A Monster Move in Bitcoin

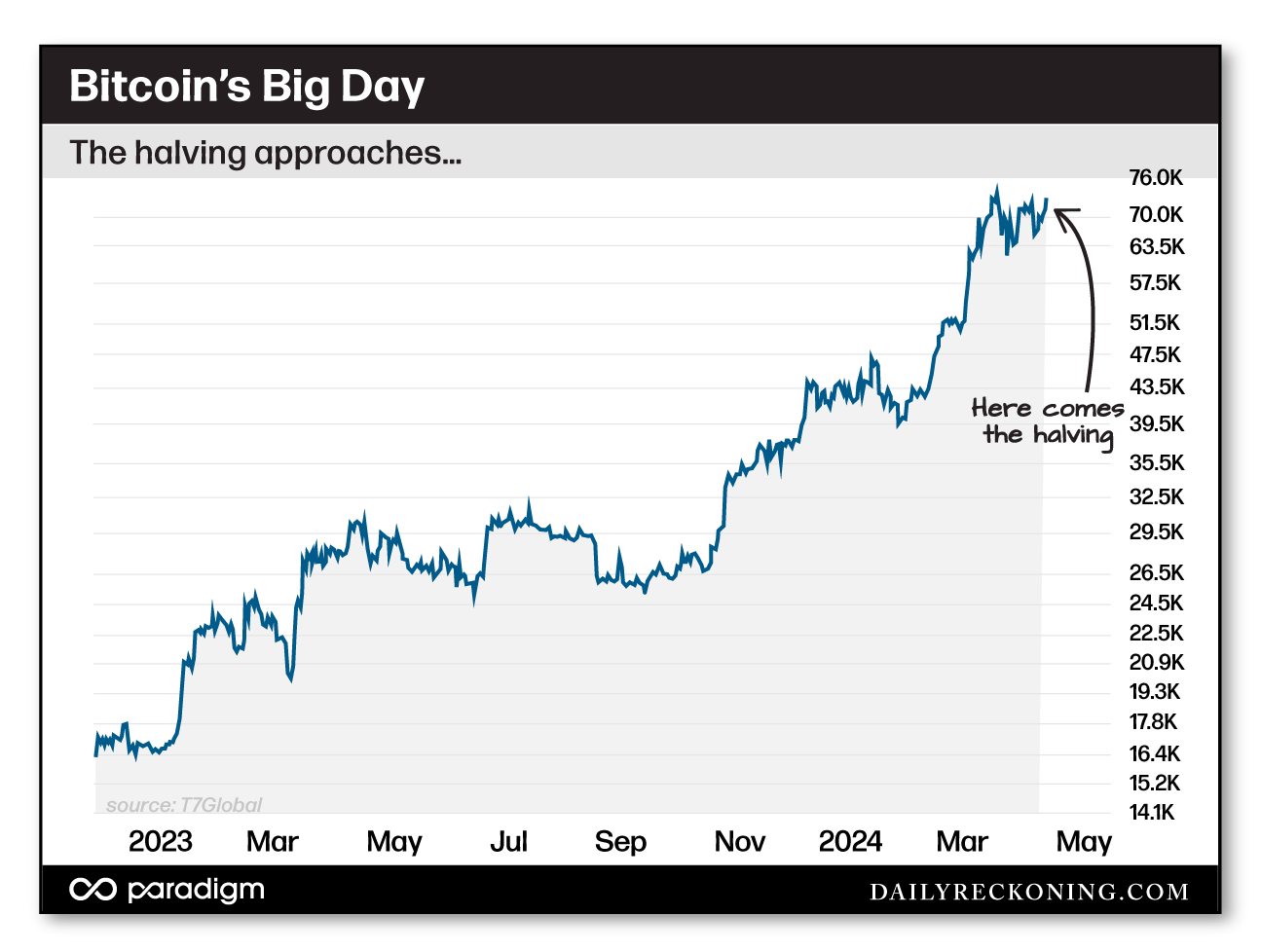

As Bitcoin once again approaches new highs this week, let’s take a moment to dissect crypto’s incredible 2024 rally — and where it might go from here.

First up: some eye-popping statistics:

Bitcoin has rallied 70% year-to-date, and nearly 160% over the trailing 12 months. It finally posted a new high in March after eclipsing $73,000, its first all-time high following the ugly “crypto winter” bear market that began in early 2022. Bitcoin has now gained more than 350% off its bear market lows. And it doesn’t appear to be slowing down anytime soon…

Crypto speculators are now looking toward this month’s main event: the halving.

Will the halving lead us to the promised land? Or will it turn out to be a non-event?

Let’s dig into the details…

First, what is the halving?

It takes a certain amount of processing power to mine Bitcoin. Currently, Bitcoin is mined at a rate of 900 per day.

After the halving, that rate will drop to 450 a day. According to our intrepid crypto expert Chris Campbell, the halving will occur at block height 840,000 (block height is the number of blocks connected in blockchain).

Chris notes that there are many variables in the halving equation, including hash rate changes, difficulty adjustments, etc. that can affect how long it takes to reach 840,000. So we won’t know the exact day or moment until it happens. Our best guess is sometime between April 18 – 22.

That gives us less than two weeks until the big event. And after the halving takes place, the new supply of bitcoin will get crunched — while demand is ratcheting higher as the bull run continues.

I can’t speak on the intricacies of the crypto ecosystem or any technical details of the halving. But I can discuss price, trends, and trading strategy — all of which are critical when dealing with a volatile asset such as Bitcoin.

Since this isn’t the first halving, we actually have a short track record to review. This is good news for the Bitcoin bulls because the past 3 halving events have led to a massive run-up in price.

While a perfect 3-for-3 record is encouraging, it’s not statistically significant. So it doesn’t guarantee we’ll see a massive bump later this month in the post-halving crypto landscape. Still, I like our chances for the rally to continue based purely on the fact that Bitcoin has been constructively consolidating for the past month — and it’s now beginning to press toward the top of its range.

If there’s one thing that’s almost always bullish, it’s new highs.

But I also understand if some investors are skittish when it comes to how Bitcoin might react to a major news event. If recent history is our guide, price action could get a little messy.

What if Crypto Investors Sell the News?

With the halving approaching, you might be worried Bitcoin is barreling toward a sell-the-news event that will result in a nasty pullback — or worse!

Sure, it’s possible. We don’t have to go too far back to find another Bitcoin event that led to some downside volatility…

We just witnessed a chaotic Bitcoin news cycle back in January when the SEC officially approved the first US-listed Bitcoin ETFs. The announcement sparked plenty of excitement throughout crypto exchanges and news providers, as well as the broader investing community. The mainstream media even dubbed the approval a watershed moment for Bitcoin and the broader crypto industry.

For traders attempting to play the news, this watershed moment failed to yield spectacular gains immediately following the announcement. Instead, the new crypto ETFs started to fall. Bitcoin also failed to hold its gains. In fact, the ETF approval hype led to an ugly $10,000-plus Bitcoin drop that took two weeks to play out.

But the drop was short-lived. Bitcoin found a floor near $40K, pivoted and broke to new highs by mid-February. Yes, some traders attempting to play a very short-term bump at the ETC approval announcement might have taken some losses. But anyone who was early enough and had the fortitude to hold onto their position through the volatility did just fine.

The assets always change. But we can count on investor behavior to stay the same, whether we’re dealing with tech stocks, commodities, or crypto. Assets like crypto that produce bigger moves over shorter time frames are going to be more volatile than slower-moving stocks and sectors.

Bitcoin will always get too far ahead of itself as positive momentum builds. Conversely, it will probably overshoot to the downside during corrections and pullbacks. Again, this is normal behavior. If we expect big swings in both directions before we jump in the crypto deep end, we’re less likely to fill our portfolios with poorly timed trades. And we probably won’t have to worry about the next shakeout scaring us out of perfectly viable positions.

Here’s What to Do Next…

Big, obvious news catalysts can cause a lot of stress if you aren’t prepared.

As the halving approaches, remember the following…

Bitcoin is somewhere in the middle of a powerful bull cycle. It has just recently posted new highs after coming out of a bear market. We’re probably not at the end of this secular bull run just yet.

Next, we need to accept that the faster the rally, the more volatility we will likely encounter. It’s the price we pay for playing the crypto market. Know your time frame and goals for any trade before you enter your position. Smart planning will help you weather any potential storms along the way.

Finally, don’t allow a quick reaction to a news event to catch you off guard. Sharp moves happen as markets quickly absorb new information. Stay alert and understand that we might see some fake outs — higher and lower — before Bitcoin settles into its “new normal.”

Finally, buckle up and enjoy the ride! This monster Bitcoin rally isn’t over yet.

Comments: