Google Drops a Nuke in the AI Wars

I’ve used OpenAI’s ChatGPT almost daily since it launched in late 2022.

It’s been a valuable research assistant, and I also use it to make the images at the top of these letters.

But suddenly ChatGPT has major competition. Google just released their latest model, Gemini 3.

Gemini 3 has taken a lead on AI benchmarks, a set of tests which grade the performance of models.

And Google’s new image creation AI, Nano Banana Pro (Google is still horrible at naming products), is impressive.

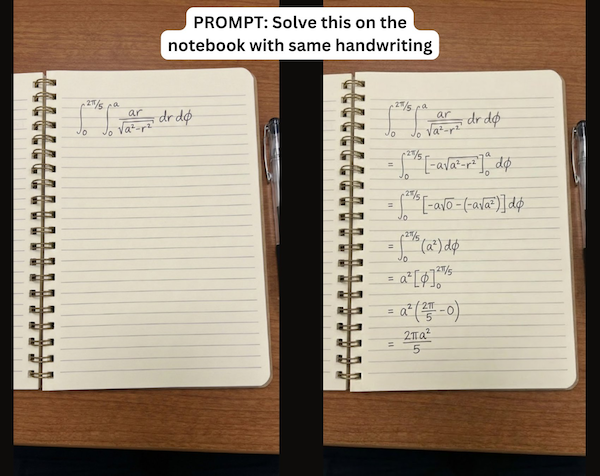

Take a look at the image below. The user submitted the image on the left, and instructed the AI to solve the math problem in the same handwriting. The result is on the right.

Source: @MinChoi on X

Incredible.

Look Ma – No NVIDIA GPUs

It shouldn’t surprise us that Google is catching up in the AI race. After all, they invented the technology that makes modern AIs possible, the transformer (we covered this in Google is No Kodak a while back).

The remarkable thing about this is they’re using their own AI hardware. No expensive NVIDIA GPUs required.

Google has their own AI chips called TPUs. They’re cheaper, more energy efficient, and specifically designed for AI tasks.

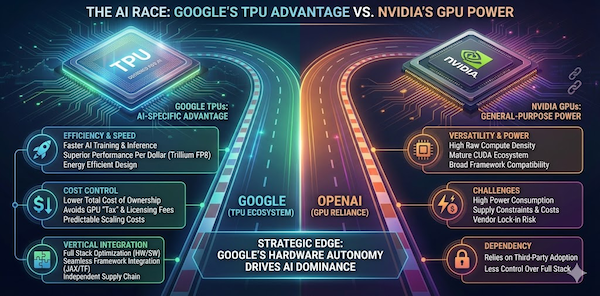

I asked Google’s Nano Banana Pro to create an infographic summarizing Google’s advantages over OpenAI when it comes to hardware:

Source: Gemini (click the link for a larger image and to see the prompt)

Having their own chips gives Google a big advantage in the AI race. They don’t have to pay the “NVIDIA tax” like everybody else.

Google is rumored to be working on selling or leasing its TPUs to other data centers. So this could be an issue for NVIDIA down the road. But we haven’t seen evidence of lacking demand for GPUs yet.

OpenAI Excitement Fades

OpenAI was the first to release a disruptive AI model to the public. And they still maintain a lead when it comes to paying consumer users.

But its latest big release, ChatGPT-5, was a disappointment. It actually seemed like a downgrade from their o3 model. We all expected a huge leap out of GPT-5, and it didn’t materialize.

Anthropic’s Claude models have overtaken OpenAI when it comes to enterprise/business users.

And now Google’s Gemini 3 could snatch away a big chunk of ChatGPT’s consumer and enterprise users. Google has an immense distribution advantage through its search, video, and productivity products.

OpenAI is a private company, so we can’t watch their shares trade in real-time. We do know its private market valuation has soared from $14 billion in 2021 to $500 billion in a recent secondary sale.

However, if it were a public company, shares would likely be diving over the past month due to soaring competition.

The best proxy we have for OpenAI shares is Softbank, the Japanese investment giant who has invested around $30 billion into OpenAI. In fact, Softbank recently sold its $5.4 billion stake in NVIDIA to invest more in OpenAI.

Softbank shares are down 30% over the past month.

Softbank founder Masayoshi Son with OpenAI CEO Sam Altman, Source: Bloomberg

I respect Softbank founder Masa, but he is known as a bit of a gambler. The fact that he’s plowing money into OpenAI this late in the cycle, at such a high valuation (rumored to be $300 billion in the April round) is not the best signal. Softbank also put billions into WeWork near the peak.

It was just 3 weeks ago that OpenAI was rumored to be planning an IPO at a $1 trillion valuation. But in those 3 weeks much has changed.

I’m not counting OpenAI out yet, but their job just got a lot tougher. Competing with a giant like Google, which generated cash flows of over $75 billion over the past year, is going to be brutal.

Alphabet (Google) shares spiked 5.5% at around noon as the market digests the latest sea change in AI.

It’s stunning to think that, at least for now, Google has the best AI model and the best AI hardware (which is proprietary).

If I had to bet on one American AI firm, it’d be Google (Alphabet). I did have a big position in GOOGL for 15 years, from 2006 to 2021. Unfortunately it looks like I sold too early. Oh well.

Seems a bit late to buy back in now, and I have a feeling we’ll get a chance to scoop up big tech stocks significantly lower in the next year or two.

I really like Google’s position here in the AI wars, but just can’t recommend buying it at a $3.6 trillion valuation. It’s a bit steep.

This AI race is going to force all the big players to invest heavily and sell their services at tiny or negative profit margins. It’ll be great for consumers, and maybe not so great for the companies in the short-term.

However, if and when we get that tech crash, Google will be at the top of my buy list.

Comments: