Getting the Gold Memo

The dramatic rise in gold and silver is finally starting to attract attention from the general public.

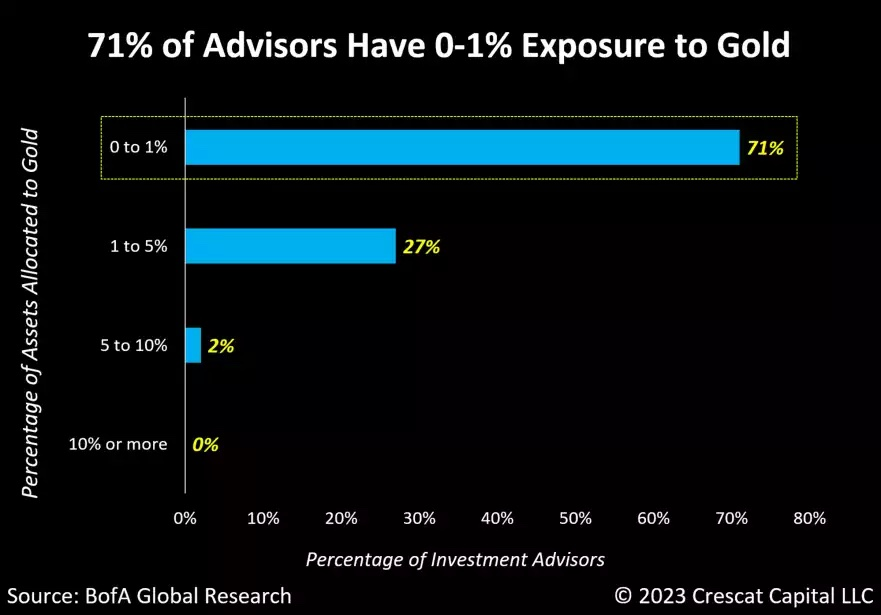

Last September, we were shocked to learn that in 2023, 71% of financial advisors had 0-1% exposure to gold.

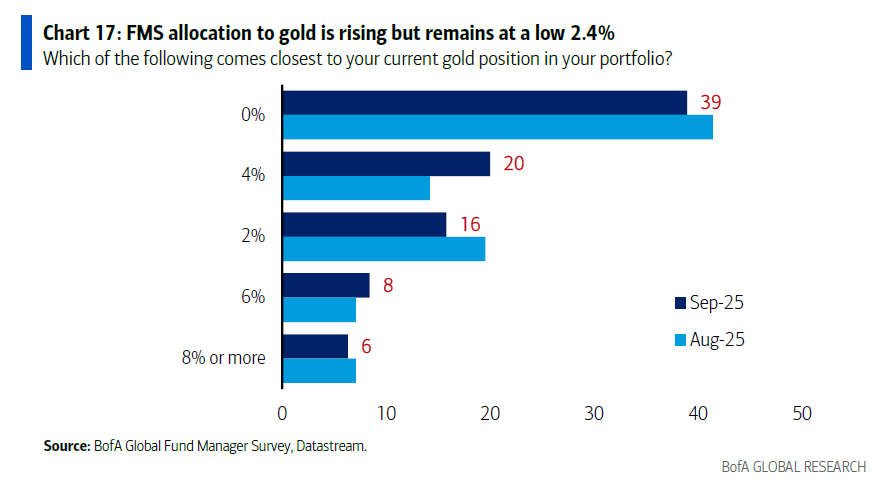

That 2023 data came from Bank of America’s fund manager survey. And in the most updated version of that survey, we’re starting to see a pickup in gold ownership among professional investors. See below:

As we can see, 39% of fund managers still have 0% exposure to gold. That means no miners, no ETFs, no bullion, nada. But note the difference between August (light blue) and September (dark blue). The number of investment pros with no exposure to gold is shrinking.

Fund managers reported a significant increase in gold holdings over just a single month!

They’re finally starting to buy in. But allocations are still very low. Overall the average manager reports just 2.4% exposure to gold. These surveys are self-reported, and I expect some of these managers overstate their true gold allocation, because it’s been doing so well lately.

For me, a 10% allocation to precious metals is the bare minimum for this environment. I’d say even 20% is reasonable today. Billionaire hedge fund kingpin Ray Dalio recently stated that a 15% allocation to gold is completely reasonable.

Considering the typical fund manager only has 2.4% exposure to gold and miners, precious metal allocations have plenty of room to grow.

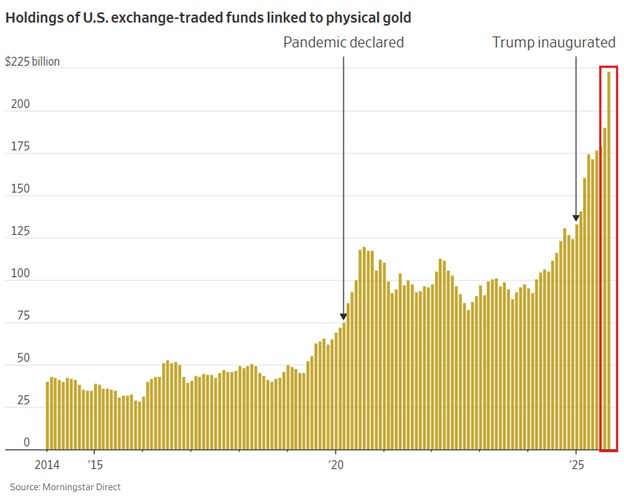

Gold ETF Holdings Grow

New research by Morningstar shows that U.S. physical gold ETF holdings are growing fast. See the chart below.

The chart looks dramatic. But in reality, physical gold ETFs only amount to $225 billion. That’s just 1/20th the size of NVIDIA alone.

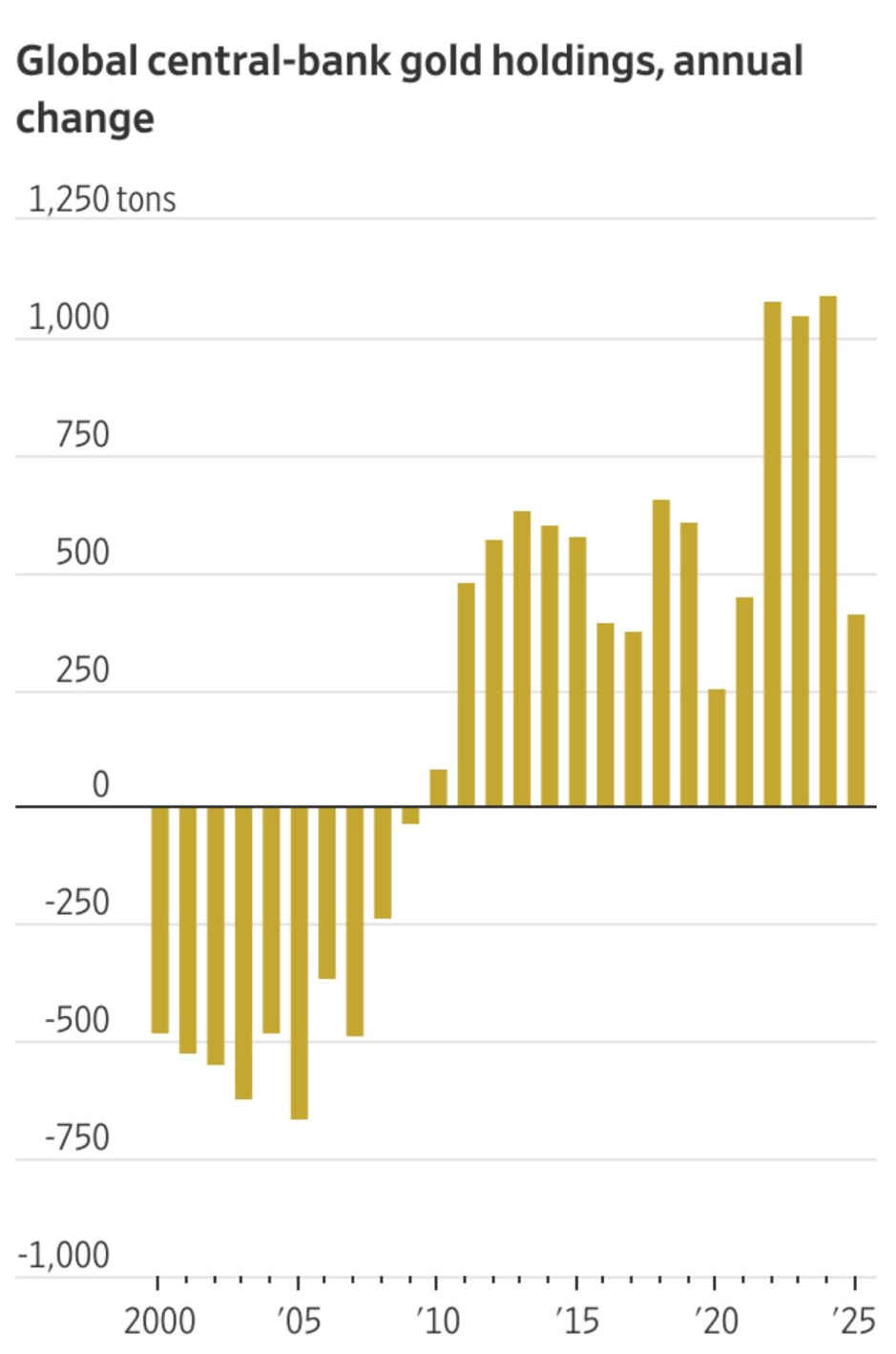

The vast majority of gold buying is still coming from central banks, not investors. See the chart below, showing the annual change in reported central bank gold holdings, via WSJ.

Note the massive spike starting in 2022, when the Biden admin and EU seized Russian central bank holdings in Europe. That was the catalyst which ignited a move out of dollars and into real money. Also, the 2025 data is only through the first half of the year.

Another thing to keep in mind is that we don’t have good data on China’s true holdings of gold. On paper, the country owns around 2,300 tonnes, but in reality they probably hold around 20,000 tonnes. China has been discreetly buying massive quantities of gold for years.

Central banks have been the primary driver of this bull market. You know, the guys who print fiat currency are rabid gold bugs. If that’s not a bullish signal, I don’t know what is.

Investors are just now beginning to become a significant source of gold demand.

Capital Rotation

Gold and silver have done incredibly well over the past few years. The crazy thing is that this was in the midst of a massive bull market in stocks.

Gold usually shines brightest after market crashes. That’s when the Federal Reserve and other central banks tend to crank up the printing presses. We saw this clearly after the 2000 dotcom crash.

So if and when the stock market has a major downturn, I expect much of that money to flow from hot sectors like tech into the safety of precious metals and natural resources.

To be clear, in the immediate aftermath of a stock market crash, gold and silver often sell off. I explained this phenomenon earlier this year during the April mini-crash after Trump’s Liberation Day speech. From Bathwater, Baby, and Silver:

Crashes like this one are fire sale scenarios. Everything goes.

For the most part, it doesn’t matter how cheap or insulated the asset is. Even hedges like gold and silver get sold. Panic rules the day.

This is the stage where leverage unwinds, and it does so violently. In other words, all the people who were long stocks on margin (debt) either sell or get liquidated. Price becomes irrelevant. Getting out is the only thing that matters.

But after the initial slump, precious metals tend to come roaring back to life and outperform indices like the S&P 500 and Nasdaq 100 for years to come.

As I write this, markets are selling off. The Nasdaq is down 2.5%, the biggest correction we’ve seen in a while. Gold and silver are holding up well. Miners are dipping, which is perfectly natural and to be expected after the incredible run they’ve had this year.

We’ll be monitoring this market correction closely to see if it turns into something larger.

Comments: