Billy Bob vs. ‘Stop Oil’ Lunatics

My wife and I just finished season 1 of Landman on Paramount+. The show stars Billy Bob Thornton as a hard-nosed oil executive in West Texas.

It’s well worth watching, as long as you don’t mind graphic content.

Despite its cruder moments, the show is entertaining. Plus, it’s rare to see the oil business portrayed in a major TV show, let alone in a balanced manner.

Source: Cowgirl Magazine

The show satisfyingly skewers activists who demand we “stop oil”, not realizing that windmills and solar panels require vast amounts of petroleum to build, transport, and operate. Not realizing that the sun doesn’t shine at night, so you need 100% backup power from reliable sources like natural gas, coal, and nuclear.

Clearly, the demise of oil and gas has been exaggerated.

With the launch of a show like Landman, it seems that even some Hollywood players are waking up to the reality that fossil fuels will play a big role in the future of energy. That’s encouraging. Eventually, all but the most brainwashed will catch on.

For now, however, many people remain stuck in the belief that the future excludes fossil fuels. So they’re avoiding the entire sector. This gives us a chance to buy shares on the cheap.

Buying Opportunity

The trade war with China has caused a significant drop in the price of crude. Today WTI crude trades about $65 a barrel, compared to $83 a year ago.

As a result, oil company shares have pulled back significantly. We may have further to fall, if the world economy hits a rough patch (which it certainly could).

But if we do have a recession, it’s almost certain the Federal Reserve will fire up the printers, leading to inflation and higher oil prices, even if growth is sluggish.

So now is a fine time to start buying in the oil and gas sector. Nailing the exact bottom is essentially impossible, so all we can do is try to get close and spread our buys out over time.

A Contrarian’s Dream

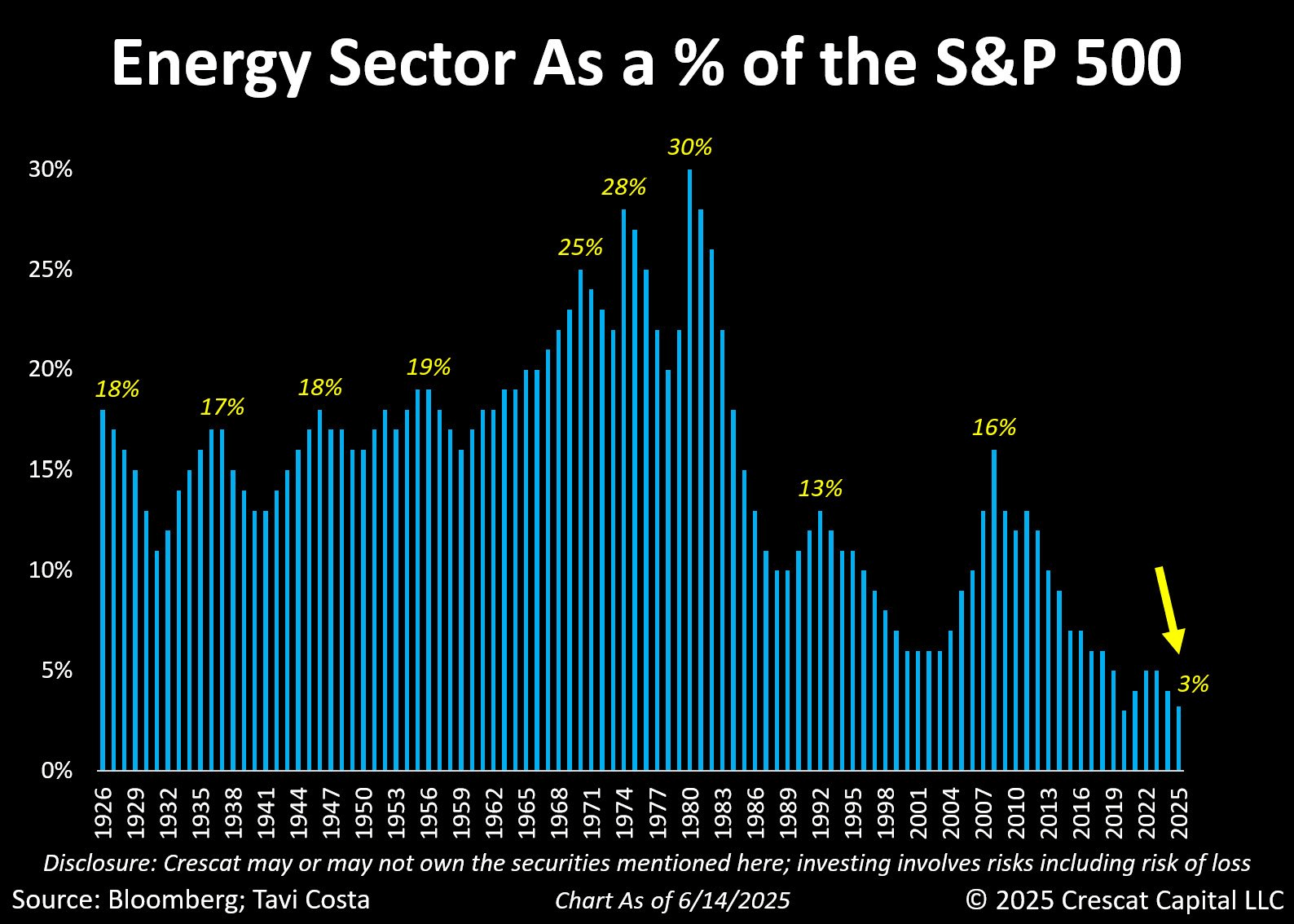

In 1980 oil and gas companies made up an incredible 30% of the S&P 500!

Source Tavi Costa of Crescat Capital

Today, energy accounts for just 3% of the S&P 500. That’s a 90% decrease since the peak.

It’s unlikely that energy will return to 30% of the stock market. Technology now makes up a much bigger chunk of the economy, and it’s unlikely to revert to previous levels.

But only 3% of the S&P 500? That’s ridiculously low. Energy remains a vital aspect of the modern world. Without natural gas and oil, we’d be living in a world closer to the Iron Age than modern day. These critical fuels aren’t going anywhere anytime soon.

Companies in this space generate some of the highest cash-flow yields in the world. A good oil company strikes the right balance between paying dividends and investing in future growth. Done correctly, it’s a beautiful asset class.

2 Stellar Investment Options

We’ve highlighted the Energy Select SPDR ETF (XLE) before as a nice diversified option to get started. It holds shares in the top 23 American oil and gas firms, including Chevron (CVX), Exxon (XOM), Kinder Morgan (KMI), and more.

The great thing about XLE is that the expense ratio is a rock-bottom 0.08%. That’s practically free. It’s a nice way to dip your toe into the energy space, and even many professional investors prefer XLE to selecting individual stocks.

We have also mentioned Petrobras (PBR, PBR.A), the Brazilian oil and gas giant. This is one of my favorite higher-risk, higher-reward plays, and I’ve built up a decent-sized position in it.

Petrobras offers a juicy dividend yield (which will ultimately depend on oil prices), but could top 13% over the next year.

The company pumps around 2.2 million barrels of oil per day. It also operates 11 oil refineries, as well as a vast network of transportation and processing infrastructure.

The primary downside risks with Petrobras are twofold. First, like any other energy firm, its profits (and dividends) are highly dependent on the price of oil and gas. If oil somehow falls to $30, or even $45, shares will fall further and dividends will be slashed.

On the other hand, if oil goes to $100+… Profits would balloon, as would the company’s share price. This is simply the nature of investing in the oil sector.

Secondly, Petrobras is headquartered in Brazil, which is currently run by socialist President Lula. This is seen as a potential risk to the firm, which is partially state-owned. Lula could meddle with the firm in a number of ways, including by increasing its taxes or forcing its hand on business decisions.

However, Petrobras is a critical institution in Brazil. It’s highly unlikely that even a hardcore socialist like Lula would risk scaring off international investors.

Additionally, Brazil will elect a new president next year. Lula’s popularity is plummeting, which has boosted hopes for a return to conservative leadership. Brazil’s Congress recently rejected Lula’s financial transaction tax, marking the first time it has denied a presidential decree in decades.

The risk/reward for Petrobras here is excellent. But as with iron miner Vale, which we covered yesterday, this stock should be treated as a long-term investment, not a quick flip. Give the dividend time to compound, and try to hold for at least a year to take advantage of long-term capital gains (assuming there are any).

We’ll keep you updated on XLE, PBR, and the larger Brazilian theme going forward.

Comments: