A Generational Opportunity in Miners

The selloff in gold miners this week has shaken out the hedge funds and momentum traders.

That’s fine, because over the next few years, they’re going to miss something special.

Precious metals prices have risen sharply over the past year, and it’s just now beginning to show up in miners’ earnings results.

We’re about to see a tsunami of cash flow hit the mining sector.

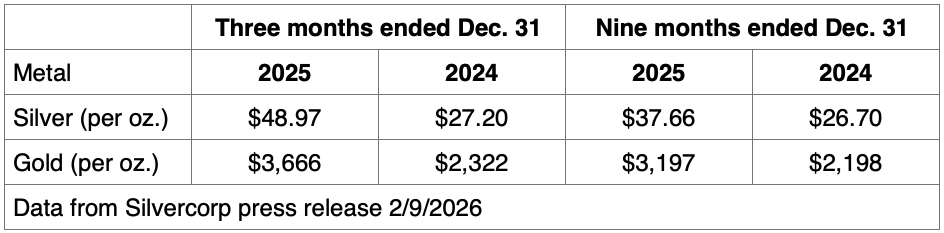

Giant miner Silvercorp (NYSE: SVM) reported its third quarter earnings for Fiscal 2026 on Monday. It covers the three months that ended in December 2025 and gives us some insight into the metal prices for that period.

The company sold silver, gold, lead, and zinc over that three-month period. Lead and zinc prices remained the same. However, as we would expect, there were huge changes in gold and silver prices. Here are the average selling prices:

As you can see, the quarterly realized price of silver jumped 80% and gold jumped 58% from 2024 to 2025. The trailing nine-month prices rose 41% for silver and 45% for gold.

Giant gold miner Agnico Eagle reported a realized gold price of $4,163 per ounce. That’s up from $2,660 in the same period last year. It had a massive impact on income. The company reported $1.5 billion in the latest report. Up from $509 million in the same period last year.

Here’s the thing, analysts blew the estimates. Agnico Eagle exceeded the most optimistic estimates by 10%.

That’s what most investors don’t understand yet. The average price for silver and gold nearly doubled in the past year. And it will have massive impact on cash flow and earnings.

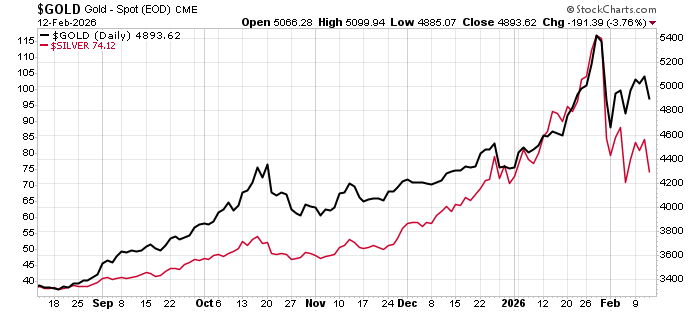

The green highlighted section of the chart above is the period that Agnico Eagle and Silvercorp reported. As you can see, the first quarter of 2026 will have higher average prices.

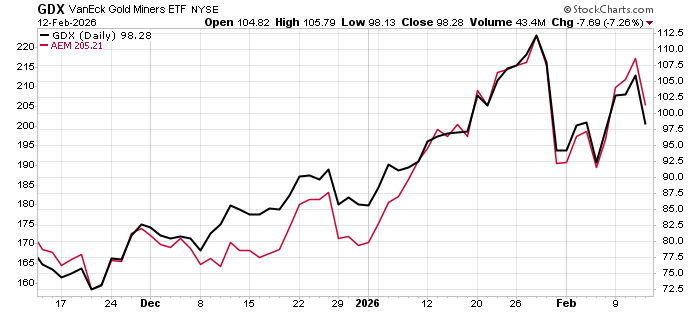

And while Agnico Eagle results exceeded estimates from those fourth quarter metal prices, the share price performed exactly like the rest of the gold miners:

The red line is Agnico Eagle’s share price. The black line is the VanEck Gold Miners ETF. As we can see, Agnico got no market recognition from its outstanding earnings.

In addition, the mining companies are not getting recognition for the even higher average price.

It’s important to note that these companies earn significantly more for their products (gold and silver) without incurring additional costs. That means the bulk of the value should go directly to their earnings.

The average gold price in the first quarter of 2026 is close to $500 per ounce higher than Agnico Eagle’s realized price in the fourth quarter of 2025.

At a minimum, Agnico Eagle will produce 825,000 ounces of gold this quarter. The extra $500 per ounce will add around $412 million in additional revenue. Most of that will go directly to earnings.

And if gold and silver prices stabilize here, we will see record earnings set across the industry. The share prices do not reflect that yet.

The next thing to watch for will be acquisitions. These companies need to invest this capital in their next mines. That means they will move down the “food chain” and buy assets.

The next group of companies to explode in value will be those with development projects.

We want to find companies that trade at a fraction of the net present value of their assets. And the market is full of them right now. Remember, mines don’t last forever. They aren’t factories.

There are finite volumes of metal in the ground. So a good mining company always has the next mine in sight. And with the current metal prices, we can expect the big miners to deploy cash with that in mind.

That’s why we recommend that you “buy the dip” in precious metals today. This moment is an opportunity for investors to get in if they haven’t yet. Or to add to existing positions. The opportunity to make a lot of money in mining remains, because few investors understand this generational opportunity.

Comments: