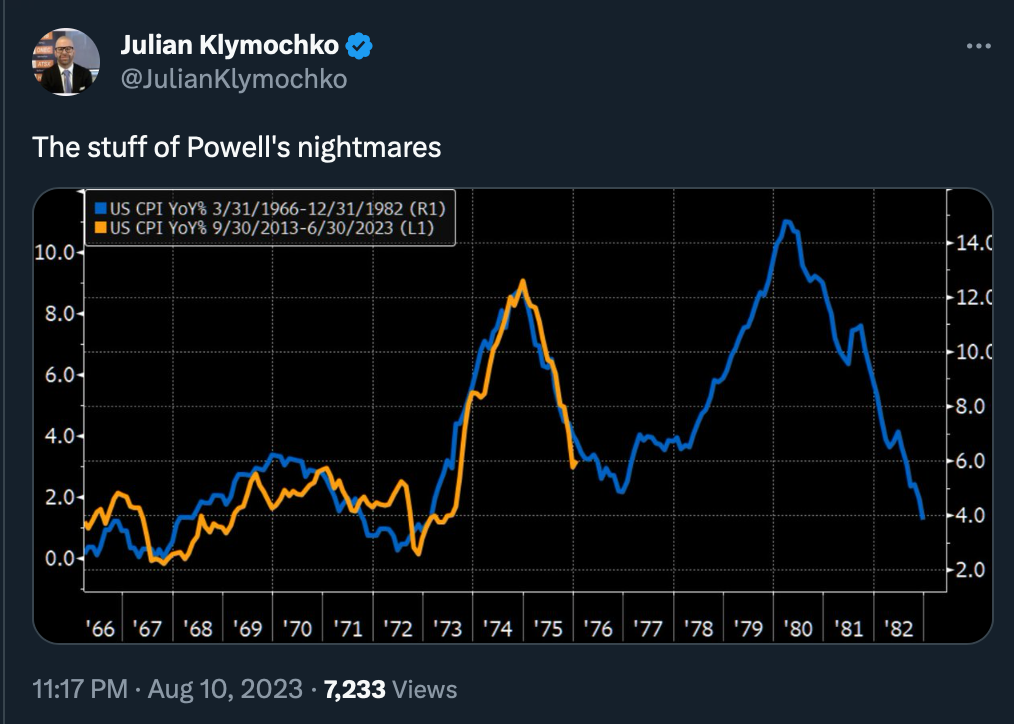

Is Inflation Really Over?

It’s been a hot minute since investors have freaked out over inflation.

Market reactions to CPI and PPI have been relatively tame this summer, signaling that most folks believe the scariest days are behind us. The Fed’s been aggressive, headline numbers are down… why worry?

Well, here’s a fun chart that’s been making the rounds on social media…

Was that just the first wave? Are we headed toward a 70’s style inflation rebound? As Klymochoko mentioned, this would be a nightmare scenario for the Fed — and the stock market.

Prediction: We shouldn’t put too much emphasis on these historical analog charts. But I do think it’s interesting that everyone assumes the inflation monster is dead and buried while we’re seeing commodity prices beginning to wake up (ahem, oil anyone?)

What do you think of these predictions? Am I on target — or just talking trash? Let me know…

![[CHART ALERT]: 3 Predictions](https://dweaay7e22a7h.cloudfront.net/wp-content_3/uploads/2023/08/shutterstock_2045692793-650x360.jpg)

Comments: