North American Trade Wars

It’s game on for the trade wars.

After months of threatening tariffs on U.S. trading partners during his 2024 presidential campaign, Trump has now taken definitive action on that front. Let’s review.

The Beginning

On Saturday, February 1, Trump announced that the U.S. was imposing 25% tariffs on all goods imported to the U.S. from Mexico and Canada (with the exception of Canadian energy, which was tariffed at 10%) and additional 10% tariffs on all goods imported from China.

These new Chinese tariffs were on top of tariffs Trump imposed on China in 2018, many of which were left in place during the Biden administration. All of these new tariffs were to take effect on Monday, February 3rd.

Boom!

Or was it?

The Mexican Concession

On February 3rd, within hours of the scheduled deadline for the new tariffs, Trump reached an accommodation with Mexico. President Claudia Sheinbaum agreed to surge 10,000 Mexican troops to the U.S./Mexican border both to prevent illegal immigration into the U.S. and to curtail the flow of fentanyl across the border. (Trump had already surged 5,000 U.S. troops to the border for the same purpose. Reportedly illegal border crossings have already declined 96% compared to the Biden administration).

In return, Trump agreed to postpone application of the Mexican tariffs for 30 days while the two sides discussed other actions and accommodations. The new deadline for tariffs is March 3, 2025.

Canada Follows Suit

Trump also spoke with Canadian Prime Minister Justin Trudeau on February 3rd. Trudeau did not initially make any concessions but late in the day on February 3rd he made the same offer as Mexico – 10,000 troops on the border and additional efforts to stop the flow of illegals and fentanyl. Trump accepted the offer and extended imposition of tariffs on Canada by 30 days.

But Trump Raises the Stakes

These delays did not mark the end of the tariff confrontation.

Beijing announced they were imposing retaliation tariffs on U.S. goods, including a 15% border tax on imports of U.S. coal and liquefied natural gas products. There is also a 10% tariff on American crude oil, agricultural machinery and large-engine cars.

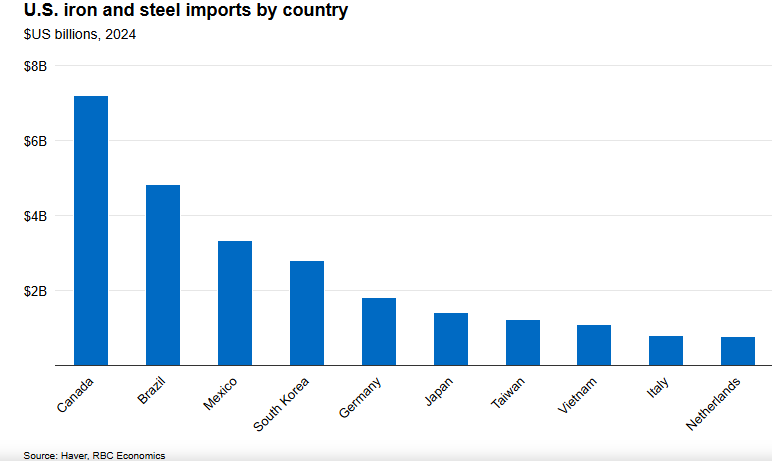

Trump answered by imposing a 25% tariff on all steel and aluminum imports into the United States. This will have a major impact on Canadian steel imports as shown in the chart below.

Source: Statista

Trade Wars Gone Global

In addition to the Mexican, Canadian and Chinese tariffs, Trump announced that EU tariffs are coming soon. Trump tentatively indicated that the EU tariffs would be 10% across the board. Trump seemed more relaxed about UK tariffs but given UK Prime Minister Keir Starmer’s tilt toward the EU lately, it may be the case that the UK is lumped in with the EU when it comes to tariffs on European trading partners.

Of course, all of these tariffs would come on top of the severe financial sanctions on Russia that have been in place since 2022 as a result of the War in Ukraine. Once retaliation is added to the original tariffs, it’s clear that a full-scale global trade war is now underway.

Let’s look closely at the trade situation with regard to Mexico and Canada.

U.S. Border Tariffs

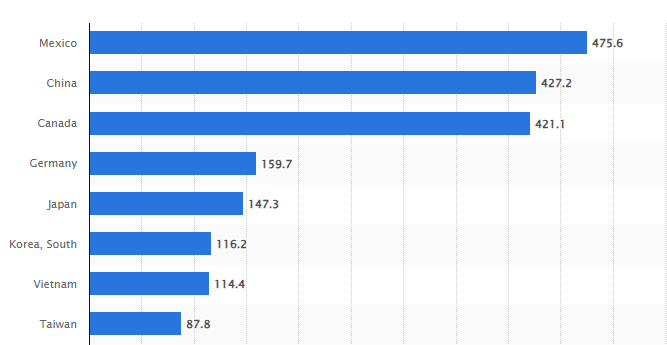

Canada ($421 billion) and Mexico ($475 billion) account for almost 30% of all goods imported by the United States. Canada and Mexico along with China are the three largest trading partners of the U.S. Obviously, Canada and Mexico are our closest neighbors, and each shares a long border with the U.S. The new trade wars will have many facets but solving problems with regard to Canada and Mexico will be a big part of the global puzzle and establish benchmarks by which other countries will be judged by the U.S.

Top Importing Countries into the U.S (in billions)

Source: Statista

The extent of Canadian and Mexican trade with the United States is difficult to overstate. Twenty-three of the fifty states rank Canada as their number one trading partner measured by imports. That includes the entire northern tier of U.S. states from Washington to Maine (with the exceptions of Idaho and Michigan) and most of the Midwest.

Ten of the fifty states rank Mexico as their number one trading partner measured by imports. That includes the entire southern tier of U.S. states (with the exceptions of California and Florida) plus the states of Missouri, Kentucky and Michigan. From automobiles to avocados, Canadian and Mexican imports are everywhere.

Trump cited three reasons for imposing tariffs on Mexico and Canada: illegal immigration, fentanyl and unfair trade practices. The issues of illegal immigration and fentanyl are closely linked because they both involve securing the border. Mexico’s and Canada’s deployment of 10,000 troops to their borders with the U.S. goes a long way toward addressing Trump’s concerns so that was the basis for the one-month delay on imposing tariffs.

A bigger issue lurking behind the U.S.-Mexico negotiations is the extent to which Chinese companies have taken over Mexican companies or built their own factories in Mexico to do an end-run around direct tariffs on China. The Chinese are putting automobile assembly plants in Mexico and exporting the cars to the U.S. free of tariffs under the U.S.-Mexico-Canada Trade Agreement (USMCA, the successor treaty to NAFTA). It may be the case that U.S. auto companies (Ford, GM) will be able to continue bringing in cars to the U.S. without duties while the Chinese-owned companies in Mexico get whacked.

That leaves open the issue of European car makers with plants in Mexico. I spoke to a well-informed source at Audi recently. They’re frantic. They just built a multi-billion-dollar plant in Mexico to do final assembly on the Q5 SUV (their most popular model). They expect that new Mexican tariffs will price it out of the market (compared to Toyotas and Nissans that are built in the USA).

Volkswagen, which owns Audi, may be in financial distress as a result of Audi’s mistake. It was clearly a major blunder on Volkswagen’s part not to locate their Audi factory in Tennessee or South Carolina as other foreign car manufacturers have. Trump and Mexico may be able to reduce tariffs on European firms in Mexico from 25% to 10% to align with tariffs that will be imposed on the EU anyway.

Subject to smoothing out exemptions or special treatment for Chinese and EU factories in Mexico, the Mexican-U.S. trade disputes seem to on their way to resolution. Problems may arise down the road with respect to Mexican cartel attacks on U.S. Immigration and Customs Enforcement personnel (ICE) but that falls more into the category of national security and military affairs than trade policy.

Canada Is a Problem

Even with the one-month delay in imposing tariffs on Canada, the substantive policy issues remain. Trudeau is not in a strong position to negotiate anything because he has already agreed to step down as party leader and prime minister. The fight to replace him as party leader is being led by former Deputy Prime Minister Chrystia Freeland, a trade-hawk and neo-fascist sympathizer.

National elections in Canada are scheduled for October 20, 2025, but could be held sooner. The national election could come down to Chrystia Freeland as the Liberal Party Leader and Pierre Poilievre as Conservative Party Leader. Poilievre is far more reasonable on trade issues than Freeland.

The Freeland Plan to fight Trump includes dollar-for-dollar tariff retaliation, an international anti-Trump trade coalition including Mexico, Denmark, Panama and the EU, a ban on purchases of U.S. goods by all Canadian federal government agencies, a ban on American companies bidding on Canadian government contracts, a ban on American firms participating in projects funded by Canada, and support for Canada’s cultural sector against “Donald Trump’s billionaire buddies.”

The even more radical Ottawa Premier Doug Ford has proposed halting Canadian energy exports to the U.S. and “ripping up” Ottawa’s contract with Elon Musk’s Starlink company.

Canadian exports to the U.S. are dominated by energy products (about $165 billion) followed by automobiles and parts (about $83 billion), and consumer goods (about $70 billion). Electronics, food, fish and aircraft make up a relatively small part of the total.

Hopefully, cooler heads will prevail. Freeland’s plan is radical, but her chances of victory are slim. Poilievre is a clear favorite to form the new government and lead as prime minister. The lower initial tariff on Canadian energy (10% versus 25% or other imports) is a good sign.

It may be the case that agreement to increase border surveillance on the Canadian side, cut down on fentanyl and to buy more U.S. goods (especially wine, dairy and beef) may be enough to get Trump to back down on Canadian tariffs. As with Mexico, higher tariffs might remain on Canadian companies being used by China to end-run U.S. tariffs. It will be impossible to maintain tariffs on the U.S.-Canada automotive trade. Cars and trucks are too big to tariff when it comes to Canada.

Comments: